Summary & Key Takeaways:- Oil market fundamentals are holding up well, and elevated refining margins should help push inventories lower in the coming weeks.

- However, speculative positioning is beginning to reach levels of extreme bullishness, and history suggests futures returns are limited from such levels.

- In addition, futures front month spreads have also moved lower of late, indicating physical market tightness may be lessening for now.

- As such, although positioning can certainly move higher from here, until we see a pick-up in demand from the summer driving season, crude oil prices are probably set to continue to consolidate around the $75-$85 range for the time being.

Oil Prices Likely Capped for Now

After rallying more than $10 since December, crude oil prices may be set for a period of consolidation as a number of the underlying drivers of the rally are no longer wholly supportive of higher prices.

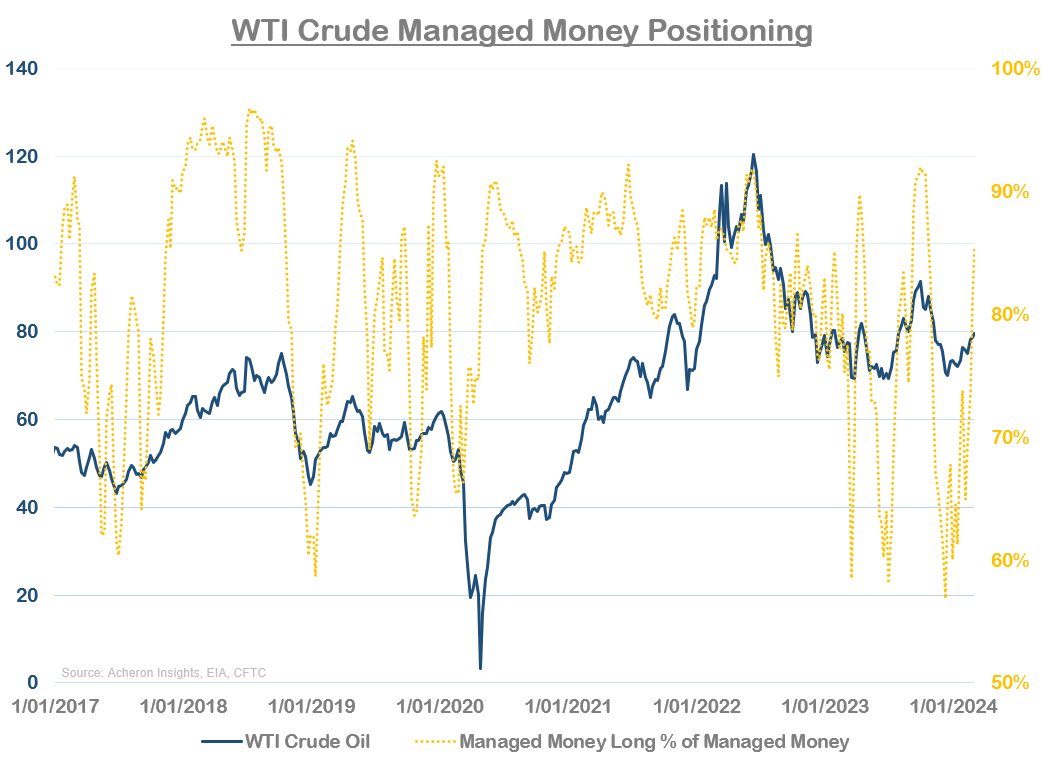

Front and center to this thesis is speculative positioning. Regular readers of mine will know my preference is to measure positioning in the energy markets through the lens of managed money (made up of hedge funds and trend-following CTAs). And, as we can see below, net managed money positioning has spiked significantly over the past couple of weeks as hedge funds and CTAs have bought back a significant number of short positions.

