DuPont de Nemours, Inc. (NYSE:DD) recorded earnings (on a reported basis) from continuing operations of 24 cents per share for fourth-quarter 2019, down from earnings of 39 cents per share in the comparable quarter a year ago. The bottom line in the reported quarter was hurt by higher tax rate and lower segment results.

Barring one-time items, earnings were 95 cents per share for the reported quarter, missing the Zacks Consensus Estimate of 96 cents.

DuPont raked in net sales of $5,204 million, down around 5% from the comparable quarter a year ago. It fell short of the Zacks Consensus Estimate of $5,217.7 million.

Net sales fell 2% on an organic basis as 1% higher pricing was more than offset by 3% lower volumes. The company faced challenges from weak automotive markets and lower nylon prices.

Full-Year Results

For 2019, loss from continuing operations (as reported) was 86 cents per share, compared with earnings of 45 cents per share a year ago. Revenues were $21,512 million for the full year, down around 5% year over year.

Segment Highlights

The company’s Electronics & Imaging segment recorded net sales of $937 million in the reported quarter, up 3% on a year-over-year comparison basis. Organic sales rose 3%. Higher volumes in interconnect solutions were masked by weaker volumes in semiconductor technologies.

At the Nutrition & Biosciences unit, sales fell 2% to $1.5 billion. Organic sales were flat year over year on 1% higher pricing and 1% lower volumes.

Net sales for the Transportation & Industrial division were $1.2 billion in the reported quarter, down 9% year over year. Organic sales fell 8% on 2% lower pricing and 6% volume decline due to sustained weakness in automotive and electronics markets.

Net sales in the Safety & Construction unit were $1.3 billion, down 3%. Organic sales rose 1% on the back of a 3% price improvement, offset by 2% lower volume. Local prices rose in all businesses and all regions.

Foe the non-core reporting segment, net sales fell 19% to $404 million. Organic sales declined 9%, impacted by 15% lower volumes. Prices rose 6% in the quarter.

Financials

DuPont had cash and cash equivalents of $1,540 million at the end of 2019. Long-term debt was $13,617 million.

The company returned more than $1.3 billion to shareholders since Jun 1 including $750 million of share buybacks.

Outlook

DuPont expects adjusted earnings per share in the range of $3.70-$3.90 for 2020. The guidance takes into account continued headwind in nylon pricing and mix. Adjusted earnings for first-quarter 2020 are projected in the range of 70-74 cents per share.

The company also sees full-year 2020 sales between $21.5 billion and $22 billion. Moreover, it envisions first-quarter net sales to be down mid-single digits, factoring in the nylon headwinds.

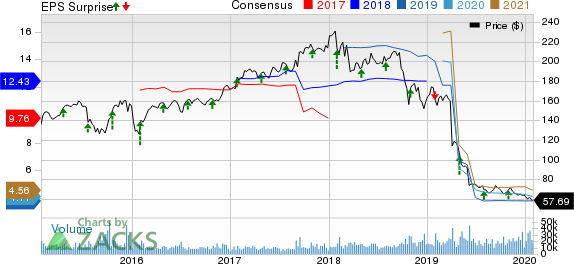

Price Performance

DuPont’s shares are down around 12.4% over the past three months, compared with the roughly 2.2% decline recorded by the industry.

Zacks Rank & Key Picks

DuPont currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the basic materials space include Daqo New Energy Corp. (NYSE:DQ) , Royal Gold, Inc. (NASDAQ:RGLD) and Pretium Resources Inc. (TSX:PVG) , each currently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Daqo New Energy has projected earnings growth rate of 326.3% for 2020. The company’s shares have rallied roughly 33% in a year’s time.

Royal Gold has estimated earnings growth rate of 83.5% for fiscal 2020. The company’s shares have shot up roughly 30% in a year’s time.

Pretium Resources has projected earnings growth rate of 106.9% for 2020. The company’s shares have rallied around 40% over a year.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

DuPont de Nemours, Inc. (DD): Free Stock Analysis Report

DAQO New Energy Corp. (DQ): Free Stock Analysis Report

Pretium Resources, Inc. (PVG): Free Stock Analysis Report

Royal Gold, Inc. (RGLD): Free Stock Analysis Report

Original post

Zacks Investment Research