The recent popularity of “tactical” investment strategies has given rise to a dizzying array of new terminology and strategy descriptions. Most investors and investment professionals lack a deeper understanding of the core nature of such strategies. They can hardly be faulted for all of the marketing material floating around that often obfuscates the difference between a separate brand and a truly separate strategy.

In reality, most “tactical” strategies are very similar and have predictable payoff profiles even if their returns are not predictable. The class of tactical strategies are essentially part of the broader class of “dynamic asset allocation”strategies (DAA). The opposite of DAA is to employ “strategic” or policy-based asset allocation that contains a constant mix (like 50/50 or 60/40).The premise of DAA is that through active shifts in portfolio weightings, one can add value versus buy and hold or stategic/constant mix portfolio allocation. One of the best articles that helps provide a solid grounding in Dynamic Asset Allocation was a classic paper by Perold and Sharpe.

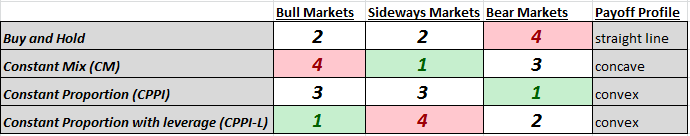

There are essentially three core strategies compared in the paper (excluding those that are option-based): 1) buy and hold–yes this is a strategy 2) constant mix (CM)- this is like a policy weighting that is constantly rebalanced such as 60/40 stocks/bonds 3) constant proportion (CPPI)- this is essentially synthetic portfolio insurance generated by using a dynamic allocation between stocks and t-bills. In CPPI, you would buy stocks as they are rising with an increasing proportion, and sell stocks when they are falling with a decreasing proportion until you hit a “floor”- which is essentially akin to a stop loss. These three strategies are demonstrated in the paper to have very different payoff profiles as a function of market conditions. The table below provides a useful “cheat sheet” that also helps clarify the differences. The best performer in a given market regime is ranked #1 while the worst performer is ranked #4:

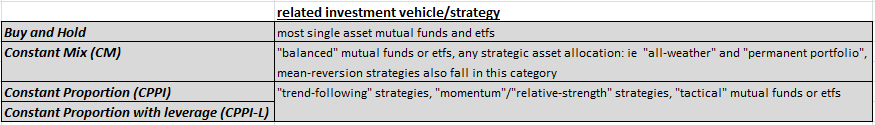

Here is a table that relates the different strategies above as closely as possible to more commonly used investment strategies or products (note that due to the multi-asset composition of these vehicles/strategies the linkages are not quite perfect):

The first takeaway is that there is no uniform winning strategy in all market conditions. Each strategy has a particular regime in which is it likely to shine. Bull Markets tend to favor Buy and Hold (BAH) unless one is able to successfully employ a CPPI strategy on the underlying asset with leverage (this may or may not be possible .Other things being equal, the degree to which CPPI-L will be able to beat a BAH is proportional to the degree of market noise; as the market becomes noisier, the CPPI-L will have more difficulty matching BAH. With more predictable/trending behavior the CPPI-L will easily beat BAH.Without the use of leverage, it is impossible for CPPI or CM to keep up with BAH in rising markets. This is the case for most tactical strategies- especially if they hold assets other than the equity market. This under-performance can also be compounded by market noise. CM also has difficulty in bull markets because it is constantly “taking profits” via re-balancing and inherently reducing the delta to the market.

In Sideways Markets, both BAH and CPPI struggle due to a lack of return and a greater abundance of noise. This is where CM shines since it is like Shannon’s Demon- the optimal strategy for capitalizing on entropy. Unlike BAH and CPPI, it is possible to make money with CM even if the market does not produce a positive return. CPPI is most vulnerable in sideways markets because it is the most sensitive to noise and can get “whipsawed.”

In Bear Markets, CPPI strategies shine because they have a fixed maximum total loss defined by the floor that is always set at a % that is greater than zero. The degree of protection that is guaranteed will be proportional to the reciprocal of the slope (1/m). The protection will also be a function of whether the floor is ratcheted as the asset rises, and also whether the floor is periodically reset- like rolling call options. BAH obviously does the worst, as it is fully exposed to any losses that incur. CM falls in the middle as it has inherently less exposure through re-balancing, and also tends to capture some of the market volatility.

