Dow Future Short Term Elliott Wave view suggests that the decline to 23205 ended Intermediate wave (4). Intermediate wave (5) is in progress as an Ending Diagonal Elliott Wave structure where Minor wave 1 ended at 24536 and Minor wave 2 ended at 24073. The Index still needs to break above Minor wave (1) at 24536 to add validity to the view that Minor wave 2 has ended at 24073. Until then, a double correction in Minor wave 2 still can’t be ruled out.

Near term, rally from 24073 low remains in progress as 5 waves and more upside is expected before Minute wave ((i)) ends. Index should then pullback in Minute wave ((ii)) in 3, 7, or 11 swing to correct cycle from 12/7 low (24073) before the rally resumes. We don’t like selling the pullback and expect Index to find buyers in pullback in 3, 7, or 11 swing against 24073 low in the first degree, but more importantly against 11/15 low (23191).

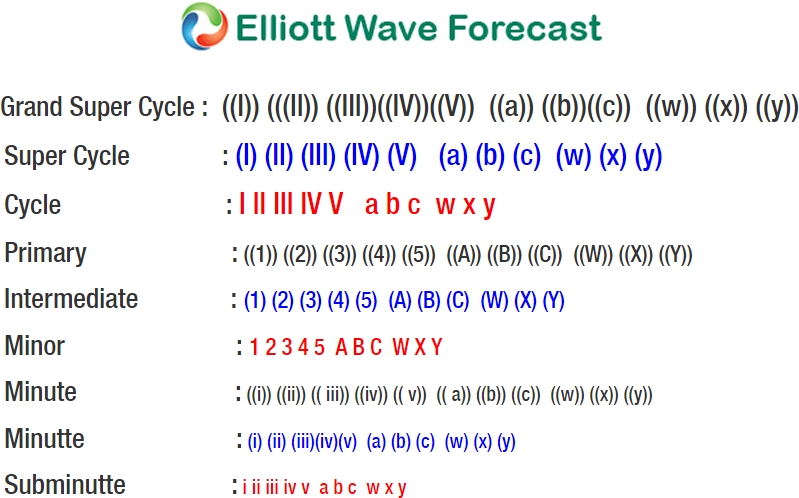

YM_F Dow Future 1 Hour Elliott Wave Chart