Stocks are up big this year, and that means it’s time to be skeptical.

Warren Buffett says you should be greedy when others are fearful and fearful when others are greedy. That doesn’t mean stocks are ready to give up all their January and February gains immediately or even eventually. But it means the right psychological disposition to have is one of doubt and skepticism. If we get the decline, you’ll be ready for it. And being ready for declines, so that they don’t surprise you and cause you to sell, is the most important thing in investing.

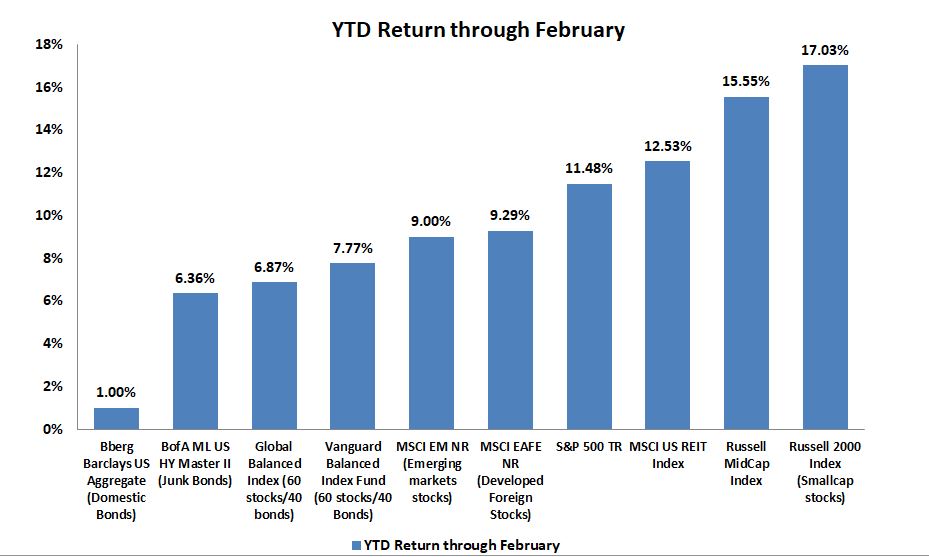

Here are the numbers. Domestic and foreign stock are all up between 9% and 12% for the opening two months of the year. Mid-caps and small-caps are up even more, with the Russell 2000 up an eye-watering 17%. Junk bonds are up more than 6% and REITs are up more than 12%. Balanced indices are up between 7% and 8%, depending on whether they have foreign stocks or not.

It’s okay to be happy about this, but it’s also good to temper that happiness with some skepticism. Stocks don’t usually go up this much in two months. In fact, they don’t usually go up this much in a year. If you’re thinking that the current move is justified because of how much stocks declined in the last quarter of 2018, you still may be fooling yourself with too much optimism. Stocks have been up like gangbusters for the past decade. (Incidentally, if you panicked at the end of last year, and sold, you know how prone you are to make moves at the exact wrong moment.)

None of this means you should run for the hills and sell all your stocks in a fit of contrarianism. But it means you should temper your expectations. (And trimming some gains might not be a bad idea. Rebalancing, especially in a tax-advantaged account is reasonable after a run like this.) It’s just as likely that stocks could drop from here as it is that they could tread water or keep going up. Nobody knows.

The end of last year is instructive about trying to time short-term moves. At the end of last year, longer term moving averages indicated that there was more downside, while shorter term moving averages indicated that the markets were “oversold,” and that at least a few days of upside were in the cards. It turned out that when things looked bleakest, on Christmas Eve or quickly thereafter, the market bottomed, and stocks have been off to the races ever since.

In other words, both the long term indicators and the short term indicators from the end of last year look foolish right now. We didn’t get a few days’ worth of gains in response to being “oversold;” instead we’ve gotten eight solid weeks of boffo returns. That’s what the market does — it makes everything look foolish sometimes. Sure, stocks might decline from here, proving the longer term indicators from late last year correct. But these two months show how hard short term timing is. It’s possible to argue that U.S. Federal Reserve Chairman Powell indicating that the rate-hiking regime would end was a wild card at the end of last year. That’s true, but it doesn’t damage the thesis that short term trading is difficult.

Being successful in the stock market isn’t so much a function of what system you follow as much as it is a function of whether you can follow a system and whether you can keep your emotions in check. Every system – buy-and-hold, buy-and-rebalance, moving average – will look foolish at times. It will deliver losses or look lackluster when others are making gains. Take Bill Bernstein’s advice in this weekend’s Wall Street Journal, and consider your financial assets (stocks and bonds) as future assets and not present assets. In other words, “mentally vaporize 75% of your assets; imagine you don’t even have them.” That can help you get through market declines. You don’t own stocks to buy groceries tomorrow, after all. Remembering that, and having the right psychological disposition can make a big difference in helping you let financial assets work for you — instead of letting them work you over.