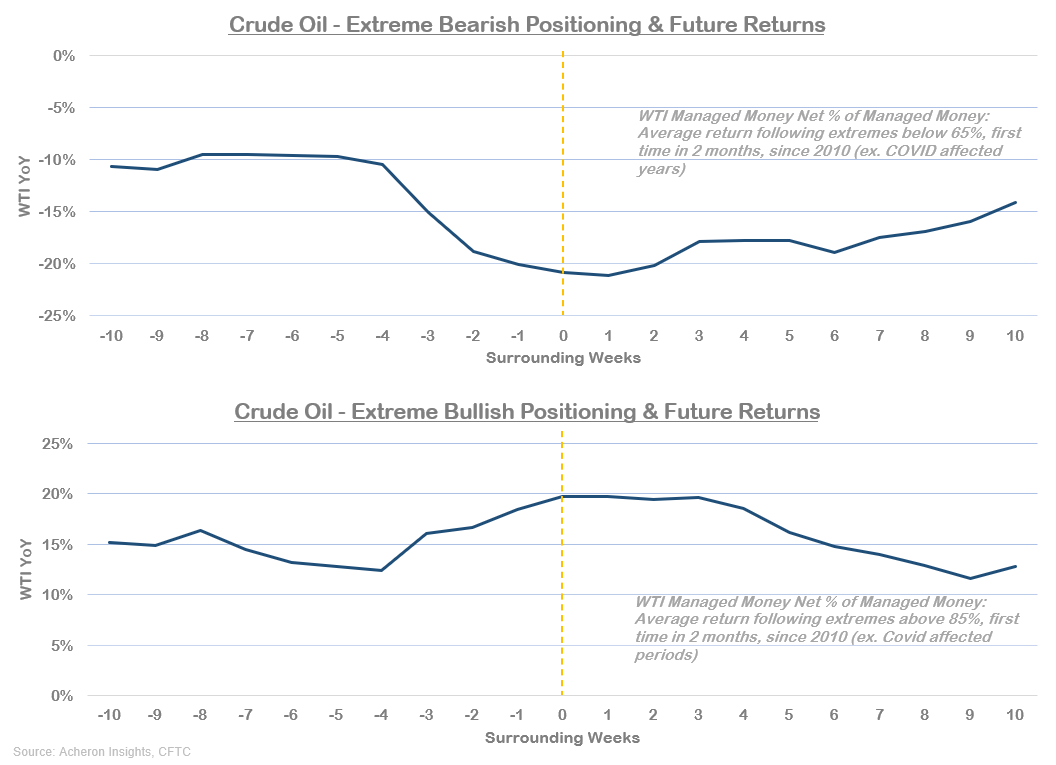

Now, their oil futures positions are closing in on extreme bullishness to a degree which generally coincides with short-term tops in price. As we can see below, history suggests - aside from the COVID-affected years of 2020 and 2021 - oil prices struggle to move meaningfully higher in the short-term when managed money net longs extend beyond 85% of total managed money positions.

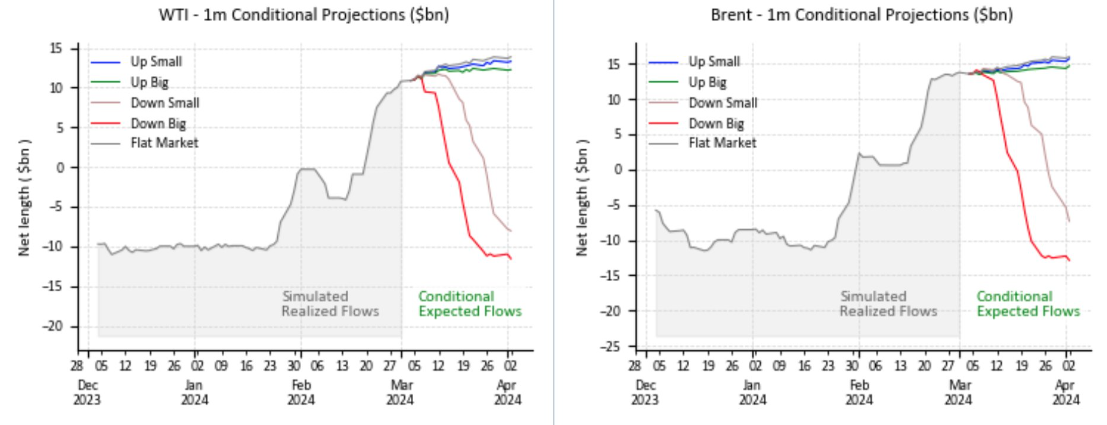

This puts CTA convexity firmly to the downside for now as they have plenty of selling and very little buying to do over the coming month, according to Goldman Sachs.

