The Nasdaq 100 has been able to hold its own relatively better than many other global indices so far this week. The big technology stocks have been able to hold up the market, while small- and medium-caps have sold off.

Some investors perhaps view technology behemoths as haven assets, which may explain their outperformance. But with overstretched valuations, coupled with growing worries about the health of the global economy and still-rising government bond yields, I am not so sure how long they will be able to hold up the market.

Monday’s slightly higher close for the Nasdaq and S&P 500 may have been helped by relief after the US Congress agreed on a stopgap spending bill to avoid a government shutdown until November 17th.

But with the bond market resuming its sell-off, this is likely to further support the dollar and undermine equities. In other words, nothing has changed since last week. Sentiment remains cagey with investors showing no desire to hold onto any gains. Investors are clearly not impressed by the latest kicking of the can down the road in so far as US debt deal is concerned.

US 10-Year Yields Could Be Heading Towards 5%

So, the focus is likely to remain on factors that had weighed on markets last month, namely, rising bond yields and a strong dollar. This morning saw the benchmark US 10-year hit a new 2023 high as it continues to ascend towards the 5% level. Monday’s strong ISM manufacturing PMI data has further supported yields and fuelled the dollar index rally, now up for the 12th week.

There will be lots of key U.S. data to look forward to this week, which should keep the dollar and bond yields in focus, which in turn should influence the stock markets. For as long as bond yields are rising, this should keep equities under pressure.

Faced with extra risk in a challenging macro environment, yield-seeking investors would rather earn a decent, fixed, return, than hope for uncertain dividend payments or further capital appreciation in stocks, with overstretched valuations.

With the bond markets continuing to sell-off, lifting yields and the dollar, this should further diminish the attractiveness of assets that pay low or zero interest and/or dividends. Therefore, growth stocks, many of which found in the Nasdaq 100, might come under the spotlight for this reason. For the same reason gold could remain undermined, although I wouldn’t rule out the possibility for an oversold bounce from around $1820 support area. See the latest XAUUSD chart.

OPEC+ could send crude oil higher again after consolidation

Investors’ focus will also remain on oil prices after their recent sharp gains amid the ongoing supply cuts by the OPEC and allies. There is a risk we could see oil prices climb above $100 and thus stoke inflationary worries further.

Ministers from the OPEC+ will meet on October 4 but are unlikely to call for a full OPEC+ meeting. This is because the group is unlikely to change the current policy, which is working wonderfully for them right now with oil prices surging until recently despite a sluggish global economy.

Rising oil prices could make stagflation even worse for oil-importing countries in the Eurozone, Japan and China, among others. This comes as borrowing costs have skyrocketed across the developed economies. If crude oil were to rise even further, then this could further hurt the global economy, which is not something that would appease the stock market bulls.

What’s more, if oil prices now resume higher then this will likely push up inflationary pressures once more, encouraging major central banks like the Fed to hold their contractionary monetary policies in place for longer. Perhaps this may be why we are seeing continued pick up in long-term bond yields. Again, this won’t be good news for growth stocks.

Nasdaq 100 analysis: Technical Levels to Watch

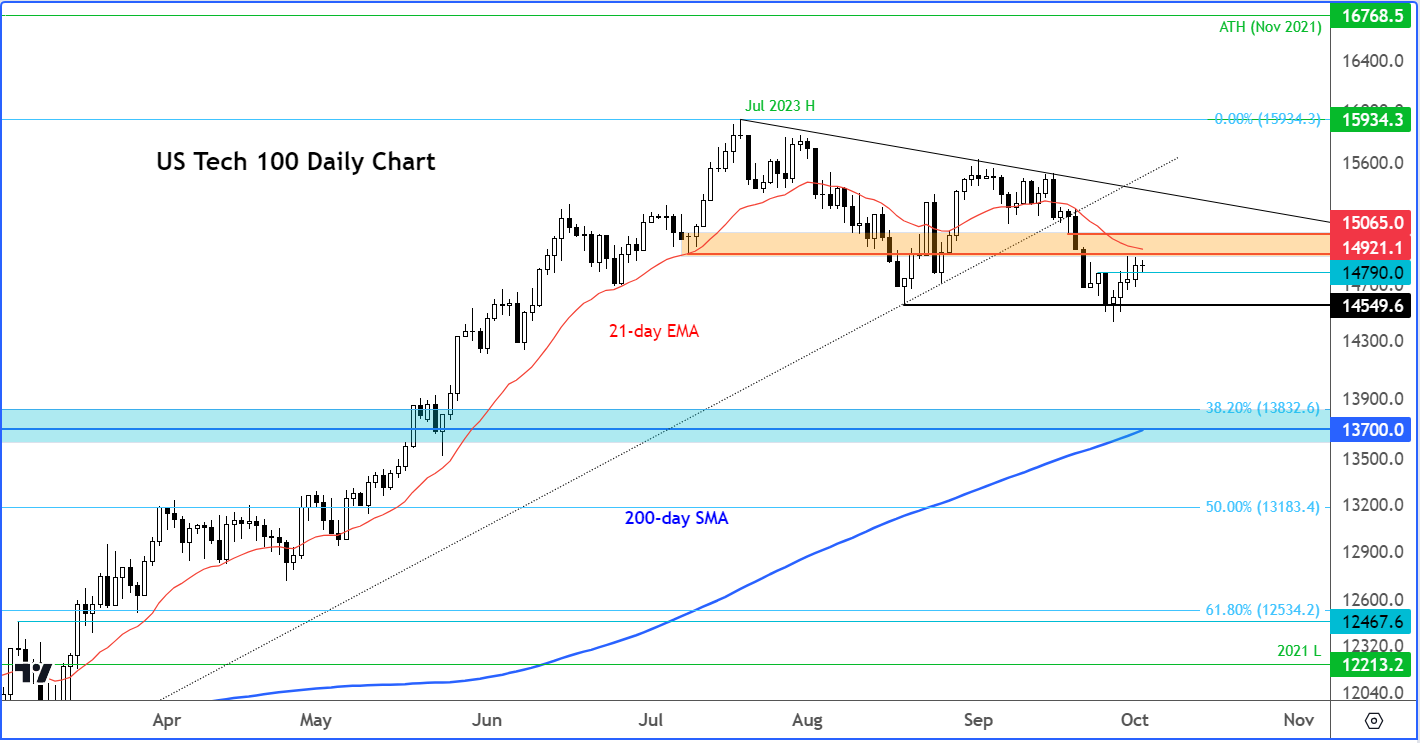

At the time of writing, the Nasdaq 100 futures were coming off their earlier highs, pointing to a lower open on Wall Street. Keep an eye on key resistance between 14920 to 15065 range. This area was previously support and where the now declining 21-day exponential moving average comes into play.

For as long as the bears defend their ground here, the path of least resistance would remain to the downside. A daily close below 13490 is what the sellers would be eying today, and if we see a decisive break below 14550 support, then this could pave the way for a much bigger correction. So, watch out below!