Cinemark Holdings (NYSE:CNK) is slated to report fourth-quarter 2017 results on Feb 23, before the opening bell.

The Zacks Consensus Estimate for revenues is pegged at $746.7 million, reflecting year-over-year growth of 6.5%. The consensus estimate for earnings is pegged at 47 cents per share, indicating year-over-year decline of 26.6%.

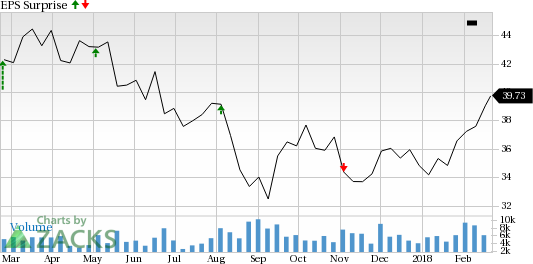

The company has a mixed earnings surprise history. Earnings lagged the Zacks Consensus Estimate in the last quarter but surpassed the same in two of the previous four quarters. The company’s bottom line matched the Zacks Consensus Estimate in the remaining quarter, with an average beat of 13.65%.

Let’s see how things are shaping up for this announcement.

Factors Likely to Influence Q4 Earnings

Headquartered in Plano, TX, Cinemark Holdings is a leading domestic and international motion picture exhibition company. It operated 533 theaters with 5,957 screens in 41 U.S. states, Brazil, Argentina and 13 other Latin American countries, as of Feb 1, 2018.

Of late, Cinemark Holdings has been opening and renovating theaters with state-of-the-art amenities. It recently opened an 8-screen theater in Spanish Fork, UT and another one in Sacramento, CA.Both will feature the company's Luxury Lounger electric recliners in all auditoriums, large wall-to-wall screens, enhanced sound systems and digital presentation in all auditoriums along with Cinemark XD auditorium and Cinema Café. The company also announced the launch of Movie Club, a unique monthly movie membership program, which will offer ticket and concession discounts along with many other exclusive benefits.

Cinemark Holdings also announced plans to renovate and upgrade Cinemark Movies 12 Theater by adding electric reclining Luxury Lounger reclining seats to all auditoriums. We expect such renovations and attractive promotional offers to help the company witness substantial subscriber growth in the to-be reported quarter.

We are also impressed with Cinemark Holdings’ efforts to reward its stockholders with a quarterly cash dividend of 29 cents per share, which was paid onDec 15, 2017 to stockholders of record as of Dec 1, 2017.

Backed by such tailwinds, the company has performed well in the past three months. The company’s shares returned 17.9% outperforming the industry’s growth of 4.5% in the said time frame.

However, Cinemark continues to face threats from alternative movie streaming services such as Netflix (NASDAQ:NFLX) , and Time Warner Inc (NYSE:TWX).’s HBO Now and Hulu. While theater chains remain the preferred choice for film studios, the recent trend of movie watchers opting for streaming services is making film studios seek better terms in box-office revenues with large-screen theater companies. This might hamper profitability. The company also competes with AMC Entertainment Holdings (NYSE:AMC) – a leisure and recreation services company.

Earnings Whispers

Our proven model does not conclusively show that Cinemark Holdings is likely to beat the Zacks Consensus Estimate this quarter. This is because a stock needs to have both a positive Earnings ESPand a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. Unfortunately, that is not the case here as elaborated below.

Zacks ESP: Cinemark Holdings has an Earnings ESP of -2.13%. This is because the Most Accurate estimate stands at 46 cents per share while the Zacks Consensus Estimate is pegged at 47 cents. You can uncover the best stocks to buy or sell before they’re reported with the Earnings ESP Filter.

Zacks Rank: Cinemark Holdings has a Zacks Rank #2, which increases the predictive power of ESP. However, the company’s negative ESP makes surprise prediction difficult.

We caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stock to Consider

AMC Networks (NASDAQ:AMCX) from the Zacks Consumer Discretionary sector has the right combination of elements to post an earnings beat in fourth-quarter 2017. It will report on Mar 1. The company has an Earnings ESP of +2.11% and carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

The company’s earnings surpassed the Zacks Consensus Estimate in each of the previous four quarters with an average beat of 21.9%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Netflix, Inc. (NFLX): Free Stock Analysis Report

AMC Networks Inc. (AMCX): Free Stock Analysis Report

Cinemark Holdings Inc (CNK): Free Stock Analysis Report

AMC Entertainment Holdings, Inc. (AMC): Free Stock Analysis Report

Original post

Zacks Investment Research