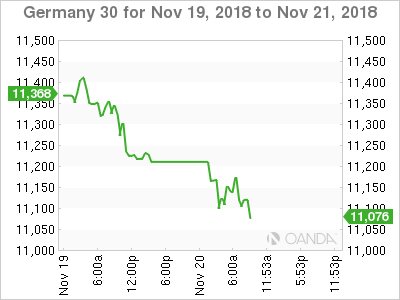

The DAX index has lost ground in the Tuesday session. Currently, the DAX is trading at 11,336, down 0.44% on the day. On the release front, there are no German or eurozone indicators. German PPI dipped to 0.3%, matching the estimate.

Global stock markets remain under pressure, with the simmering U.S-China trade war a key factor. An Asia-Pacific Economic Cooperation summit in Papua New Guinea ended in discord on Sunday, with leaders unable to agree on a final communique. U.S Vice President Mike Pence, who headed the U.S. delegation, was blunt in his remarks, saying that China would have to drastically change its trade practices before the U.S. would remove current tariffs on $250 billion in Chinese goods. The DAX has declined 2.72% in November, and earlier on Tuesday dropped to its lowest level since late October.

The ECB remains on track to wind up its stimulus package in December, but policymakers may have to reassess this stance, based on recent eurozone growth numbers, which are the weakest since 2014. Germany, the locomotive of the eurozone, has hit some headwinds, after posting a decline in GDP in the third quarter. The simmering trade dispute between the U.S. and China shows no signs of being resolved anytime soon, which will continue to take a bite out of German and eurozone exports. If the eurozone economy continues to soften, there could be calls on the ECB to continue stimulus into 2019.

*Key events are in bold

DAX, Tuesday, November 20 at 8:30 EST

Open: 11,157 Low: 11,187 High: 11,081 Close: 11,103