US stocks have found relief on the back of a less hawkish Federal Reserve. Among major averages, the Dow Jones Industrial Average is hanging on its highest levels since mid-August. Although markets are muted due to the US holiday on Friday, the Wall Street future index is set to have a winning week and can be on traders’ watchlist for the next week.

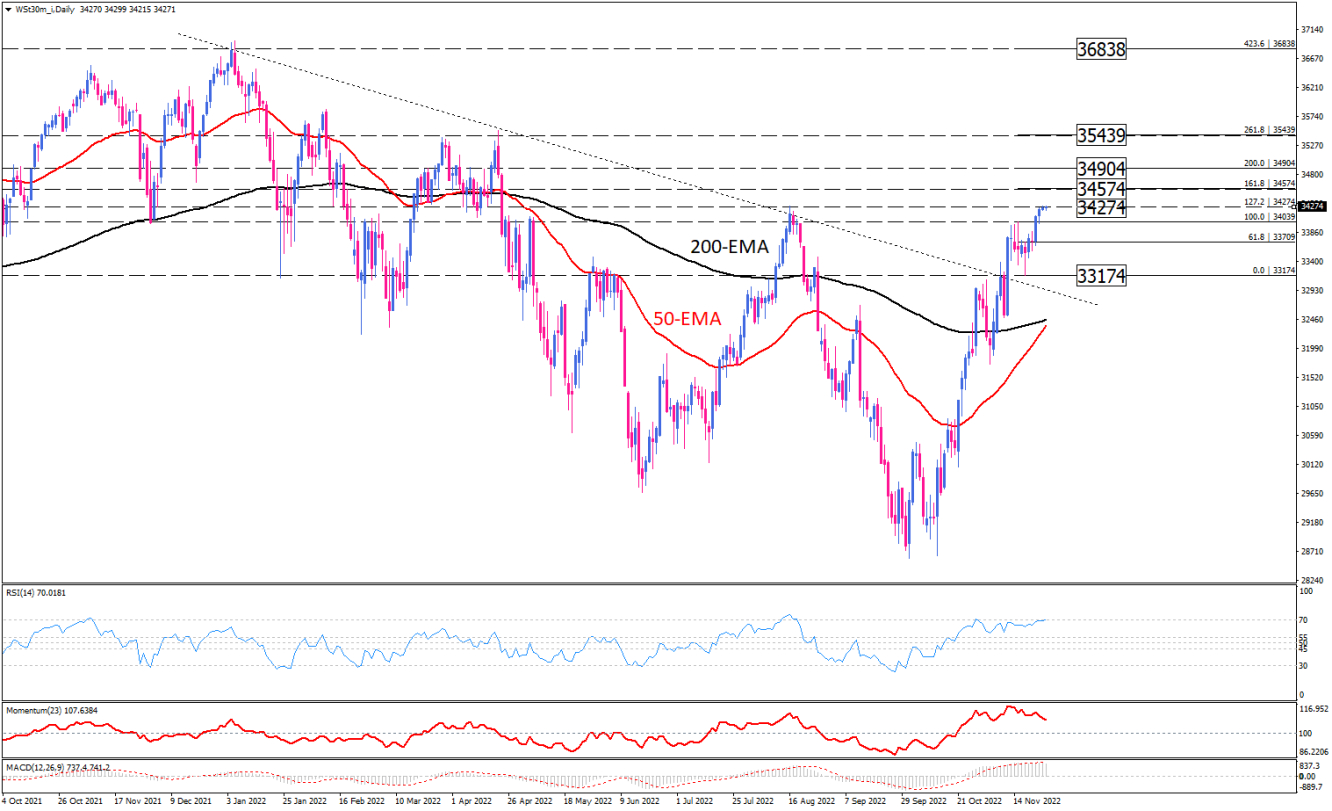

This is the second day in a row that the index is hovering around the 34274 mark as upside momentum is getting out of steam. However, if buyers overcome this crucial resistance, the next level of interest can be estimated at around 34574. Overstepping this barrier would have bulls turn their attention to higher targets at 34904 and 35439, respectively. If all fundamentals favor buyers, the year peak of 36838 could come under the spotlight.

Otherwise, if sellers successfully defend the almost four-month high record, the price could back down to retest the round support level of 34000. The further decline can result in targeting the last bottom at 33174, which is in the vicinity of the broken trendline.

Short-term momentum oscillators suggest that bullish sentiment will likely wane at its extreme levels. The RSI is moving beneath the 70-level, on the verge of the overbought area.

At the same time, momentum is retreating from its peak towards the 100 threshold, which can be interpreted as an early sign of decreasing bullish forces. Likewise, positive MACD bars slightly tend to shrink below the signal line.