Source: Goldman Sachs

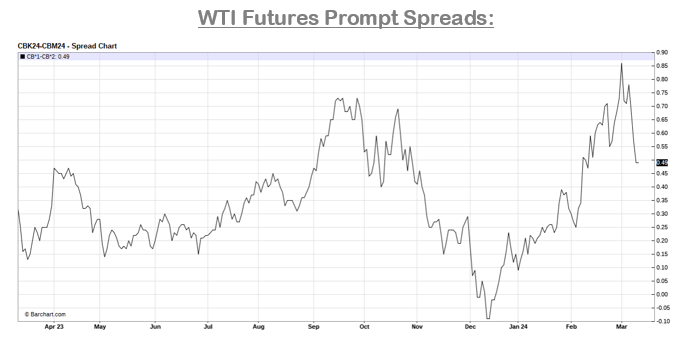

Meanwhile, what we have also witnessed since the beginning of March is front month WTI (and Brent) futures spreads move lower. While the term structure remains in backwardation, falling prompt spreads does suggest physical market tightness is weakening at the margins, and is generally a forbearer of short-term movements in price.

In terms of the inventory picture however, things are looking like they may start trending in the right direction, which should help to put a floor under prices.

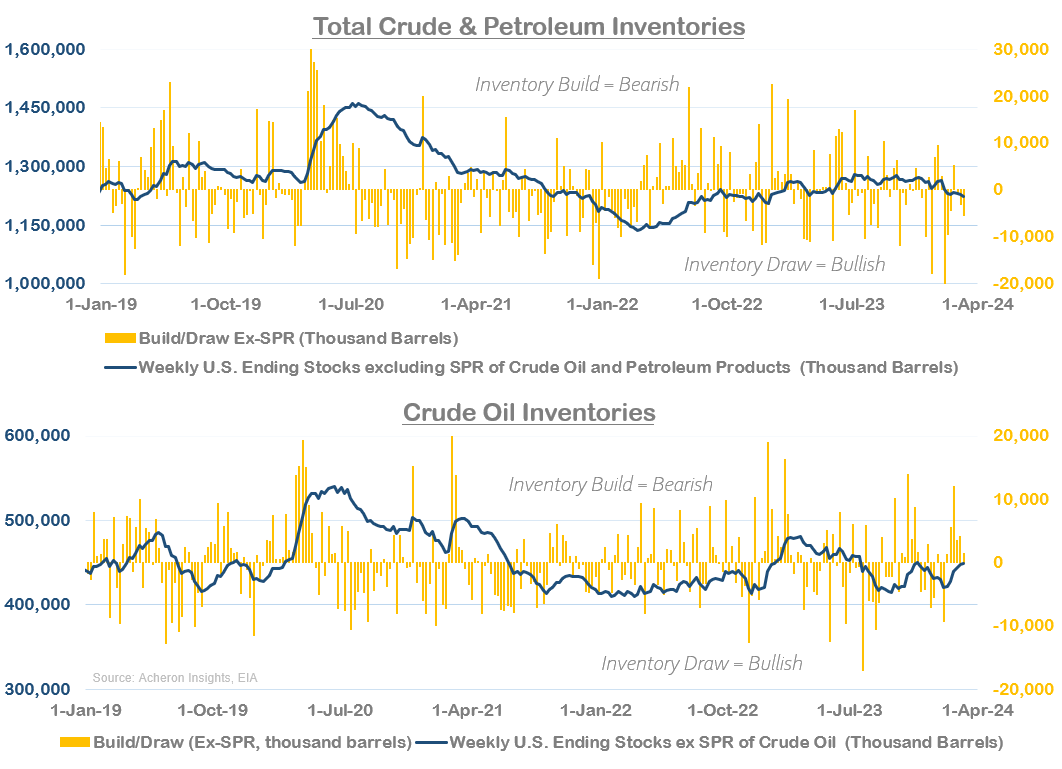

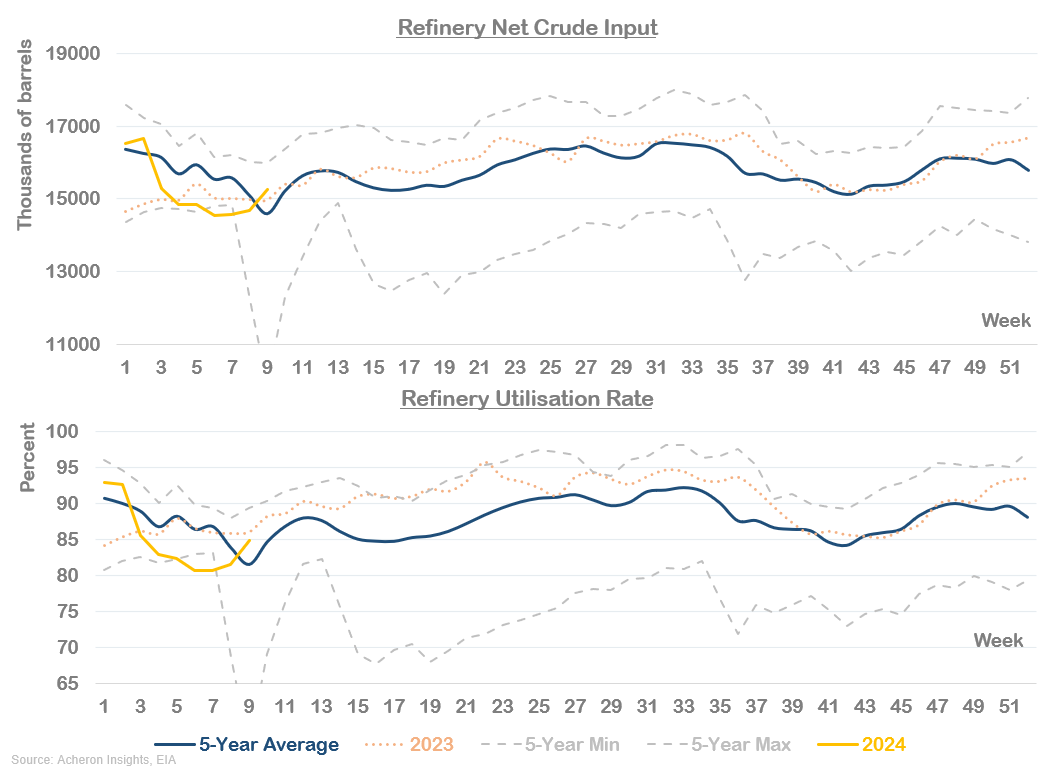

Inventories have indeed undergone an interesting start to the year. As I have noted in recent oil analyses, 2024 began with crude oil draws and refined product builds. But, as we have progressed into refinery maintenance season and certain refiners were hampered by outages, crude draws turned to builds while refined products builds turned to draws. Thus, total crude and petroleum inventories currently reside close to its five-year seasonal average.

