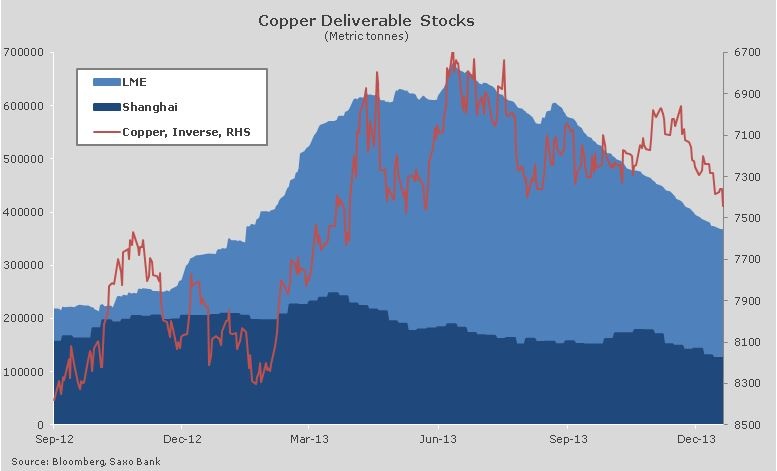

Copper was one of the best performing commodities in December as it reacted to rising growth prospects in the US and sustained growth prospects in China, the world's two largest consumers. Supporting the move has been the continued drop in inventories at warehouses monitored by the two major futures exchanges in London and Shanghai.

Copper inventories on the London Metal Exchange and the Shanghai futures exchange both fell to the lowest since January according to the most recent data from December 31. With the focus on copper in recent months having been mostly centred around the prospect for increased availability of supply, the continued pick up in demand as evidenced through the drop in inventory levels has forced traders to switch their focus.

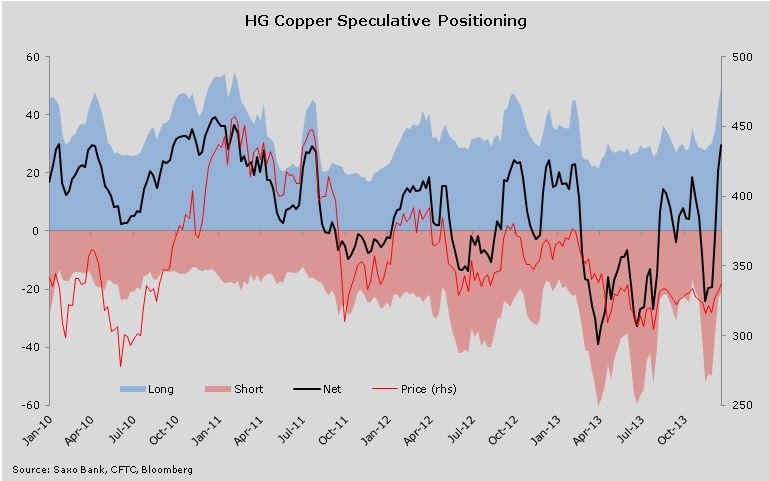

This helped copper rise to the top of the performance table in December, not least helped by an initial round of short covering after hedge funds had built a major net-short position during October and November. During December, hedge funds have gone from being net short of 19,316 contract of futures on options on HG Copper traded in New York to being net long of 29,489 contracts, the equivalent of 334,400 metric tons.

Continued demand from US and China will be required in order to support the current rally which so far has seen the price recover 50 percent of the February to June sell-off. The month of January has provided a positive return for copper in each of the past three years at an average of 4.6 percent. With raised growth expectations one of the key drivers as 2014 begins, a fourth annual January gain in a row seems likely. However, supply is rising, which should leave the upside fairly limited. But never underestimate what momentum can do to the price and currently, momentum is supporting those holding a bullish view.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Copper Finishes 2013 On A Strong Note As Inventories Keep Falling

Published 01/02/2014, 06:01 AM

Updated 03/19/2019, 04:00 AM

Copper Finishes 2013 On A Strong Note As Inventories Keep Falling

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.