- Cisco sales are slowing as the company faces economic and supply-chain headwinds

- Despite this short-term risk to its growth, Cisco is a solid stock to own

- Cisco is the biggest maker of equipment that power corporate networks and form the backbone of the internet

There are many reasons to be concerned about the technology industry these days. Both small and large companies are cutting back on spending after a decade of investment boom as the economy enters a slow patch or a potential recession next year.

These headwinds have also hurt Cisco Systems (NASDAQ:CSCO). Shares of the IT and networking brand specialized in switches, routers, cybersecurity, and IoT (Internet of Things) are down about 30% this year amid signs that demand for networking gear is slowing.

When Cisco reports its latest quarterly earnings tomorrow, Wall Street analysts expect sales growth to be in the low single digits, a sharp reversal from the pandemic-fueled growth. Investors closely monitor Cisco’s outlook as a proxy for corporate spending on infrastructure.

Earnings Insights From InvestingPro

Source: InvestingPro

Despite the current uncertain economic environment which poses a short-term growth risk, I find Cisco a solid defensive stock to own. There are many reasons to believe that the company can weather a shaky economy and tech spending slowdown.

First, Cisco’s product portfolio is very diversified. Besides selling cyclical networking products, such as gears and switches, the tech giant is well-positioned to sustain a potential economic recession.

Moreover, there is little indication investment in hybrid cloud, hybrid work, network security, and 5G technology is slowing.

That explains why Cisco’s order pipeline was steady through the end of the last quarter. Unlike the personal computer industry, which is steeply declining, networking and security technology remain essential for companies.

Strong Order Backlog

Highlighting the strengths above cited, Chief Executive Officer Chuck Robbins, during the August earnings call, said:

“With our revenue performance obligations (RPO) totaled more than $31 billion, and when combined with low cancellation rates, which remain below pre-pandemic levels, this sets the stage for increased visibility and strong revenue growth as we head into fiscal ’23.”

For Cisco’s 2023 fiscal year, which began August 1, the company expects 4% to 6% revenue growth, reflecting the existing backlog and expectations of improving parts availability as supply constraints ease.

Another factor proving a stabilizing force in the current environment is that Robbins is shifting Cisco’s focus to become a provider of networking services delivered over the internet. The idea is to pursue more sources of revenue beyond the networking equipment that is Cisco’s hallmark. Reflecting that shift, security and its business that sells optimization of internet-based services are showing strong growth.

Software sales stood for 30% of total revenue in fiscal 2021 and made up 43% of such revenue during the fiscal quarter that ended July 31. The company wants subscriptions to generate 50% of annual revenue in its fiscal 2025.

In a recent note, analysts at Loop Capital said that Cisco could continue to see strong demand for its products, which reflects the value of networking technology. They wrote in their note:

“Simply said, networking is becoming too critical, and we are in the midst of an unprecedented investment cycle in networking.”

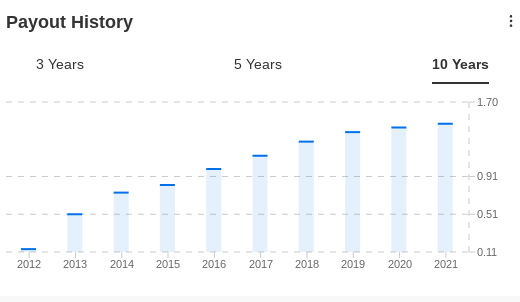

In addition to growth, Cisco is also a reliable dividend payer. It has been raising its payout for 13 straight years, making it an attractive option for those seeking growing income during economic turmoil.

Source: InvestingPro

With a current annual yield of about 3.39%, investors are getting a quarterly payout of $0.38 a share. With a manageable payout ratio of 53%, there is more room for dividend hikes in the future.

Bottom Line

After the recent pullback, Cisco stock looks attractive. The company is likely to beat the market expectations on earnings, given its strong order backlog, which will provide a revenue boost as the supply-chain situation improves.

Over the long run, Cisco is becoming less reliant on low-margin and cyclical products as it accelerates its transition to a services business. That shift has made its stock attractive for both growth and income-oriented investors.

Disclosure: As of the time of writing, the author doesn’t own Cisco stock. The views expressed in this article are solely the author’s opinion and should not be taken as investment advice.