- Explosive Rally Took DraftKings To A High In March 2021

- Gravity Hit Shorts Gambling Stock

- Acquisition Costs Have Weighed On The Company

- Potential Is Huge

- 3 Reasons Why DKNG Could Be A Takeover Candidate

- The company has already paid the customer acquisition costs. A takeover would allow the buyer to acquire the customers at pennies on the dollar compared with the price DKNG paid, leading to an accretive instead of a dilutive merger or acquisition.

- DKNG’s earnings have been pathetic, but it has excellent brand recognition.

- DKNG’s franchise is fantasy sports. An acquirer would immediately have a leadership role in the potentially lucrative business.

Online sports gambling has enormous potential. Sports fans love the action of having an interest in the outcome of their favorite game or performance of individual athletes. Long before there was legal gambling, bookies took action on events. Legalization and taxation lead to substantial revenue flow for governments searching for new ways to pay for services.

DraftKings (NASDAQ:DKNG) burst on the scene with a novel approach to cement its position as a leading sports gambling company. Aside from taking action on events and athlete performance, the company offered fantasy sports, where fans could create teams and compete for monetary prizes.

The sports gaming business is growing, and so is competition. While DraftKings exploded higher in 2021, the price action over the past year has been disappointing for stockholders who believe the company would hold a leading role in the business. On Feb. 28, DKNG shares were trading at less than one-quarter the price at the March 2021 high.

Explosive Rally Took DKNG To A High In March 2021

After trading at a low of $10.60 per share in March 2020, DraftKings shares took off. DKNG went public via SPAC in 2020.

Source: Barchart

The chart highlights the rally that took DKNG over seven times higher to a high of $74.38 per share in March 2021, where the rally ran out of steam.

Gravity Hit Shorts Gambling Stock

Since the March 2021 high, DKNG shares made lower highs and lower lows falling to less than one-quarter the level at the high.

Source: Barchart

The chart shows the decline from $74.38 to the most recent low of $16.56 on Feb. 22, 2022. At just over the $22.50 per share level on Feb. 28, DKNG remains in a bearish trend, not far from the low.

In late 2021, famed short seller Jim Chanos revealed he was short DKNG shares.

Acquisition Costs Have Weighed On Company

On Nov. 30, Chanos tweeted a screenshot of DKNG’s third quarter revenue and expenses, showing sales and marketing spending of $303 million and revenues of $212 million.

Chanos said:

“You can believe in sports betting, but this business model is flawed.”

DraftKings customer acquisition costs have been far more than the company’s revenues.

Source: Yahoo Finance

The chart shows DKNG posted losses over the past four consecutive quarters. Analysts expect the company to lose $1.11 per share in Q1 2022.

Source: Yahoo Finance

The annual earnings trend is ugly, with losses growing each year since 2018.

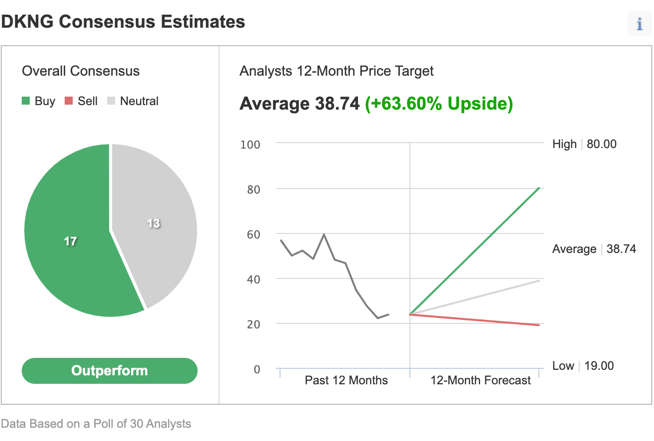

A survey of 30 analysts by Investing.com has an average price target of $38.74 for DKNG shares, with forecasts ranging from $19 to $80. At just over $22.50, the stock is a stone’s throw away from the low end of the range.

Potential Is Huge

While Chanos does not doubt the growth of the sports betting business, he has profited by identifying DKNG’s approach, spending without abandon on acquiring customers.

Meanwhile, the growth potential for the overall business remains enormous. New York legalized online sports betting in January 2022. New York is the most populous of the 20 U.S. states that allow residents to gamble on their smartphones. One-quarter of the U.S. mobile sports wagers on the Super Bowl came from New York. As more states starving for tax revenues legalize online gambling, the business will grow. In New York, DKNG was one of many companies taking bets on the NFL championship. FanDuel, Caesars Sportsbook, BetMGM, and four other mobile sportsbooks have licenses to take bets.

With the Super Bowl in the rearview mirror, the next big event for the gambling industry is March Madness. The NCAA college basketball tournament attracts even more betting than the NFL championship as it features 67 games. In 2019, Nevada’s March Madness total handle was more than double the Super Bowl handle.

As companies compete for their share of the wagering, DKNG has overspent on acquiring bettors, and its stock has suffered.

3 Reasons Why DKNG Could Be A Takeover Candidate

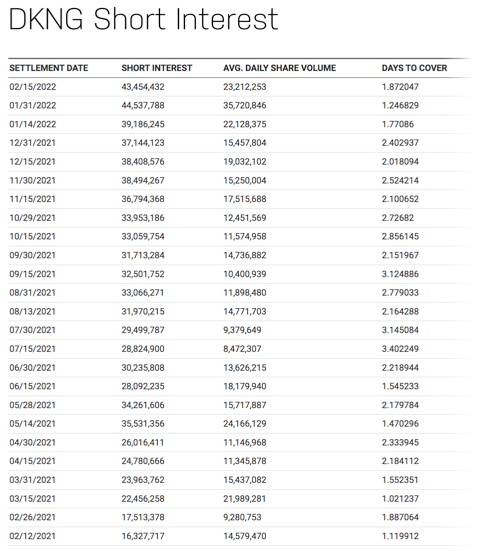

While DKNG may not emerge as the leading online sports betting company, three reasons make the stock ripe for a recovery. With March Madness coming up, revenues should improve. Moreover, at $20.25 per share at the end of last week, the company had a market cap of just under $8 billion. In late November 2021, Chanos announced he was short DKNG, trading at over the $35 level at the time, and he likely sold it at far higher levels. Moreover, the short-interest has been growing:

Source: NASDAQ

The chart illustrates the short interest of more than 43.45 million shares as of Feb. 15. At the $22.50 level, Chanos likely booked a substantial profit as the risk of a short position rose as the stock price fell to the $16.56 low on Feb. 22.

At a $9-billion market cap, DKNG could become a juicy takeover target as the sports betting market matures, consolidates, and M&A activity increases. The factors that favor a DKNG takeover are:

Chanos is correct that the online sports betting business is attractive, but DKNG made mistakes betting on customer acquisition without attention to revenues. However, at the $22.50-per-share level, an acquiring company will likely pay a healthy premium for the company. At below $25 per share, DKNG could be a good bet.