Commercial Metals Company (NYSE:CMC) said that it will sell $300 million total principal amount of 5.375% senior notes due 2027. The company expects the completion of the offering to take place on Jul 11, subject to customary closing conditions.

Commercial Metals noted that it plans to use the net proceeds from the offering to fund its previously declared cash tender offer with aggregate purchase price ceiling (not including the interest accrued) of $300 million for its outstanding 7.35% senior notes due 2018. The company also said that it may redeem a portion of the remaining 2018 Notes that are not tendered subsequent to its expiration.

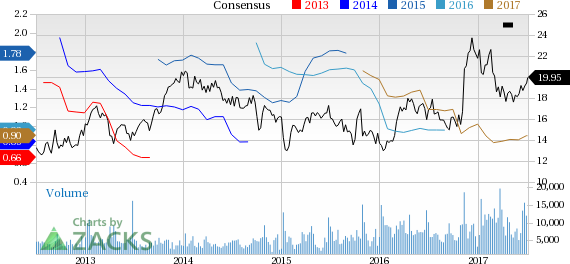

Shares of Commercial Metals have rallied around 9.4% in the last three months, against the Zacks categorized Steel-Producers industry’s 2.8% decline.

Commercial Metals anticipates strong demand owing to strong levels of bidding in its fabrication business. The company expects shipment levels to grow in the fiscal third quarter due to strong construction season in both the U.S. and Poland.

The company believes that the new administrative policies of U.S. will support economic growth through tax reform, a reduced regulatory environment and more rigorous enforcement of trade actions, among others. Also, the company is well positioned to capitalize on the benefits from these actions.

However, margin pressure is expected to continue as imports make it difficult to increase selling prices for the company’s products in sync with a rise in scrap costs.

Commercial Metals currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked companies in the basic materials space include The Sherwin-Williams Company (NYSE:SHW) , Ternium S.A. (NYSE:TX) and Hitachi Chemical Company, Ltd. HCHMY. All the three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Sherwin-Williams has expected long-term earnings growth rate of 11.4%.

Ternium S.A. has expected long-term earnings growth rate of 18.4%.

Hitachi Chemical has expected long-term earnings growth rate of 5%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

Sherwin-Williams Company (The) (SHW): Free Stock Analysis Report

Ternium S.A. (TX): Free Stock Analysis Report

Commercial Metals Company (CMC): Free Stock Analysis Report

HITACHI CHEMICL (HCHMY): Free Stock Analysis Report

Original post