Once again, let me start with some of my morning tweets:

· GM all. I don't have much of an upside target but may test 1410. Haven't seen any downside trigger yet. SPX hourly reversal at 1395

· Retest of overnight high in ES failed. But also a small double bottom. lets just wait and watch which way it goes. No rush to front run.

· Selling or shorting here would be dumb. At least we should see the hourly reversal.

That hourly reversal now stands at 1404. The daily reversal is at 1375 and long term monthly reversal is at 1320. So till 1320 is taken out we are still in an uptrend. Take that. I would expect almost everyone to be numb by now and resigned to never ending up move. Already we see talks of SPX 1600 and beyond!

But I think we are now entering in a correction zone.The next few days may bear me out. I would expect between 3-5% corrections by the end of the month. However such a correction will definitely be a buy opportunity.Precious metals continue on a sell signal and we may have to wait till Mid-April for a decent tradable bottom. Euro is making an inverse H&S and we may see a bounce upto 1.33. The AUD/USD and SPX correlation has now been replaced by NZD/JPY and SPX. NZD/JPY" width="608" height="383">

NZD/JPY" width="608" height="383">

This is a classic example as to how old correlations break down and new are formed.

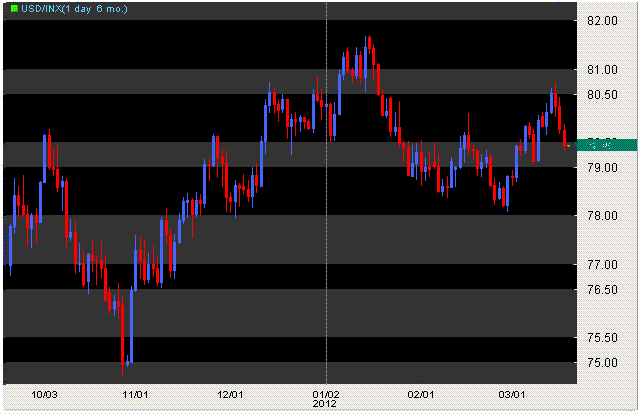

US $ index lost 3 days in a row but we may see a rebound from here.

A lower close will give a sell signal and considering the total market, we are not ready for the blast off rally yet. May be next month.

As you can see, more often than not, it pays to follow the unbiased and uncluttered market analysis. I would be wrong from time to time but I have now incorporated the trend following algorithms with my other parameters which should reduce the whipsaw and will prevent front running.No economic analysis or complex charts based on TA or EW. Pure trading and investing guidelines which works.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Deja Vu?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.