The Swiss Franc is turning on the US Dollar in the currency markets, as it moves ever lower to yearly lows.

USD/CHF" title="USD/CHF" height="242" width="474">

USD/CHF" title="USD/CHF" height="242" width="474">

The Swiss economy has so far been very strong, with low unemployment and very little political disruption. In contrast, the US economy has been struggling as of late, with weak economic data across the board. This weak economic data has been oversold a little as of late, as the US economy is still in recovery, just a little more sluggish than most would like. However, the threat of holding off tapering has been weighing on the denizens of the investing world and as such, we have seen a move lower.

The fear of a weaker US economy itself seems a little irrational, but for the trading world, its news and all news will be incorporated, pondered and then traded upon. For now, the USD/CHF pair is certainly looking weaker and drifting ever so further down to hard resistance, and yearly lows.

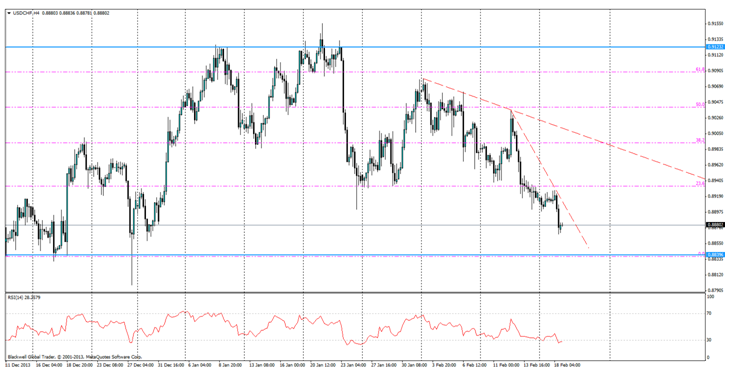

Current movements lower suggest two trend lines; a very solid trend line sloping down and a very steep one which is unlikely to hold up to large amounts of pressure. Each is bearish in nature, and overall market sentiment remains strongly bearish.

The 0.8839 level seems to be the main level of heavy support for the USD/CHF, and it’s likely that a strong case for a pullback could be made at this level, if not a test of market participants to push the pair lower and see if there is room for strong movement south.

Current RSI movements also show strong selling pressure of the USD before light pull backs on each big plunge.

Fibonnaci also looks to be playing a part in the trading of the pair with the 23.6 level acting as support and resistance, however, this level is well above the current market price. And it’s unlikely the market will move up to it in the next 24 hours, unless of course we see positive data out of the US.

With bad weather conditions over the last few months in the US, it seems unlikely that New Home sales will increase, or that building permits will see a major boost, and forecasts have taken this into account, expecting a lower result over the last month.

The USD/CHF is certainly looking to push lower, with strong momentum and weak economic data expected, there is certainly the ability to push past the resistance. But traders should be aware of the chance of a solid pullback as past trading patterns have shown that the Swiss Franc can range quite heavily.