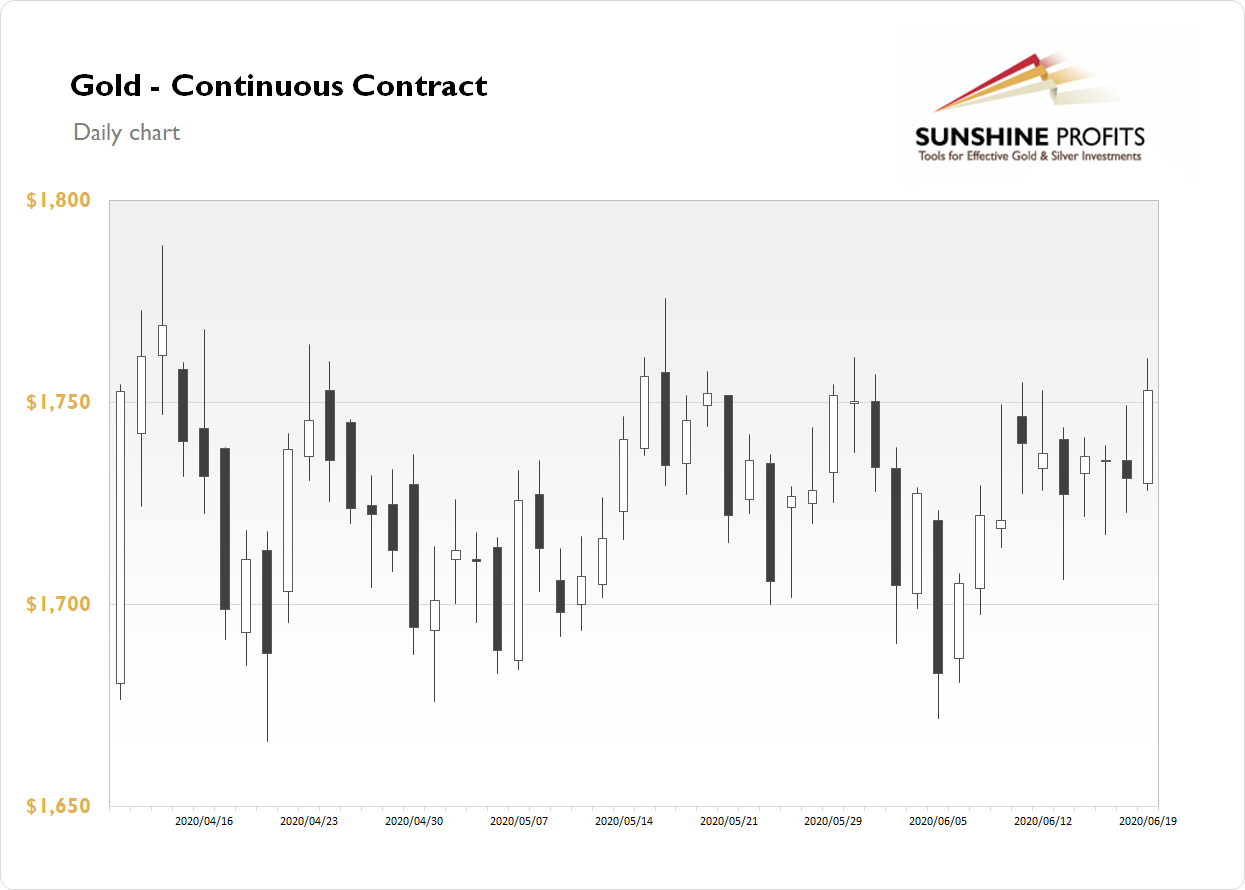

The Gold futures contract gained 1.27% on Friday, as it broke slightly above the price level of $1,750. Last week's Powell's testimonies on Wednesday, Thursday, and his Friday's speech didn't bring any new surprises for the financial markets. But gold got closer to its medium-term highs. However, it continues to trade within a consolidation, as we can see on the daily chart:

Gold is 0.68% higher this morning, as it is trading along Friday's daily high. What about the other precious metals? Silver gained 1.94% on Friday and today it is 1.1% higher. Platinum gained 1.86% and today it is up 2.0%. Palladium lost 0.01% on Friday and today it is 0.02 lower. So overall precious metals' prices are gaining today.

Last Thursday's Philly Fed Manufacturing Index has been much better-than-expected but the Unemployment Claims number came at 1.5 million again vs. expectations of 1.3 million. So overall, the recent economic data releases have been mixed.

Today, we will have the U.S. Existing Home Sales release. The previous release came at 4.33 million, and the expectations for the month of May (annualized number) are at 4.15 million.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Monday, June 22

- 10:00 a.m. U.S. - Existing Home Sales

- 11:00 a.m. Canada - BOC Governor Macklem Speech

Tuesday, June 23

- 3:15 a.m. Eurozone - French Flash Services PMI, French Flash Manufacturing PMI

- 3:30 a.m. Eurozone - German Flash Manufacturing PMI, German Flash Services PMI

- 9:45 a.m. U.S. - Flash Manufacturing PMI, Flash Services PMI

- 10:00 a.m. U.S. - New Home Sales, Richmond Manufacturing Index