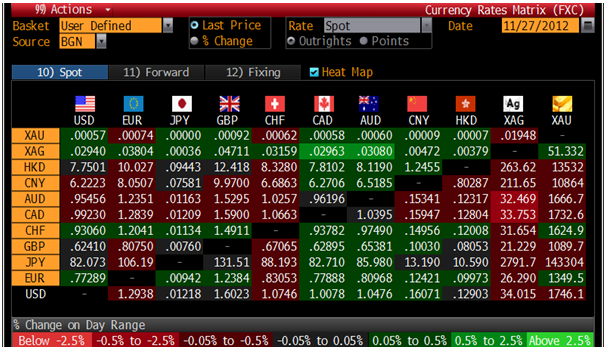

Tuesday’s AM fix was USD 1,747.25, EUR 1,349.54, and GBP 1,090.46 per ounce.

Monday’s AM fix was USD 1,747.25, EUR 1,347.56, and GBP 1,090.87 per ounce.

Gold edged up $1.30 or 0.07% in New York on Monday and closed at $1,748.40. Silver traded off and recovered, climbing to a high of $34.16 and finished with a gain of 0.12%. The yellow metal then moved slightly upward on Tuesday after Greece’s creditors reached a new bailout deal, which will help fund emergency aid for Athens.

The 34.4 billion euro in aid plus reducing interest rates on the bailout loans expect to cut Greek debt to 124% of GDP. The interest rates have been dropped to 50 basis points above the interbank rate so countries like Italy and Spain will be lending at a loss. The eurozone’s dangerous but easy policy choice of “extend and pretend” continues which is bullish for gold in the coming months.

Mark Carney has been named as the new governor of the Bank of England by Chancellor George Osborne.

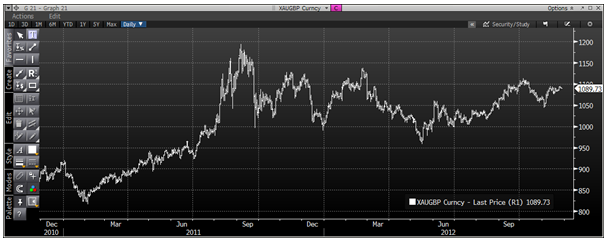

Mr. Carney, the governor of the Canadian central bank, will serve for five years and will hold new regulatory powers over banks. Carney would be considered something of a monetary dove. The Goldman Sach’s alumni’s appointment means that ultra-loose monetary policies will likely continue at the Bank of England leading to weakness in sterling – especially versus gold.

The US Commodity Futures Trading Commission said that institutions and hedge funds slightly raised their bullish bets on silver and gold futures in the week ending November 20th.

The White House and Republicans are still in a stalemate over the fiscal cliff. The White House press secretary said that President Obama is still waiting for a realistic proposal to look at. “President Obama would be open to proposals that closed loopholes or capped deductions,” Carney said, “so long as raising the top tax rate remains on the table.”

Obama has asked for $1.6 trillion in higher revenues to pay down the debt. In the 2011 debt ceiling negotiations, Republicans were considering a plan that would involve only $800 billion in new revenue or half what is needed to avoid the cuts and pay down the deficit. “Extend and pretend” will also likely be seen in the U.S. – with obvious ramifications for the medium and long-term outlook of the dollar.

The Chinese Ministry of Industry and Information Technology said that China aims to produce between 420 and 450 tonnes of gold bullion in 2015, up about 25% from 2011, while consumption may reach 1,000 tonnes at that time.

CME Group declared a force majeure at one of its New York precious metals depositories yesterday, run by bullion dealer and major coin dealer Manfra, Tordella and Brooks (MTB), due to “operational limitations” posed by Hurricane Sandy. MTB has “operational limitations” following Hurricane Sandy and can’t load gold bullion, platinum bullion or palladium bullion, CME Group Inc., the parent of the Comex and New York Mercantile Exchange, said today in a statement.

