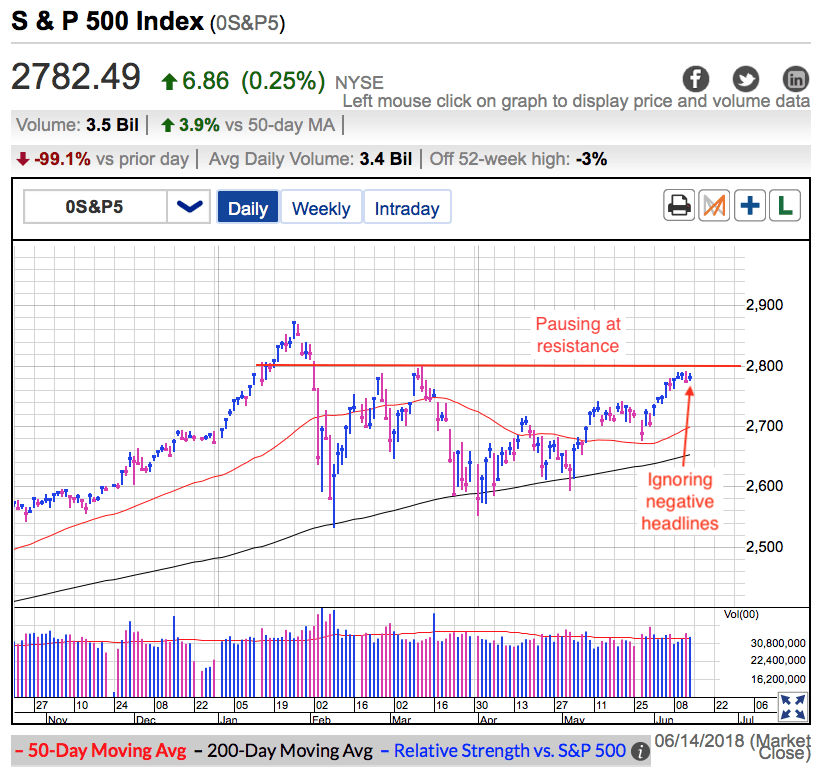

On Thursday the S&P 500 traded sideways for a fourth day as we consolidate recent gains under 2,800 resistance. Things got a little spooky Wednesday after the Fed said a fourth rate-hike this year was likely, one more than previously expected. Higher rates have been a concern and that was enough to send some traders scrambling for the exits and prices stumbled into Wednesday’s close. But the selling was short-lived and prices rebounded Thursday, hardly missing a beat.

As I’ve been writing about for months, the headlines that have been dominating the financial pages have already been priced in. If any of these headlines were going to knock us down, it would have happened by now. Instead, owners who feared these headlines bailed out months ago and were replaced by confident dip-buyers willing to own these risks. If they didn’t sell rate-hike headlines two, three, and four months ago, why would they sell them now? The answer is they wouldn’t. And as we saw Thursday, Wednesday’s dip was little more than a flash in the pan.

This is a strong market, not a weak one. Bears have been wrong for months and they will stay wrong unless they change sides. But another thing I frequently point out is risk is a function of height, meaning this rebound to the highest levels in several months also makes this a more risky place to be adding new money. The best buys come when the crowd is scared, not when it is breathing a sigh of relief. The best time to buy was weeks ago, and anyone not invested is probably better off waiting for a better entry point. Or at the very least, dollar-cost-averaging into the market.

The market is acting well and we should keep doing what is working. Our favorite buy-and-hold positions are doing great and we should stick with them. Even though the S&P500 is consolidating underneath prior highs, FAANG stocks are on fire and many of them are setting new all-time highs on a daily basis. The strongest stocks are leading the way as expensive keeps getting even more expensive. The downside is this rebound sucked a lot of emotion out of the market and volatility is crashing. While that is good for nerves, it isn’t so good for swing-trading. Those of us that were paying attention made good money this spring jumping in and out of the emotional gyrations, but unfortunately the market is transitioning back into slow-money where buy-and-hold works better than swing-trading.

Summer is often a slow time for the market, but that calm often sets the stage for a more exciting fall season. So far the market is acting well and that most likely means big money will start chasing prices higher into year-end when they return from their summer cottages. In the meantime, stick with what is working and right now that is buying-and-holding our favorite tech stocks.