- Dollar rises as Fed survey eases recession fears

- Risk-linked currencies gain more on improving sentiment

- Spotlight turns to US CPI numbers

- Wall Street trades mixed ahead of the data

Fed loan survey lends mild support to the US dollar

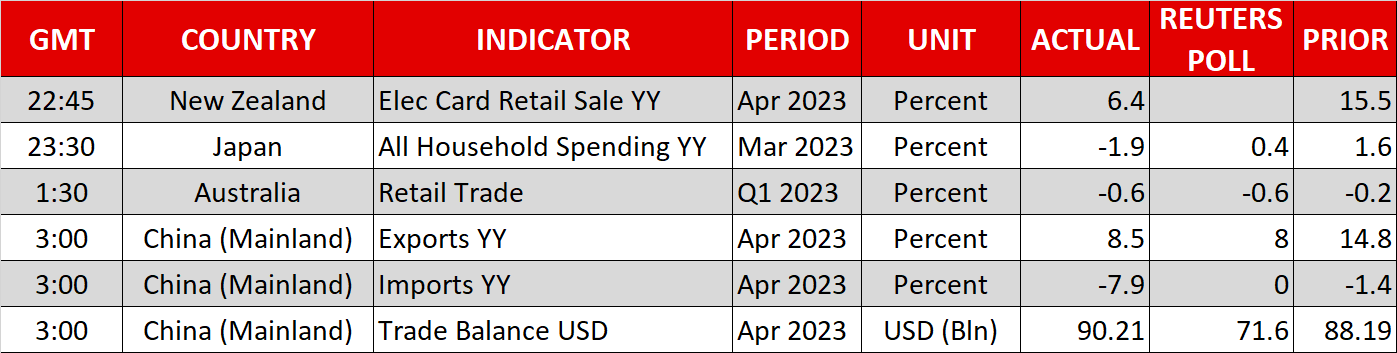

The US dollar gained some ground versus the euro, the pound, and the yen yesterday, but underperformed against the risk-linked aussie, kiwi and loonie. The greenback is slightly outperforming most of its peers today.

Traders may have decided to buy some US dollars after a loans survey conducted by the Federal Reserve showed that although credit conditions continued to tighten, this was likely due to the already-delivered rate hikes rather than severe stress in the banking sector. The fact that the risk-linked currencies performed better than the dollar suggests that the survey may have somewhat eased fears of an impending recession in the US.

That said, volatility in the FX market remained subdued, with Deutsche Bank’s currency volatility index, although rebounding somewhat, staying near its lowest levels in a year. Perhaps investors were reluctant to assume large positions ahead of Wednesday’s US CPI numbers, and also due to the ongoing stalemate in the US Congress over raising the debt ceiling. Market participants didn’t alter their Fed bets either. They are still seeing a 90% probability for policymakers to step to the sidelines in June and they are pricing in around 70bps worth of rate cuts by the end of the year.

Investors lock gaze on Wednesday’s CPI numbers

Regarding the CPI data, the headline rate is forecast to have held steady at 5.0% y/y and the core one to have ticked down to 5.5% y/y from 5.6%. That said, given that the ISM and S&P global PMI surveys showed that output prices accelerated during the month, the risks surrounding Wednesday’s numbers may be tilted to the upside.

The US dollar could gain if indeed there is an upside surprise, but calling for a bullish reversal may still be premature. Fed cut bets are unlikely to vanish. After all, they remained firmly on the table even after the PMIs revealed accelerating prices. As long as the ECB and the BoE are expected to deliver more hikes this year and no cuts at all, the greenback may stay in a downtrend against both the euro and the pound.

Wall Street trades indecisively, oil extends recovery

Wall Street traded indecisively as well. The Dow Jones slid 0.17%, but the Nasdaq gained 0.18%. The S&P 500 closed nearly unchanged. This corroborates the view that market participants were careful in assuming large positions ahead of the inflation numbers. An upside surprise could result in a slide, but nothing game changing.

Should rate cut bets stay on the table, those investing in high-growth firms are likely to stay active. Due to these companies being mostly valued by discounting expected cash flows for the quarters and years ahead, incorporating lower interest rates into the calculations results in higher present values. A potential slide in the S&P 500 could trigger some buy orders near the 4,050 support zone, with a potential rebound perhaps aiming for another break above the key hurdle of 4,150.

A Fed signaling that it could stop raising rates in June, a healthy US jobs report on Friday, and a sign of relief from the Fed loan survey yesterday allowed oil prices to rebound and extend their recovery as market participants became less concerned about a potential recession. What also proved supportive for oil prices was weekend news that Alberta declared a state of emergency in response to wildfires, which may have raised speculation about supply shortages.