Despite continued momentum at the Fossil brand, product innovation in the watch portfolio and expansion in wearable technology, Fossil Group, Inc. (NASDAQ:FOSL) has been witnessing sluggish results over the past few quarters due to economic, competitive and consumer headwinds.

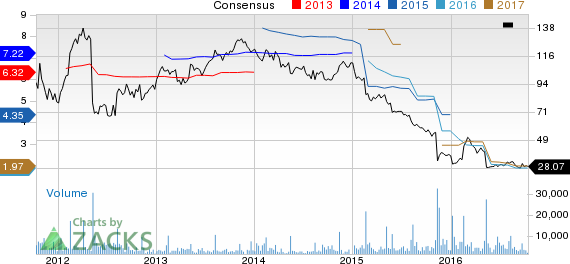

Also, the company’s share price has declined nearly 18% year to date.

Let’s delve deeper to find out what’s happening at this Richardson, TX-based designer and manufacturer of clothing and accessories.

Factors at Play

Fossil has surpassed earnings estimates in all the past four quarters. Solid watch portfolio and expansion in wearables have remained its strengths. However, softness in watch sales, weak comps in the U.S., sluggish performance in key international markets and unfavorable currency have been weighing on this Zacks Rank #4 (Sell) stock.

The company has been witnessing soft sales in licensed watches over the past few quarters, due to increased competition from new entrants in the market. Decline in its multi-brand licensed watch portfolio and a challenging environment for the traditional watch category are major reasons for the slump.

The company noted two factors that have been impacting watch sales. First, tech-enabled watches are significantly affecting the sales of traditional watches. Second, the success of the Michael Kors brand is overshadowing other brands’ performance. Moreover, in Jan 2016, Burberry announced that it is exiting the watch business and does not intend to renew its license agreement upon its expiration at 2017 end. The company continues to expect weakness in this category.

Fossil expects several challenges in the near term, which would hamper its operations. The company anticipates intense competition from new players, while evolving consumer preference across the world will lead to a volatile sales pattern. Though this should not be a problem over the long term, as the company plans to upgrade its products technologically, the near-term implications remain severe.

However, the traditional watchmakers like Swatch and LVMH's Tag Heuer are also developing smartwatches to cater to the rising demand. Thus, Fossil’s connected wearables and smartwatches are likely to face tough competition.

Also, we note that this global consumer fashion accessories maker has been recording sluggish comps in the U.S. over the past few quarters due to weak traffic. The company is witnessing a massive change in consumer shopping behavior, and has therefore adopted a cautious stance in the U.S.

Fossil is also battling economic challenges in many key markets, including China, Europe, Russia and Greece, and thus does not expect much international growth this year. The company’s performance in Europe and Asia are decelerating, which again is a concern.

Stocks to Consider

Some well-positioned retailers include The Children's Place, Inc. (NASDAQ:PLCE) , Urban Outfitters Inc. (NASDAQ:URBN) and Tilly's, Inc. (NYSE:TLYS) , all sporting a Zacks Rank #1 (Strong Buy). You can seethe complete list of today’s Zacks #1 Rank stocks here.

The Children’s Place has an average positive earnings surprise of 33.06% in the trailing four quarters. It also has a long-term earnings growth rate of 10.33%.

While Urban Outfitters has a long-term earnings growth rate of 15.00%, Tilly’s has a growth rate of 15.50%.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand.Click to see them now>>

FOSSIL GRP INC (FOSL): Free Stock Analysis Report

URBAN OUTFITTER (URBN): Free Stock Analysis Report

CHILDRENS PLACE (PLCE): Free Stock Analysis Report

TILLYS INC (TLYS): Free Stock Analysis Report

Original post