- Dollar continues to slide on Fed pivot bets

- US GDP numbers for Q4 enter the limelight

- More ECB hawks flap their wings

- Loonie slides as BoC says it will likely stop raising rates

BoC pause adds to bets that the Fed will follow suit

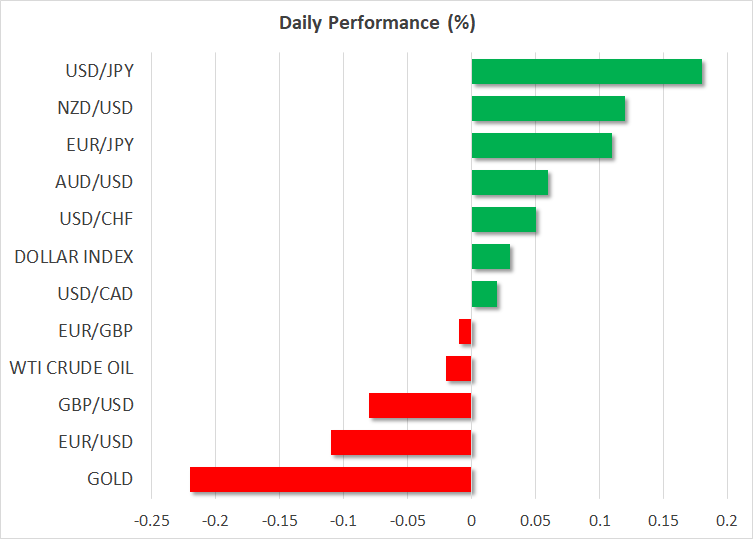

The US dollar traded lower against all but two of the other major currencies on Wednesday, with the exceptions being the Canadian and New Zealand dollars.

With no major US data to drive the US dollar, it seems that traders continued adding to their short positions based on the divergence between ECB and Fed expectations. On Tuesday, the preliminary PMI indices added credence to this narrative, with the Eurozone returning to growth in January and the US contracting for the seventh straight month.

On top of that, the BoC’s decision to hike by 25bps and signal that it would likely stop raising interest rates while it assesses the impact of cumulative hikes, may have added to speculation that the Fed is also headed towards the exit.

However, next week’s meeting seems too early for the Fed to signal a pause. According to Fed funds futures, investors are almost fully pricing in a 25bps hike for next week, but they see another one of the same size being delivered in March. In contrast to the Fed itself, which projects 75bps worth of additional hikes instead of 50 and a prolonged pause thereafter, the market still believes that two quarter-point cuts may be required by the end of the year.

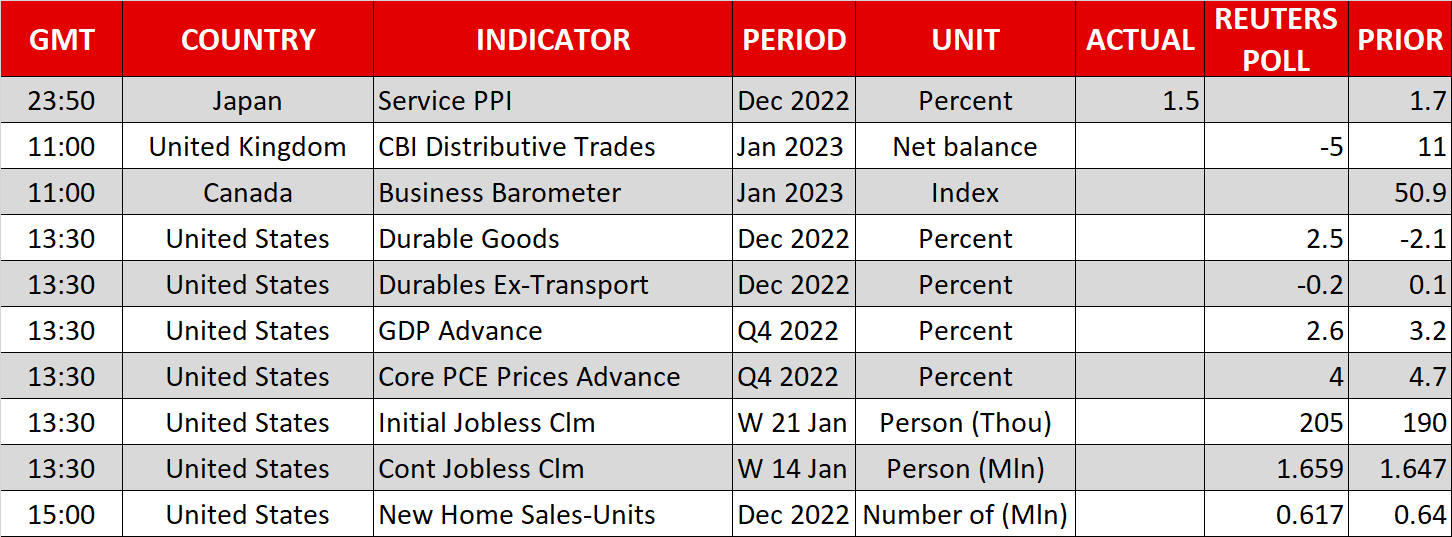

US GDP numbers on tap, more ECB hawks flap their wings

Today, traders may turn their gaze to the first estimate of US GDP for Q4. Expectations point to a slowdown to 2.6% qoq SAAR from 3.2% in Q3, which is still a strong pace of growth. However, with retail sales weakening sharply over the last two months and the manufacturing and housing sectors in recession, this could be the last quarter of solid growth before the lagged effects of the Fed’s prior super-sized hikes are felt by the economy.

The Q4 numbers may offer guidance as to how weak upcoming quarters could be. For example, a downside surprise could work against expectations of a soft landing and instead ignite fears of a deeper recession. In such a case, the dollar is likely to stay in a downward trajectory, especially against the euro.

Despite ECB member Fabio Panetta reportedly saying earlier this week that the ECB should not pre-commit to any moves beyond March, Bundesbank’s President Nagel and his Irish counterpart Makhlouf said they would not be surprised if rate increments extend into the second quarter. Following President Lagarde’s hawkish remarks at Davos last week, more hawkish comments by ECB policymakers combined with further improvement in euro area activity and accelerating core inflation are likely to keep the common currency supported. Euro/dollar closed Wednesday above 1.0900, increasing its chances to challenge the 1.1175 zone in the not-too-distant future.

Loonie falls after BoC hits brakes on tightening cycle

The Canadian dollar was the main loser yesterday, coming under strong selling interest after BoC policymakers signaled that they will likely take their hands off the hike button as they assess the cumulative impact of prior rate increases.

Having said that though, the next part of their guidance said that they are prepared to take interest rates higher if needed to return inflation to target. This suggests that they have not fully closed the door to more rate hikes, and if the data continues to point to elevated underlying price pressures, market participants could well readjust their bets to price in that possibility. Combined with a weaker dollar and the fact that the financial community is still seeing China’s reopening as an overly positive development, dollar/loone could give back its BoC-related gains soon.

Wall Street mixed, awaits more earnings

Wall Street ended another session mixed yesterday, with the S&P 500 and the Dow Jones closing near their opening levels, and the Nasdaq sliding 0.18%. Earnings remain on top of investors’ agenda, with 95 of the companies in the S&P 500 having reported already.

However, the percentage of those beating estimates is well below the average beat rate of the past four quarters, prompting analysts to revise down their forecasts for aggregate earnings. They now see S&P 500 earnings dropping 3% y/y, while at the turn of the year they were estimating a 1.6% drop.