EUR/JPY Daily Outlook

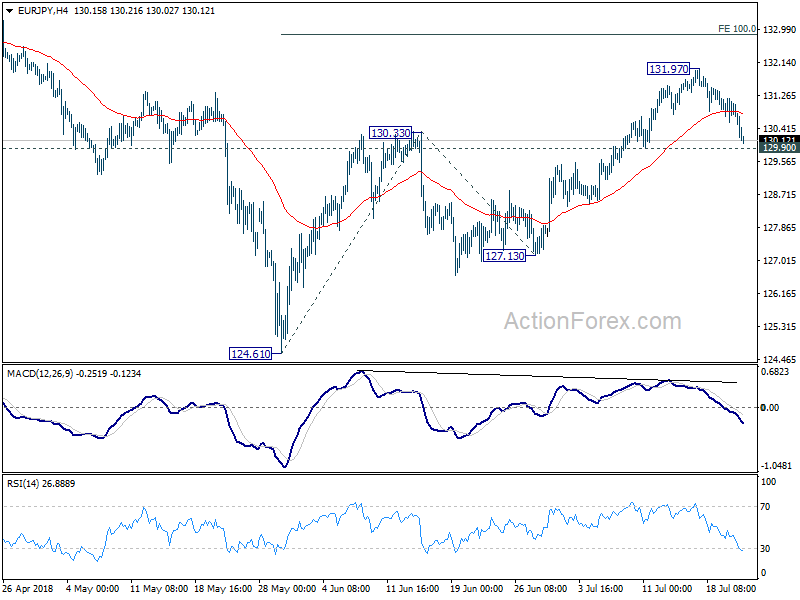

Daily Pivots: (S1) 130.39; (P) 130.80; (R1) 131.06;

EUR/JPY’s fall from 131.97 extends today but it’s still held above 129.90 support. Intraday bias remains neutral and near term outlook stays bullish for another rally. On the upside, above 131.97 will target 100% projection of 124.61 to 130.33 from 127.13 at 132.85 next. However, considering bearish divergent condition in 4 hour MACD, break of 129.90 will indicate short term reversal, and turn bias back to the downside for 127.13 support and below.

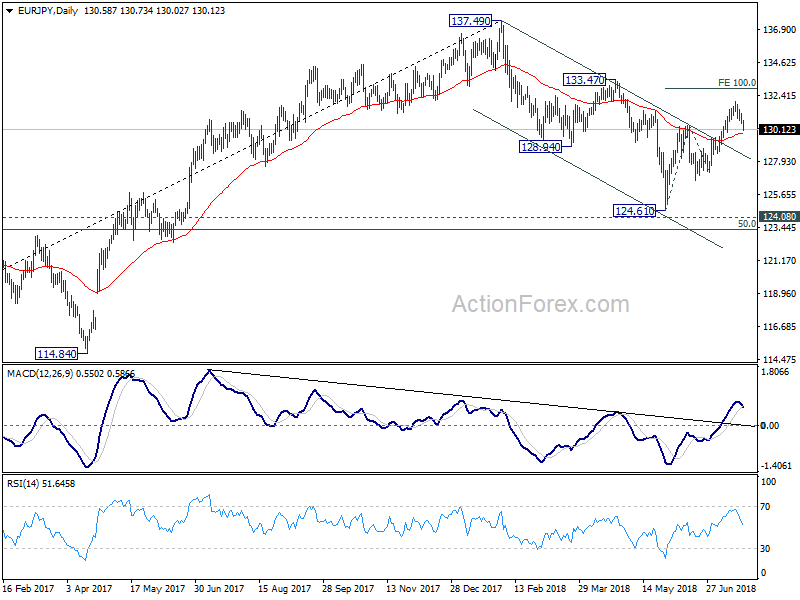

In the bigger picture, the strong break of channel resistance from 137.49 suggests that the decline from there has completed. The three wave structure suggests that it’s a correction. With 124.08 key resistance turned support intact, medium term bullishness is also retained. Break of 133.47 will affirm this bullish case and target 137.49 and above. This will now be the favored case as long as 127.13 support holds.

