USD/CAD Daily Outlook

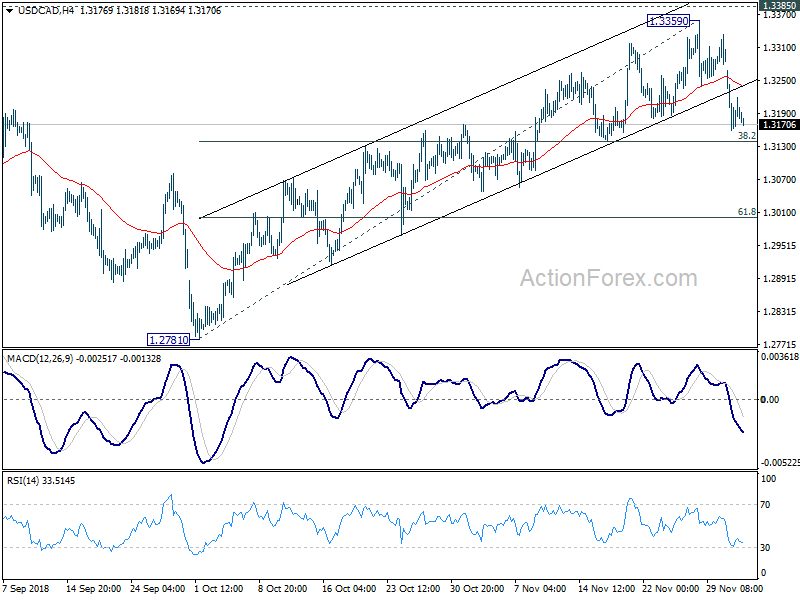

Daily Pivots: (S1) 1.3148; (P) 1.3209; (R1) 1.3259;

Intraday bias in USD/CAD remains on the downside for the moment. Rise from 1.2781 should have completed at 1.3359, ahead of 1.3385 key resistance. Further fall should be seen to 38.2% retracement of 1.2781 to 1.3359 at 1.3138 first. Break will target 61.8% retracement at 1.3002. On the upside, break of 1.3385 resistance is needed to confirm upside momentum. Otherwise, risk will stay on the downside even in case of strong rebound.

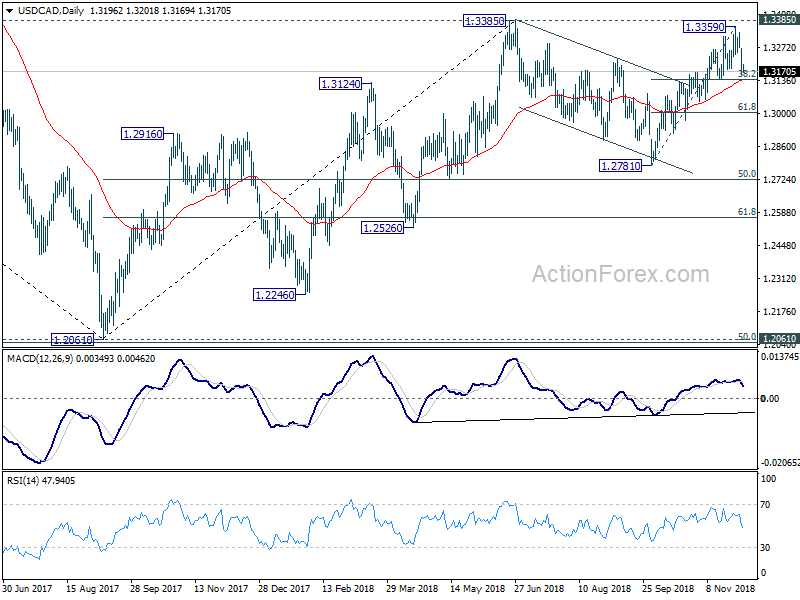

In the bigger picture, current development argues that medium term corrective pattern from 1.3385 is extending with another falling leg. While deeper decline could be seen, downside should be contained by 50% retracement of 1.2061 to 1.3385 at 1.2723 to bring rebound. An eventual upside break out is still expected to 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685, at a later stage.

AUD/USD Daily Outlook

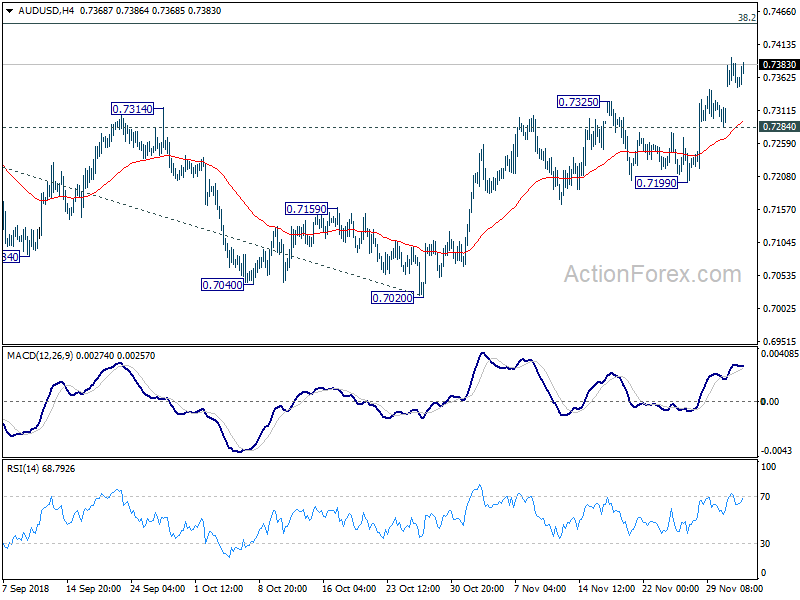

Daily Pivots: (S1) 0.7339; (P) 0.7366; (R1) 0.7387;

Intraday bias in AUD/USD remains on the upside. Current rebound from 0.7020 medium term bottom should target 38.2% retracement of 0.8135 to 0.7020 at 0.7446 and above. On the downside, break of 0.7284 minor support will turn intraday bias neutral first. But near term outlook will stay bullish as long as 0.7199 support holds.

In the bigger picture, AUD/USD’s decline from 0.8135 should have completed at 0.7020 already, ahead of 0.6826 key support (2016 low). Stronger rebound should be seen. But still, we’d expect strong resistance from 0.7500 support turned resistance to limit upside. Medium term fall from 0.8135 should extend to take on 0.6826 low at a later stage.