In general, CPPI-type strategies are most related to trend-following and momentum or relative-strength investing. The broad class of “tactical” or “active” strategies are likely to have a payoff profile very similar to CPPI. In contrast CM-type strategies are either more similar to “balanced” type passive funds or ETFs, “strategic” asset allocation methodologies that are static, or represented by strategies that attempt to capture mean-reversion. BAH-type strategies represent virtually any passive holding- I would include most equity or bond mutual funds/etfs in here simply because they all seek to have low tracking error and make minor bets on individual holdings in an attempt to outperform on a relative basis.

Perhaps the most important takeaway from the paper was defined as a theory for which strategy will be likely to outperform/underperform:

“the fact that convex and concave strategies are mirror images of one another tells us that the more demand there is for one of these strategies, the more costly its implementation will become, and the less healthy it may be for markets generally. If growing numbers of investors switch to convex strategies, then markets will become more volatile, for there will be insufficient buyers in down markets and insufficient sellers in up markets at previously “fair” prices. In this setting, those who follow concave strategies may be handsomely rewarded. Conversely, if growing numbers of investors switch to concave strategies, then the markets may become too stable. Prices may be too slow to adjust to fair economic value. This is the most rewarding environment for those following convex strategies. Generally, whichever strategy is “most popular” will subsidize the performance of the one that is “least popular.” Over time, this will likely swell the ranks of investors following the latter and contain the growth of those following the former, driving the market toward a balance of the two.” Perold and Sharpe, “Dynamic Strategies for Asset Allocation.”

The theory is simple and is supported by recent market history- if everyone wants for example market upside with protection–ie tactical type strategies- then buy and hold and constant mix will probably outperform. The opposite is true if everyone wants a more passive approach. Remember the 1990′s when everyone was switching to index funds? That massive shift in demand gave rise to one of the most profitable decades for tactical/active management- 2000- 2008. The spectacular success of tactical strategies in 2008 especially gave rise to tremendous demand for tactical which subsequently underperformed in a big way in 2009. Renewed market problems in 2010 and 2011 and the prospect of a sovereign debt crisis produced good performance for tactical strategies and naturally tremendous demand given all of the renewed “fear mongering”. Naturally 2012 was not kind to tactical strategies–especially those that sought to minimize volatility to protect against a crisis. As investors begin to pile into equity markets and passive investments again, it is possible that tactical products will eventually outperform.

The key lesson is that markets do not exist in a vacuum– the relative peformance of a strategy is inversely proportional to the general demand for that strategy: when it is least popular to be tactical, it is likely that tactical will outperform. In contrast, when it is least popular to be passive or hold a strategic asset allocation it is most likely that these will outperform. Basically, if it hurts to invest in a given strategy and you have a lot of company in feeling that way it is probably a good idea to invest! The problem is that most investors and advisors want to go with what is working now as this is the easiest sell and also the most comfortable to invest in. On the choice of which dynamic strategy to use in the long run, again Perold and Sharpe had some wise words:

“Which dynamic strategy is demonstrably the best? The goal of this article is to emphasize that “best” should be measured by the degree of fit between a strategy’s exposure diagram and the investor’s risk tolerance (expressed as a function of an appropriate cushion). Ultimately, the issue concerns the preferences of the various parties that will bear the risk and/or enjoy the reward from investment. There is no reason to believe that any particular type of dynamic strategy is best for everyone (and, in fact,only buy-and-hold strategies could be followed by everyone). Financial analysts can help those affected by investment results understand the implications of various strategies, but they cannot and should not choose a strategy without substantial knowledge of the investor’s circumstances and desires.”

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

DAA: Lessons From Perold And Sharpe

Published 03/18/2013, 02:45 AM

Updated 07/09/2023, 06:31 AM

DAA: Lessons From Perold And Sharpe

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.