Dominion Energy Inc. (NYSE:D) announced that it acquired a 10 megawatt (MW) solar facility in Clarke County, VA., from the project's developer, an affiliate of Chicago-based Hecate Energy, LLC. The company also declared its intention to acquire another 20 MW solar farm, presently under construction in Northampton County, VA, from the same company in the third quarter of 2017.

The new solar additions will increase Dominion Energy’s solar power generation capacity to nearly 409 MW in Virginia. In fact, they are a part of its strategy to add 500 MW in solar power plant and have plans to invest more than $800 million in the state by 2020.

Moreover, both these solar projects have long-term power purchase agreement with Old Dominion Electric Cooperative (ODEC).

Dominion’s Solar Plans

Since 2013, the company has invested $2.6 billion to develop its solar projects. These projects will also allow Dominion Energy to enjoy the benefit of solar-related investment tax credits and enhance its gross renewable operating fleet to 1,800 MW by the end of 2018.

Notably, to address the increasing demand for electricity, Dominion Energy might plan to add at least 5,200 MW of solar in Virginia over the next 25 years.

What’s in Store for Solar Industry?

The recent decision of the Trump administration to support coal industry could hurt growth trajectory of the renewable industry. However, the current projections provided by the U.S. Energy Information Administration (EIA) indicate toward a steady growth of solar generation in the country.

In 2016, the total utility-scale solar electricity generating capacity in the U.S. was 21 gigawatts (GW). Moving ahead, EIA expects solar capacity additions during the year to reach 29 GW and 32 GW by the end of 2017 and 2018, respectively. We believe these solar additions will help to lower emission levels.

Given the positive forecasts from EIA, we expect big utility operators like Duke Energy (NYSE:DUK) to keep on expanding its renewable portfolio and lower emission in the process. It is to be noted that the company operates 400 MW of solar assets and has plans to expand its solar asset over time.

Price Movement

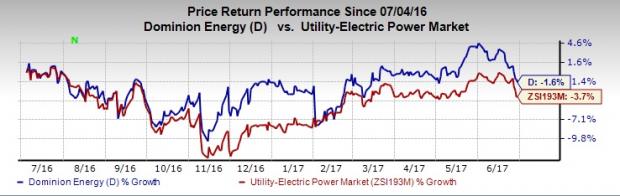

Shares of Dominion Energy have lost 1.6% in last twelve months compared with the Zacks categorized Utility – Electric Power industry’s fall of 3.7%.

Even though Dominion Energy’s return in last one year is in negative territory, however, expansion of its electric transmission, natural gas facilities and midstream assets are strong positives.

Zacks Rank & Stocks to Consider

Dominion Energy currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the same space are Pattern Energy Co (NASDAQ:PEGI) sporting a Zacks Rank #1 (Strong Buy) and Atlantic Power Corporation (NYSE:AT) holding a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Pattern Energy delivered average positive earnings surprise of 77.28% in the last four quarters. Its 2017 earnings estimates moved up by 114.3% to 15 cents over last 90 days.

Atlantic Power Corporation pulled off average positive earnings surprise of 98.53% in the last four quarters. Its 2017 earnings estimates moved up from a loss of 8 cents to gain of 14 cents over last 90 days.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Duke Energy Corporation (DUK): Free Stock Analysis Report

Dominion Resources, Inc. (D): Free Stock Analysis Report

Atlantic Power Corporation (AT): Free Stock Analysis Report

Pattern Energy Group Inc. (PEGI): Free Stock Analysis Report

Original post

Zacks Investment Research