EUR/AUD Daily Outlook

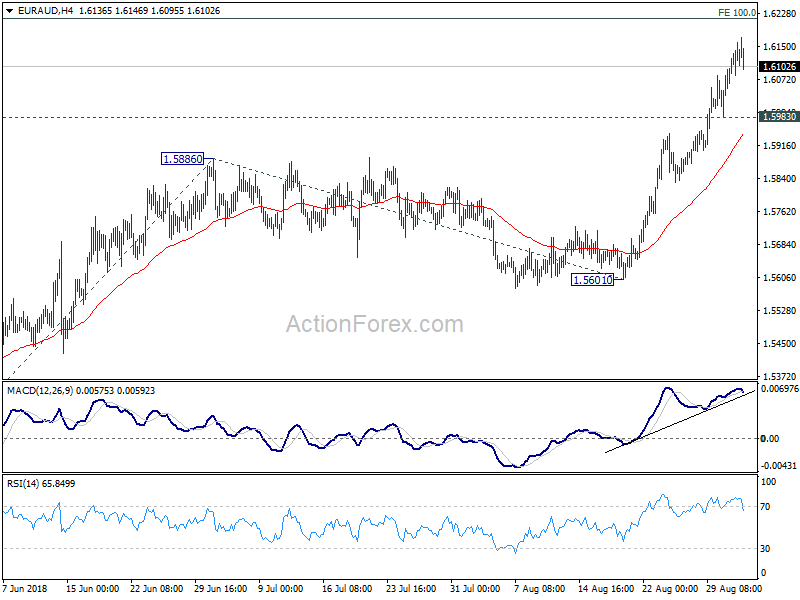

Daily Pivots: (S1) 1.6065; (P) 1.6115; (R1) 1.6180;

EUR/AUD is losing some upside momentum as seen in 4 hour MACD. But further rise is still expected as long as 1.5983 minor support holds. Current rally should target 100% projection of 1.5271 to 1.5886 from 1.5601 at 1.6216, which is close to 1.6189 high. Upside could be limited there on initial attempt to bring consolidation. On the downside, break of 1.5983 support is needed to indicate short term topping. Otherwise, further rise will remain in favor in case of retreat.

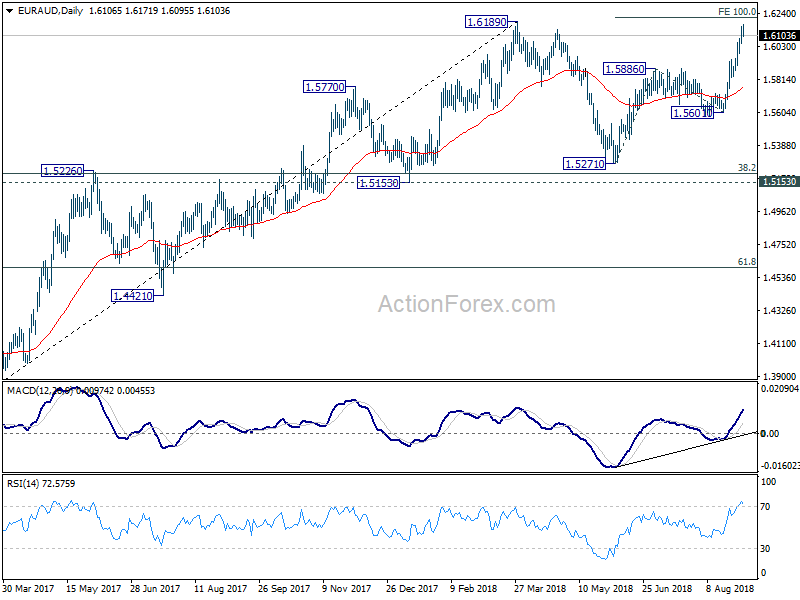

In the bigger picture, EUR/AUD drew strong support from 55 week EMA and rebounded. And the development argues that medium term rally from 1.3624 (2017 low) is still in progress. Firm break of 1.6189 will target a test on 1.6587 (2015 high). On the downside, break of 1.5601 support will now be the first sign of medium term reversal, and will bring a test on 1.5271 key support for confirmation.

