It may be time for investors to take a serious look at commodities and raw materials. A bipartisan $1-trillion infrastructure spending bill cleared the Senate on Tuesday and now awaits approval from the House when members return to Washington next month.

Included in the bill is $550 billion in funding for things most people think of when they hear the word “infrastructure” — roads, bridges and the like. About $66 billion is allocated to rail, $11 billion to highways, $42 billion to ports and airports. Another $73 billion goes toward updating the nation’s aging power grid to include more renewables like wind, solar and hydroelectric.

Should the bill get signed into law, it will help close an estimated infrastructure spending shortfall of nearly $3 trillion over the next 10 years. That’s according to the American Society of Civil Engineers (ASCE), which for 20 years now has scored the overall health of the nation’s physical infrastructure. In 2021, the group gave it a less-than-mediocre C-.

Shares of domestic steel and aluminum producers rallied on the news, with Ohio-based Timkensteel Corp (NYSE:TMST) climbing the most at 11.2%. Nucor Corp (NYSE:NUE), the largest steel-maker in the U.S., finished up 9.6%, while Century Aluminum (NASDAQ:CENX) rose 9.3%.

I believe further gains could be in the works. According to estimates by Citigroup (NYSE:C), the infrastructure plan could increase U.S. steel demand by as much as 3 million to 4 million metric tons per year.

Copper producers and refiners could also get a boost, as copper wiring is a much-needed component of wind turbines, solar arrays and other green-energy generation projects. Besides funding renewables, the infrastructure bill also sets aside $7.5 billion toward the electrification of public transport and another $7.5 billion toward public electric vehicle (EV) charging stations, which should also boost copper demand.

Inflation To Remain Elevated?

Also contributing to my bullishness is the potential for inflation to remain elevated in at least the medium term. In July the consumer price index (CPI) increased 5.3% compared to the same month last year, the second straight month that inflation was about 5%. That’s more than double the average annual inflation rate of 2% for the past 20 years.

Inflation can be hard on your pocketbook, but it could also benefit your portfolio if you know how to position it.

Demand for commodities and building materials is surging at a time when global supply chains are still trying to overcome disruptions caused by the pandemic. Couple this with runaway government spending and near-zero rates, and we could see higher prices for some time longer.

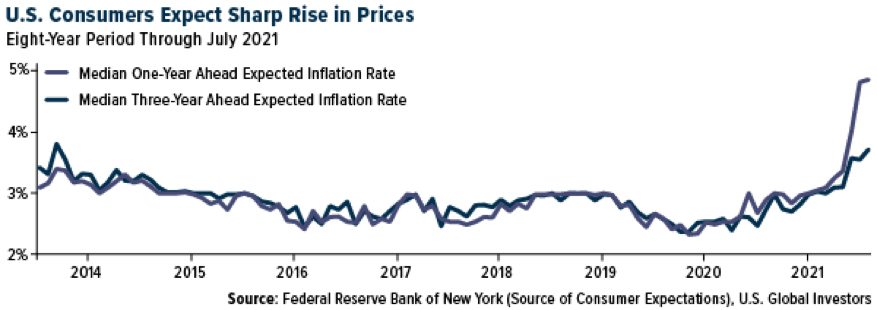

Consumers appear to be signalling expectations for a period of sustained inflation. According to the Federal Reserve Bank of New York’s August survey of consumer expectations, U.S. households anticipate a median inflation rate of 4.8% a year from now and one of 3.7% three years from now. These are the highest readings since the New York Fed began tracking consumers’ inflation expectations in August 2013.

Disclosures: All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.