USD/CAD Daily Outlook

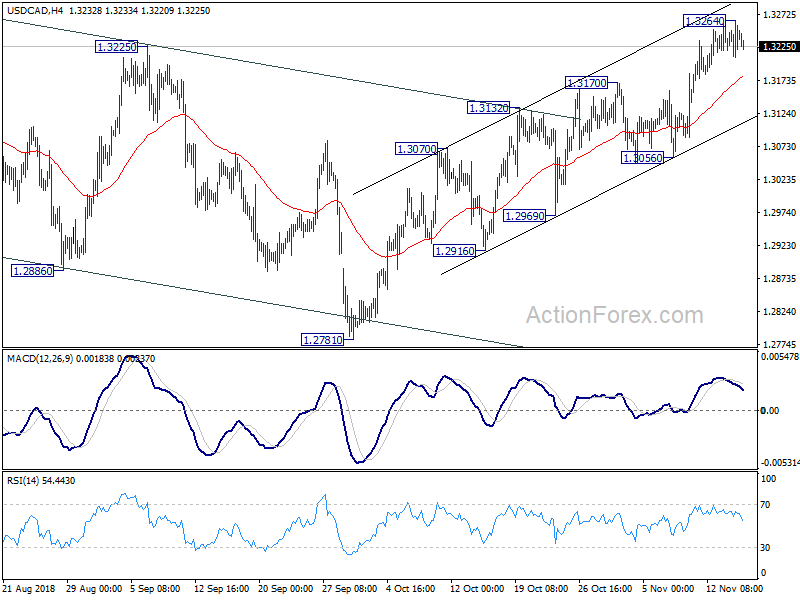

Daily Pivots: (S1) 1.3212; (P) 1.3238; (R1) 1.3268;

A temporary top is in place at 1.3264 in USD/CAD and intraday bias is turned neutral first. Further rise is expected as long as 1.3056 support holds. On the upside, above 1.3264 will extend the rally from 1.2781 to retest 1.3385 high. However, break of 1.3056 will indicate near term reversal and turn outlook bearish

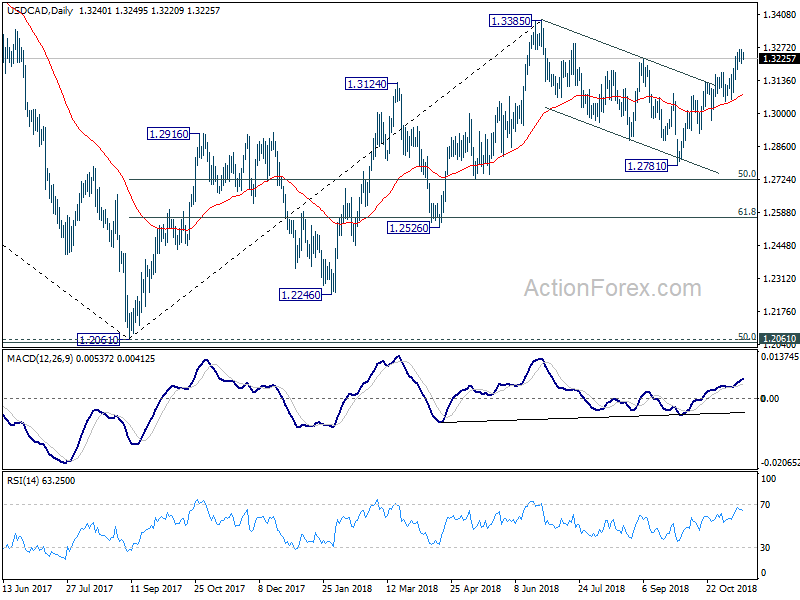

In the bigger picture, current development revives the case that corrective fall from 1.3385 has completed at 1.2781 already. And whole up trend from 1.2061 (2016 low) is ready to resume. Break of 1.3385 will target 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685. This will now be the favored case as long as 1.2781 support holds.