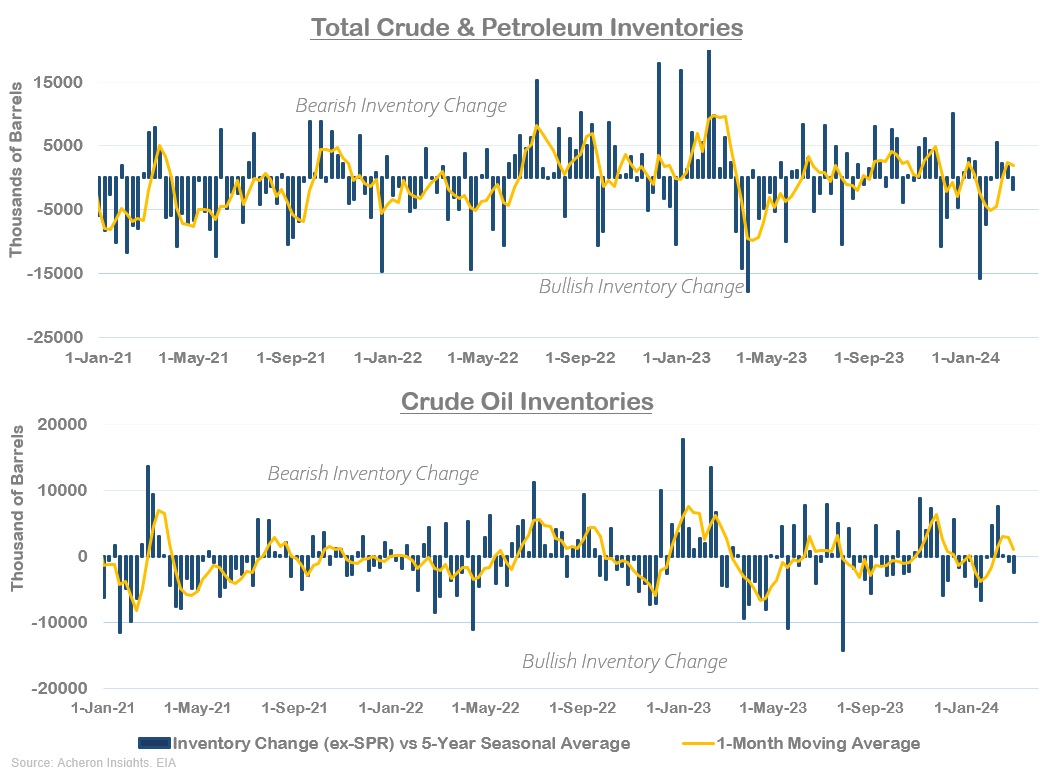

For this to turn bullish, we have been looking to see refined product draws exceed crude oil builds, which has been the case for the most part in recent weeks. Indeed, as we can see below, total crude and petroleum inventories have seen a number of draws to start 2024 (though these have lessened in their size of late), while crude oil inventories flipped from draws to builds.

On a seasonally adjusted basis, the inventory picture has actually weakened over the past few weeks, though last week’s draw in total crude and petroleum inventories did exceed its seasonal average as refinery demand for crude oil comes back online.

