Plano, TX-based Dr Pepper Snapple Group Inc. (NYSE:DPS) reported strong second-quarter 2016 results, surpassing the Zacks Consensus Estimate for both earnings and sales for the fourth quarter in a row. In addition, the company raised its guidance for full year 2016 and revealed that it expects to return over $1 billion to shareholders in the form of dividends and share repurchases.

Earnings Beat

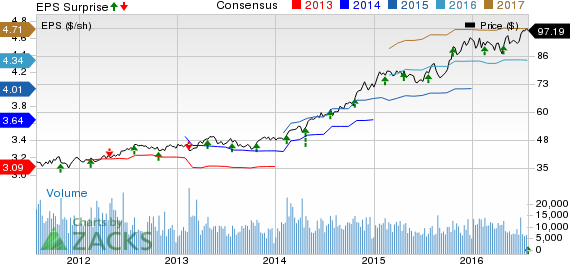

Second-quarter adjusted earnings per share (EPS) of $1.25 beat the Zacks Consensus Estimate of $1.19 by 5.04%. Moreover, earnings increased 11% year over year helped by strong top-line performance and margin expansion.

Strong Revenues and Margins

Dr Pepper Snapple’s net sales of $1.695 billion were ahead of the Zacks Consensus Estimate of $1.687 million by 0.5%. Net sales rose 2% year over year as favorable product/package mix, price hikes and sales volume offset currency headwinds and unfavorable segment mix.

While sales were driven by 1% volume growth, currency hurt sales by 2%.

Adjusted operating income of $387 million increased 6% year over year. Adjusted operating margin increased 70 basis points (bps) to 22.8% driven by higher sales, and productivity improvements.

Volumes in Detail

Dr Pepper Snapple’s sales volume is measured in two ways: 1) sales volume and 2) bottler case sales (BCS) volume. Sales volume represents concentrates and finished beverages sold to bottlers, retailers and distributors. BCS includes the sale of finished packaged beverages by the company and its bottlers to retailers and independent distributors.

Sales volume increased 1% in the quarter.

In the quarter, BCS volume went up 1%, lower than 2% increase in the previous quarter. During the quarter, Carbonated Soft Drinks (CSDs) volume increased 1% and non-carbonated beverages (NCBs) volumes increased 2%.

Geographically, volumes were flat in the U.S. and Canada, softer than 2% increase in the last quarter, while increasing 6% in Mexico and the Caribbean, same as in the previous quarter.

2016 Outlook

Dr Pepper Snapple raised its earnings guidance for 2016. The company expects full year 2016 earnings in the range of $4.27 to $4.35 per share, higher than its previously estimated range of $4.20 to $4.30 per share. Currency headwinds are expected to hurt 2016 EPS by 3%, which is higher than the prior expectation of 2.5%.

The company still expects net sales to be up approximately 2%. Currency is likely to have a negative impact of about 1% on sales.

The full-year tax rate is likely to be about 35.5%. Capital expenditure is expected to be nearly 3% of net sales. The company plans to repurchase roughly $650 million to $700 million shares in the year.

Dr Pepper Snapple has a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked stocks in the broader beverage sector are Primo Water Corp. (NASDAQ:PRMW) , Constellation Brands Inc. (NYSE:STZ) and The Chefs' Warehouse, Inc. (NASDAQ:CHEF) . All the three companies carry a Zacks Rank #2 (Buy).

DR PEPPER SNAPL (DPS): Free Stock Analysis Report

PRIMO WATER CP (PRMW): Free Stock Analysis Report

CONSTELLATN BRD (STZ): Free Stock Analysis Report

CHEFS WAREHOUSE (CHEF): Free Stock Analysis Report

Original post

Zacks Investment Research