The slight adjustments to the stock markets on Monday and Tuesday couldn’t diminish the investors’ positive outlook and the growth of key global indexes has resumed on Wednesday afternoon. The S&P 500 futures and FTSE100 have both added 0.4% at the start of the day. STOXX 600 has grown by 0.6% and Brent Oil is once again attempting to climb over $62.

The hopes for Chinese stimulus inadvertently spiked the demand for commodities, which in turn triggered a general increase in economic growth, similar to that in 2009 when China became the key driver of the global economy. Although, this time is different.

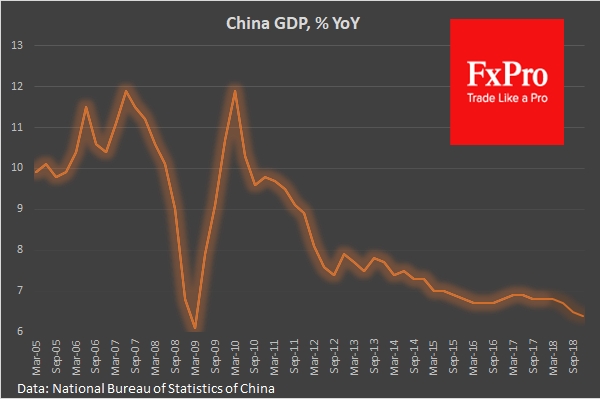

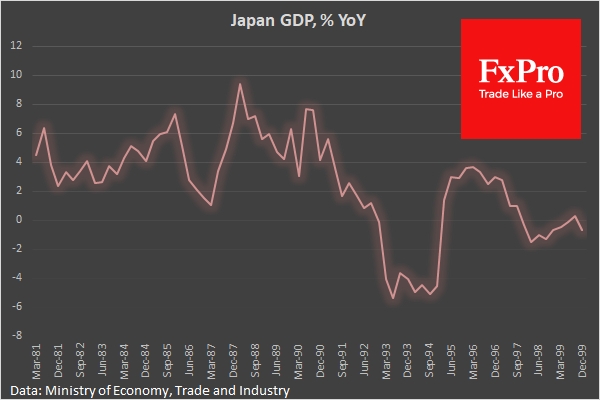

First of all, in addition to the complication of trade talks with the US, China is experiencing structural problems. For instance, the shift in focus from export to internal consumption is not going smoothly. The risk could be that China will follow in Japan’s footsteps which is at the moment living through its second ‘lost decade’, unable to fully depend on internal consumption as a source of growth. China’s GDP adds more than 6% annually. This is a fairly healthy rate of growth by global standards but is actually China’s slowest rate since the early 90s.

Furthermore, it’s only the investors’ attitudes that feel the negative effect of the back and forth of trading talks. In reality, even before the increase in tariffs was implemented, US businesses have sought to build up volumes of orders, which is what stimulated figures. It’s important to remember that China does really need a trade agreement and that’s why the US will be holding their hard line. The current government shutdown is the longest in history and is a clear example of how slow a negotiator President Trump is.

His advisors have indicated that America will not take a soft approach with China, and that had an instant impact on the markets. The key indexes have begun to decline, losing 0.8%, while the Yuan is in the minus by 0.2%.

Now both sides have agreed to come to a consensus on the matter, however the politicians still have a long way to go and no one should be expecting fast progress in talks any time soon.

Alexander Kuptsikevich, the FxPro analyst