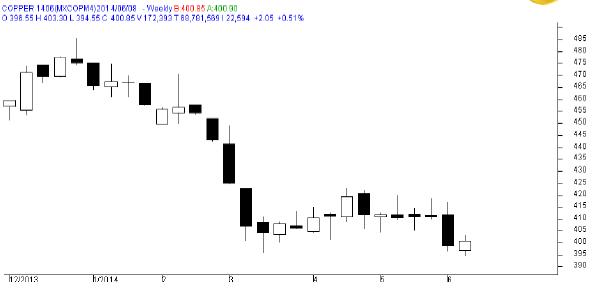

MCX Copper June as seen in the weekly chart above has opened at 396.55 levels and as expected during this week prices made a low of 394.55 levels. During this week prices made a high of 403.30 levels and finally closed 0.51% higher at 400.85 levels. For last couple of weeks prices have been seesawing between support and resistance levels

For the next week we expect Copper prices to find support in the range of 394 – 392 levels. Trading consistently below 392 levels would lead towards the strong support at 384 levels and then finally towards the major support at 378 levels.

Resistance is now observed in the range of 404 - 405 levels. Trading consistently above 405 levels would lead towards the strong resistance at 410 levels, and then finally towards the major resistance at 417 levels.

MCX / LME Copper Trading levels for the week

Trend: Down

S1 – 390 / $ 6,700 R1 – 403 / $ 6,950

S2 – 384 / $ 6,600 R2 – 409 / $ 7,060

Weekly Recommendation: Sell MCX Copper June between 404 – 405, SL- 410, Target – 394 / 392