Talking Points:

- US Dollar Technical Positioning Warns of Downswing Ahead

- S&P 500 Has Room to Extend Deeper Above the 2000 Figure

- Crude Oil Poised to Renew Selloff After Chart Support Break

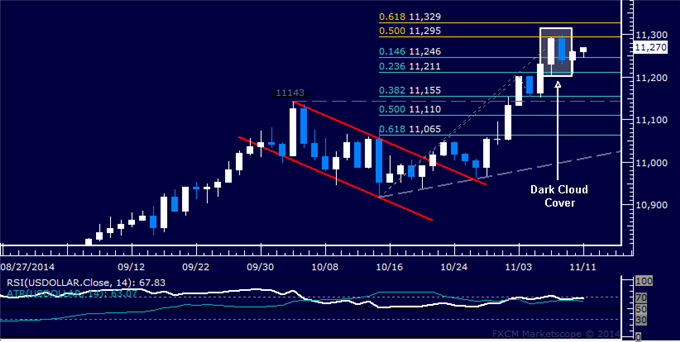

US DOLLAR TECHNICAL ANALYSIS – Prices may be gearing up for a turn lower after prices produced a bearish Dark Cloud Cover candlestick pattern. Near-term support is at 11246, the 14.6% Fibonacci retracement, with a break below that on a daily closing basis exposing the 23.6% level at 11211. Alternatively, a reversal above the 50% Fib expansion at 11295 clears the way for a test of the 61.8% Fib threshold at 11329.

S&P 500 TECHNICAL ANALYSIS – Prices pushed to another record higher, with buyers now aiming to challenge resistance marked by the 23.6% Fibonacci expansion at 2051.00. A break above this barrier on a daily closing basis exposes the 38.2% level at 2081.20. Alternatively, a reversal below the 14.6% Fib at 2032.30 aims for resistance-turned-support at 2022.10, the September 19 high.

GOLD TECHNICAL ANALYSIS – Prices turned lower anew after testing resistance in the 1178.86-80.84 area marked by the December 2013 low and the 23.6% Fibonacci retracement. Near-term support is at 1131.11, the 76.4% Fibonacci expansion, with a break below that on a daily closing basis exposing the 100% level at 1092.78. Alternatively, a push above resistance targets the 38.2% retracement at 1212.23.

CRUDE OIL TECHNICAL ANALYSIS – Prices edged below the 38.2% Fibonacci expansion at 82.22, exposing the 50% level at 80.46. A further move beneath that targets the 61.8% Fib at 78.70. Alternatively, a reversal back above 82.22 aims for the intersection of channel floor support-turned-resistance and the 23.6% expansion at 84.39.