AUD/USD Daily Outlook

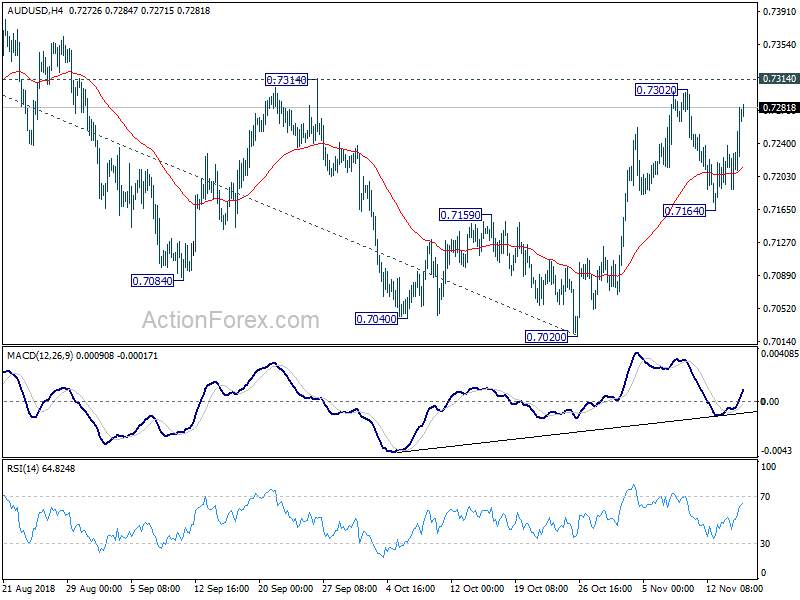

Daily Pivots: (S1) 0.7195; (P) 0.7225; (R1) 0.7262;

AUD/USD rebounds strongly today but stays below 0.7302 temporary top. Intraday bias remains neutral first. On the upside, decisive break of 0.7314 will indicate medium term reversal. Further rally should be seen to 38.2% retracement of 0.8135 to 0.7020 at 0.7446 next. However, break of 0.7164 will suggest that rebound from 0.7020 has completed and maintain medium term bearishness. Intraday bias would be turned back to the downside for retesting 0.7020 low.

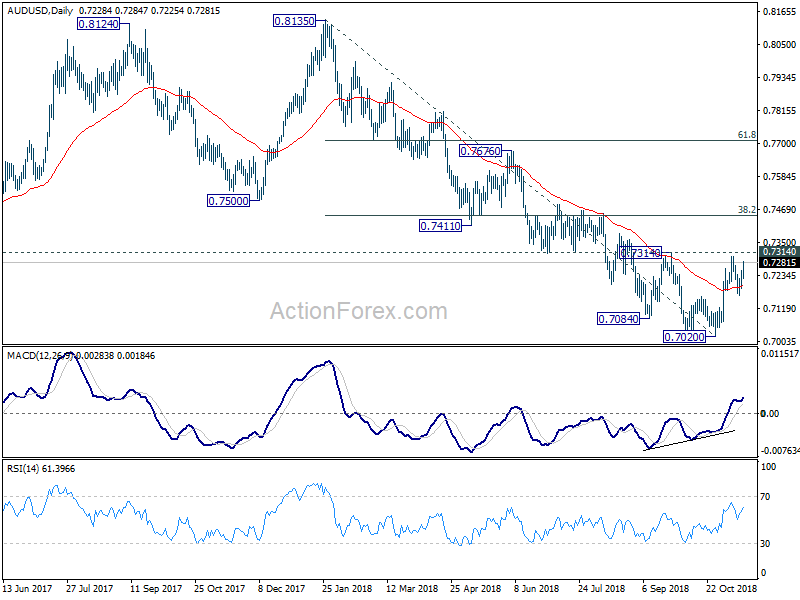

In the bigger picture, as long as 0.7314 resistance holds, fall from 0.8135 is tentatively treated as resuming long term down trend from 1.1079 (2011 high). Decisive break of 0.6826 will target 0.6008 key support next (2008 low). However, firm break of 0.7314 will suggest that whole decline from 0.8135 has completed. And, the corrective pattern from 0.6826 (2016 low) is extending with another rising leg towards 0.8135 before completion.