GBP/JPY Daily Outlook

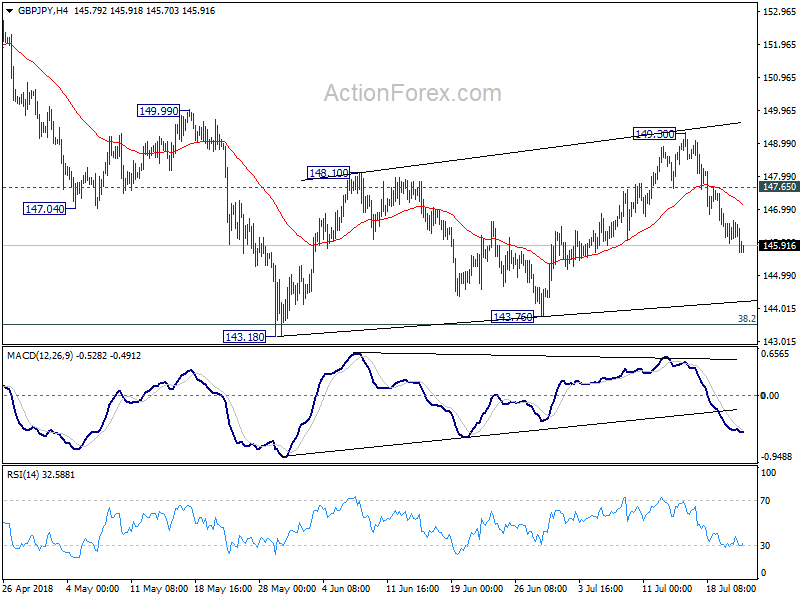

Daily Pivots: (S1) 146.00; (P) 146.34; (R1) 146.69;

Intraday bias in GBP/JPY remains on the downside for the moment. Consolidation consolidation pattern from 143.18 has completed with three waves up to 149.30 already. Deeper fall should now be seen back to 143.18/76 support zone. On the upside, above 147.65 minor resistance will turn bias back to the upside for 149.30/99 resistance zone instead.

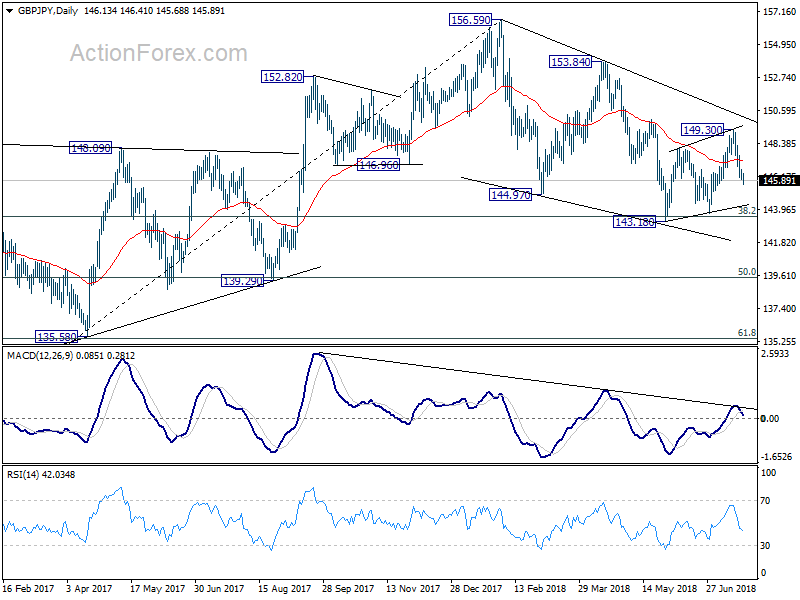

In the bigger picture, no change in the view that decline from 156.59 is a corrective move. In case of another fall, strong support should be seen above 139.29 cluster support (50% retracement of 122.36 to 156.59 at 139.47) to contain downside and bring rebound. Meanwhile, break of 153.84 should confirm that the correction is completed and target 156.59 and above to resume the medium term up trend.