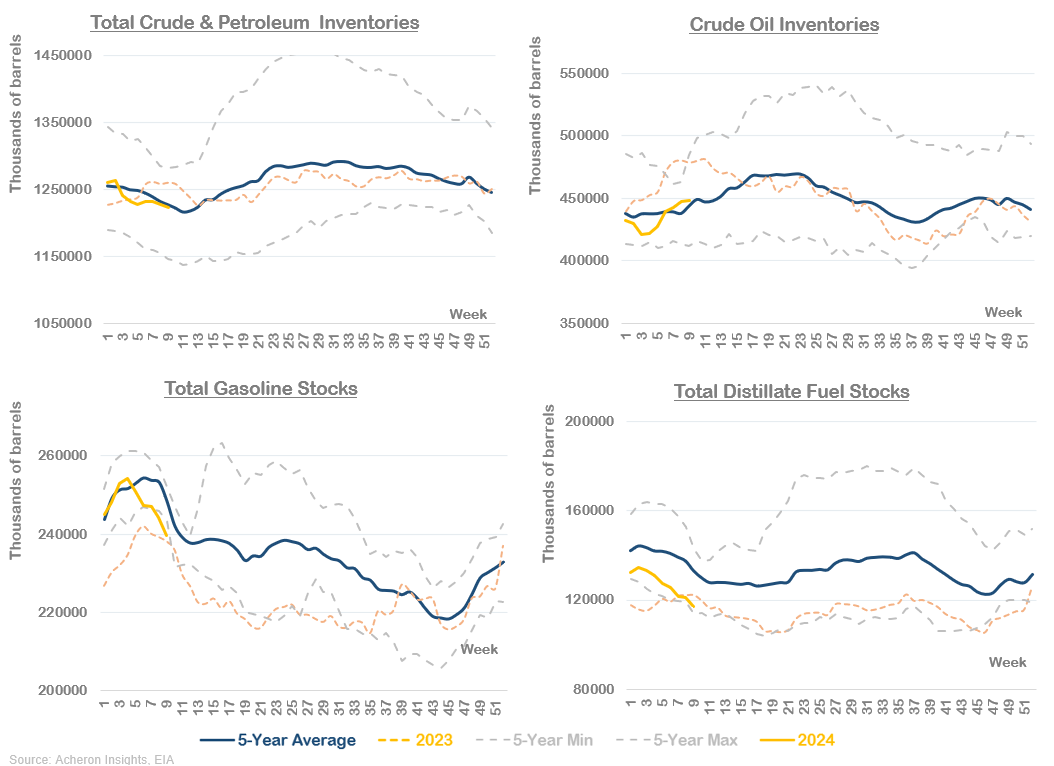

As it stands, the overall inventory picture remains rather sanguine, with total crude and petroleum inventories in line with five-year averages, as are crude inventories. For the primary refined products in gasoline and distillates, inventories have moved significantly lower in recent weeks due to the drop in refinery utilization, once again leaving refined product inventories at or near five-year lows.

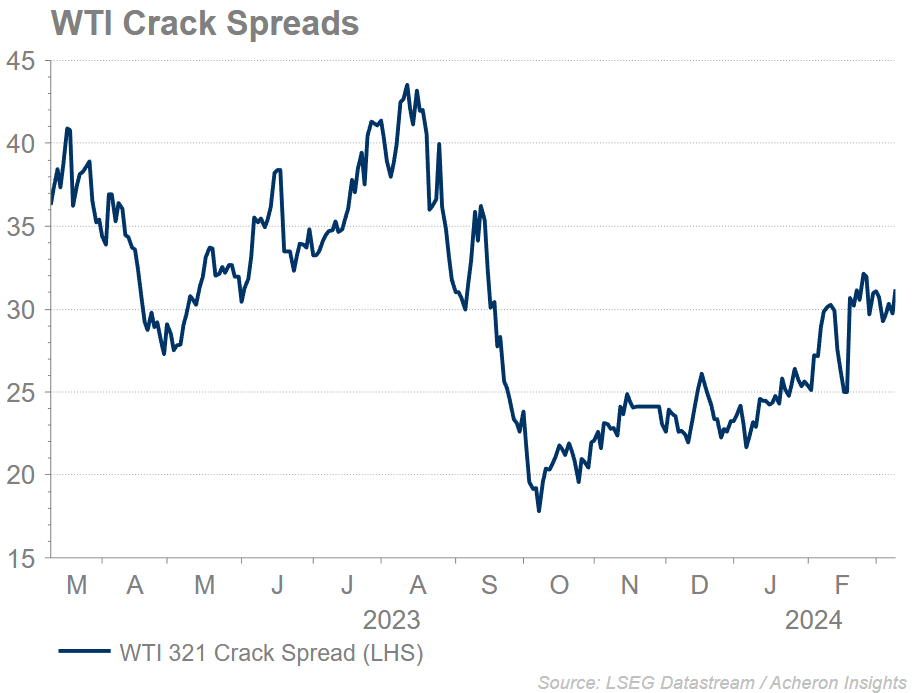

Fortunately, refining margins (i.e. crack spreads) have held up relatively well in recent weeks, despite a brief dip. The incentives for refiners to increase throughput remain high.

Therefore, as refinery demand comes back online as they take advantage of these elevated refining margins, we should see crude oil demand pick up and thus result in inventory drawdowns. And, so long as underlying demand for refined products remains steady, we should see both crude oil inventory draws as well as total crude and refined product inventory draws. So long as the latter occurs and crack spreads remain elevated, the market should remain relatively well-supported.

But, given we are still a couple of months away from the northern hemisphere’s summer driving season where demand should pick up, the risk to the market is that crude oil inventory draws are offset by refined product builds. Regardless, so long as crack spreads hold firm and refinery demand picks up, I suspect the market may be well supported.

In summary, we have a combination of a potentially bullish outlook for inventories clashing with less-than-bullish signals in weakening prompt spreads as well as elevated positioning. As such, although positioning can certainly move higher from here, crude oil prices are probably set to continue to consolidate around the $75-$85 range for the time being.