Adaptive network solutions provider Ciena Corp (NYSE:CIEN) stock exploded higher on its fiscal Q4 2021 earnings release hitting multi-year highs. The optical fiber leader is benefitting from the 5G buildout and digital transformation among the 30 largest global carriers.

The company is experiencing a growth spurt running on all cylinders as it raised fiscal full-year 2022 guidance transcending analyst top and bottom-line estimates. The company benefits from bandwidth demand and networking systems buildout, which is expected to grow globally at a 7.5% CAGR by 2026.

Prudent investors seeking to jump on this global growth trend can watch for opportunistic pullbacks in shares of Ciena to build a position.

Q4 Fiscal 2021 Earnings Release

On Dec. 9, 2021, Ciena reported its fiscal Q4 2021 results for the quarter ending October 2021. The company said earnings-per-share (EPS) of $0.85 meeting consensus analyst estimates for $0.85. Revenues grew 25.7% year-over-year (YoY) to $1.04 billion, beating analyst estimates for $1.02 billion.

The company authorized a $1 billion share buyback program. Of this buyback, $250 million will be accelerated to be completed by the end of fiscal Q2 2022. Ciena CEO Gary Smith commented,

“Our strong financial results exceeded our expectations in the fourth quarter and for the full fiscal year, driven by continued execution of our strategy and our demonstrated ability to manage supply chain challenges.

Looking ahead, we intend to continue driving growth in our business by leveraging our market leadership and investing to capitalize on robust demand dynamics. In addition, our strong balance sheet and cash generation expectations allow us to increase the return of capital to our shareholders.”

Q1 Fiscal 2022 Guidance

Ciena expects fiscal Q1 2022 revenues between $870 million to $910 million versus $880 million consensus analyst estimates. The company expects fiscal full-year 2022 revenues to grow 11% to 13% YoY between $4.02 billion to $4.09 billion versus $3.9 billion. The target annual growth rate of 6% to 8%. The company expects an adjusted EPS annual growth target of 10%.

Conference Call Takeaways

Ciena CEO Gary Smith set the tone,

“Revenue in the fourth quarter exceeded $1 billion for the first time and came in higher than expected. Additionally, orders in the quarter were once again significantly higher than revenue. And with our third consecutive quarter of orders outpacing gain, we have substantial momentum and increased confidence in the demand environment.

We ended the year with our highest ever backlog of approximately $2.2 billion. We doubled our backlog of the year ago. This performance, I think, reflects our market leadership within a robust demand environment. Specifically, the combination of our differentiated balance sheet, leading innovation and R&D capabilities, and deep and growing customer relationships around the globe give us a distinct strategic advantage in the industry.

And, of course, our people continue to amaze us with their resilience and kindness as they continue to perform at the highest levels. Moving to highlights from the fourth quarter and fiscal year. Our focused investments are in three key areas: optical, routing and switching, and software automation. And they are yielding remarkable results. In optical, we continue to lead the market in high-capacity coherent technology. Q4 was a record quarter for WaveLogic 5 Extreme. We added 34 new customers, including 13 unique logos, in all regions.

Our total customer count for WaveLogic 5e is now 140 globally, and we’ve shipped nearly 25,000 on modems to date. We also sent our first customer orders in Q4 for our WaveLogic 5 Nano coherent pluggable optics. We had a strong quarter in routing and switching, and we continue to build momentum in this space. In Q4, we secured a dozen new wins, including significant multiyear deals with two of the largest US Tier 1 service providers, one of which is for a nationwide 5G cell site router deployment.

Additionally, we’ve now closed the deal with AT&T to acquire its Vyatta virtual routing and switching technology which will help strengthen our Adaptive IP capabilities and increase our exposure to certain 5G use cases. We also announced a partnership with Samsung (OTC:SSNLF) to couple our xHaul solutions, next-gen MCP domain controller and services, with Samsung 5G core and RAN equipment to support global 5G networks. Moving to our software automation business.

Blue Planet performed well in FY21, growing 23% in the year to deliver annual revenue of $77 million, which again was above the high end of our target range, as well as record bookings a year ago. Some of the markets wins in the year for Blue Planet include British Telecom, Vodafone (NASDAQ:VOD) [indiscernible], as well as a US Tier 1 service provider and large US MSO.”

He concluded,

“Our overall software business currently constitutes less than 10% of our total revenue. We do see this growing over time as we expand both, the adoption and application, and move to more recurring and subscription-based models. Of course, the strong secular demand for bandwidth and automation remains challenged by the global supply chain constraints in the current environment, and we continue to believe that these supply challenges are likely to persist through at least to the middle of calendar ‘22.

And to be clear, supply conditions are adversely impacting product costs, availability, and lead times, as well as our overall supply chain operations. We expect these variables to affect our gross margin as well as the level and timing of revenue during fiscal ‘22. And we’ve obviously incorporated all of these elements and considerations into our guidance accordingly. However, as you can see from our performance to date, we continue to manage these challenges well. And while we are obviously not immune, we expect to continue to outperform others in this regard going forward.”

CIEN Opportunistic Pullback Levels

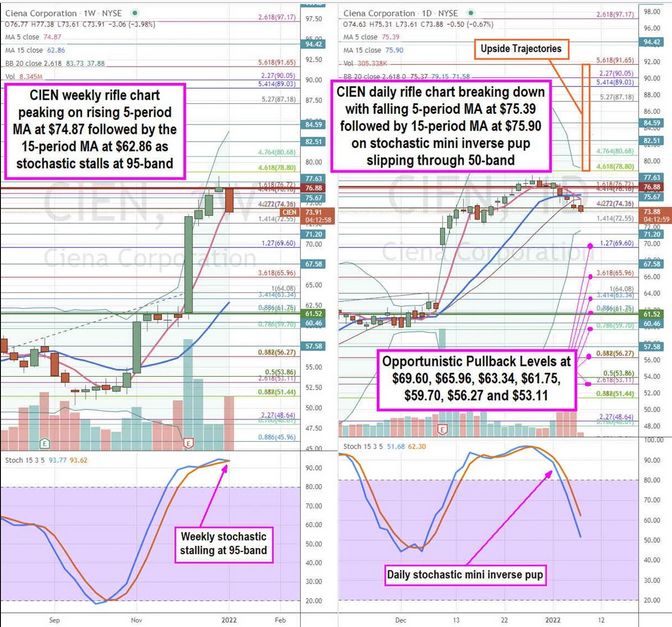

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for CIEN stock. The weekly rifle chart formed a shooting star just below the $78.80 Fibonacci (fib) level. The weekly rifle chart has a rising 5-period moving average (MA) that overshot down at $74.87, followed by a widely lagging 15-period MA at $62.86.

The weekly stochastic stalled on the mini pup at the 95-band. The weekly upper Bollinger Bands (BBs) sit at $83.78. The daily rifle chart is starting to break down as the 5-period MA at $75.39 crossed below the 15-period MA at $75.90 as the daily stochastic mini inverse pup slips under the 50-band.

The daily BBs have a tight range between the lower BBs at $71.58 and upper BBs at $79.15, resulting from compression, which precedes a price range expansion. The daily market structure high (MSH) sell triggered the breakdown under $76.88. The daily market structure low (MSL) buy triggered the breakout through $61.52.

Prudent investors can look for opportunistic pullback levels at the $69.60 fib, $65.96 fib, $63.34 fib, $61.75 fib, $59.70 fib, $56.27 fib, and the $53.11 fib level. Upside trajectories range from the $78.80 fib level to the $91.65 fib level.