MTB must provide holders with metal at Brinks Inc. in New York to meet current outstanding warrants in relevant delivery periods with compensation for costs, Chicago-based CME said. The CME said that MTB will not be able to deliver metal as the lower Manhattan company deals with "operational limitations" almost a month after the arrival of Hurricane Sandy.

MTB is one of five depositories licensed to deliver gold against CME's benchmark 100-troy ounce gold contract, held 29,276 troy ounces of gold and 33,000 troy ounces of palladium as of Nov. 23, according to data from CME subsidiary Comex. In a notice to customers on Monday, CME declared force majeure for the facility, a contract clause that frees parties from liability due to an event outside of their control.

CME said that individuals holding MTB warrants or certificates for a specific lot of metal stored in the depository, may receive gold delivered from Brinks Co. (BCO) in New York. MTB is responsible for any additional costs incurred by customers receiving metal from Brinks, CME said. "This shouldn't have a material impact on the way market participants are doing business," a CME spokesman said. "They'll still contact MTB if they want to take delivery on contracts," and MTB will arrange for delivery through Brinks according to Dow Jones Newswires.

In a notice posted to its website dated Nov. 12, MTB said the firm "sustained substantial damages" following Hurricane Sandy's arrival in New York City on Oct. 29, and had curtailed its operations.

The force majeure will remain in effect until further notice from the exchange, the CME said. The delivery period for CME's December-delivery precious metals futures begins on Friday.

NEWSWIRE

(Bloomberg) -- Turkey Becomes Gold Reprocessing Center for Iran, Hurriyet Says

Scrap gold and gold jewelry imported into Turkey from Greece, Portugal, Cyprus, countries in the Balkans and North Africa being converted to standard gold bars within 4 hours in Turkey, Hurriyet newspaper says, without saying where it got the information.

-- Iranians use Turkish lira payments for natural gas at Turkish banks to buy gold in Turkey.

-- Gold is then exported back to Iran, or to countries including India, U.A.E., Qatar and Kuwait, where it can be exchanged for currency and transferred back to Iran.

NOTE: U.S. to review Turkey’s exemption from Iran sanctions in December, after Turkish Deputy Prime Minister Ali Babacan said Iran is buying gold in Turkey with money received for natural gas.

(Bloomberg) -- ETF Securities Starts Gold, Silver, Platinum Funds on HKEx

The ETFs will track the London benchmark prices of the metals and begin trading tomorrow, according to a statement on the Hong Kong Exchanges website yesterday. The funds on silver and platinum are the first on the exchange for those commodities.

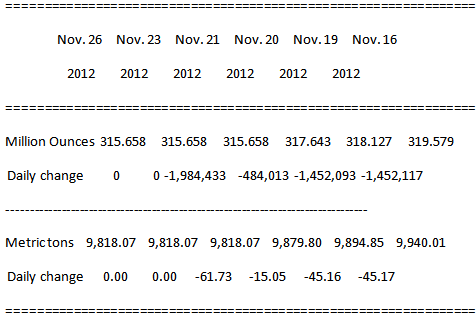

(Bloomberg) -- IShares Silver Trust Holdings Unchanged at 9,818 Metric Tons

Silver holdings in the iShares Silver Trust, the biggest exchange-traded fund backed by silver, were unchanged at 9,818.07 metric tons as of Nov. 26, according to figures on the company’s website.

NOTE: Ounces are troy ounces.

(Bloomberg) -- Silver Expected to Outperform Gold in 2013, CICC Says

China International Capital Corp. comments in e-mailed report today.

Silver seen at $35/oz in 3 mths; $38/oz 6 mths; $35 in 12 mths.

Silver forecast to average $36/oz in 2013; $32/oz in 2014.

NOTE: Silver for immediate delivery trades at $34.17/oz at 2:59 p.m. Singapore time.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

CME Declares Force Majeure Due To Operational Limitations On NYC Gold

Published 11/28/2012, 01:21 AM

Updated 07/09/2023, 06:31 AM

CME Declares Force Majeure Due To Operational Limitations On NYC Gold

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.