In another heady week of heated action on U.S. stock markets, the Dow Jones Industrials rocked to new highs while the S&P 500 rolled just below all time highs. The Dow Jones Industrials (DIA) posted its best winning streak since 1996 this week, with ten up days in a row while the S&P 500 (SPY) came close to its all time high before closing lower on Friday.

For the week, the Dow Jones Industrial Average (DIA) advanced 0.8% while the S&P 500 (SPY) added 0.6%.

The Nasdaq 100 (QQQ) fell 0.28% on Friday to close down slightly for the week, while the Russell 2000 (IWM) fell 0.06% on Friday to post a 1.1% gain for the week.

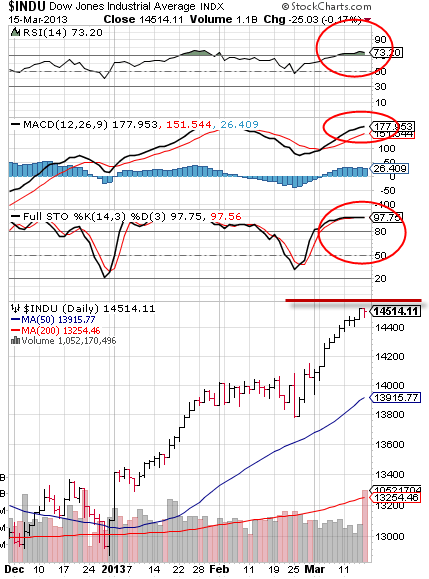

The chart of the Dow Jones Industrials (DIA) shows the overbought nature of the market with RSI at 73, Stochastic overbought and Momentum still positive but leveling off. ETF News You Can Really Use

In economic news last week, retail sales came in well ahead of expectations with 1.1% growth in February and weekly jobless claims fell to 332,000. The Empire State Index rose but missed expectations and Friday’s consumer sentiment report fell sharply to 71.8 in March, down from 77.6, well below expectations and its lowest reading since late 2011.

European industrial production fell and inflation rose at the fastest pace in three years and Europe dropped on Friday at the conclusion of the EU Summit.

Next week brings housing starts and home builder’s index but the main event will be on Wednesday with the FOMC interest rate announcement and Fed Chairman Bernanke’s press conference which will be closely watched for clues about the future of the Fed’s asset buying program. Thursday brings key reports with Markit Flash PMI, weekly jobless claims, leading indicators and Philadelphia Fed reports.

However, the key event next week will be whether or not the S&P 500 (SPY) can breach and hold its all time closing high of 1565, reached on October 9, 2007. Friday’s close on the S&P 500 (SPY) at 1560 leaves the closely watched index tantalizingly close to its all time record.

Importantly, it reaches this level in significantly overbought conditions and with some fundamental headwinds in the form of the impending sequestration budget cuts and analysis like that from highly regarded Goldman Sachs Asset Management Chairman Jim O’Neill who said on Bloomberg TV that “ridiculously strong levels” of economic growth would be needed for the S&P 500 (SPY) to break above the 1600 level that investors would so much like to see.

Bottom line: The Dow Jones Industrials (DIA) put on a dazzling show while the S&P 500 (SPY) flirts with new highs in the face of technical and fundamental barriers. Next week will provide more ammunition for both bulls and bears as this dramatic action continues on global markets.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Dow Jones Industrials Rock, S&P 500 Rolls

Published 03/17/2013, 06:13 AM

Updated 05/14/2017, 06:45 AM

Dow Jones Industrials Rock, S&P 500 Rolls

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.