EUR/JPY Daily Outlook

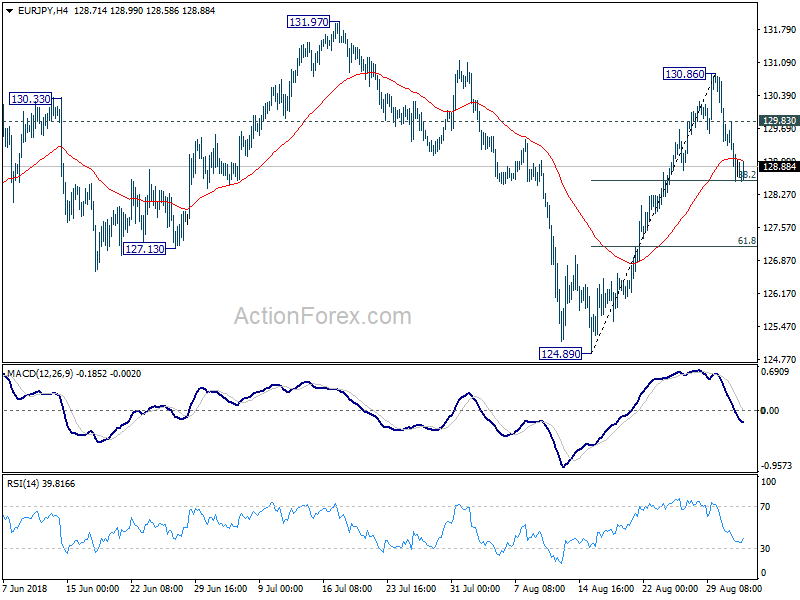

Daily Pivots: (S1) 128.39; (P) 129.11; (R1) 129.67;

Focus in EUR/JPY remains on 38.2% retracement of 124.89 to 130.86 at 128.57. As long as 128.57 holds, another rise is still mildly in favor. On the upside, above 129.83 minor resistance will turn bias back to the upside for 130.86 first and then resistance zone between 131.97 and 61.8% retracement of 137.49 to 124.61 at 132.56. However, firm break of 128.57 will argue that rebound from 124.89 has completed, and it’s the third leg of consolidation pattern from 124.61. In that case, intraday bias will be turned back to the downside for 124.61/89.

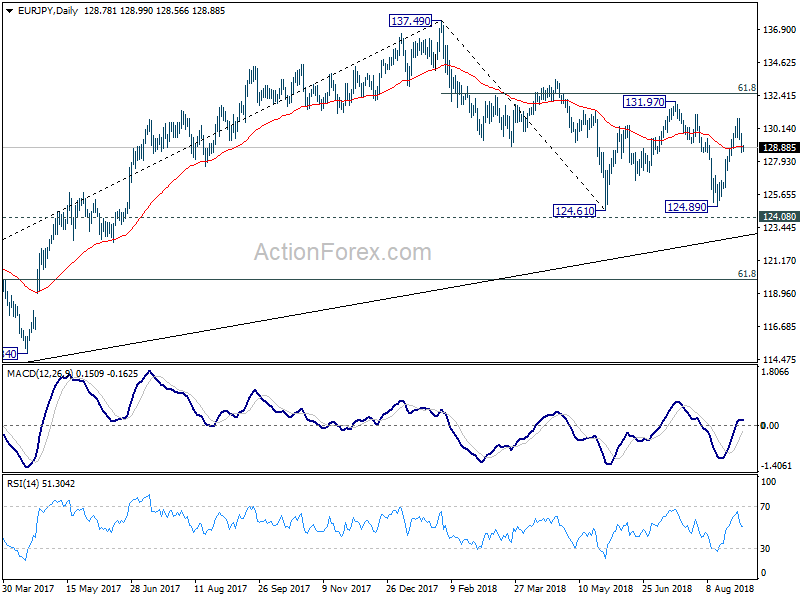

In the bigger picture, EUR/JPY once again rebounded ahead of 124.08 key resistance turned support. It’s also held well above long term trend line from 109.03 (2016 low). The development argues that such rise from 109.03 might not be over yet. Decisive break of 61.8% retracement of 137.49 to 124.61 at 132.56 will pave the way to retest 137.49 high. But, firm break of 124.08 will argue that whole rise from 109.03 (2016 low) has completed at 137.49. Deeper decline would be seen to 61.8% retracement of 109.03 to 137.49 at 119.90 next.