Focus on the Central Bank speakers

- We don’t have any major data release today, but we have plenty of Central Bank speakers to keep us busy, starting from the UK, where we have BoE MPC members Andy Haldane and Ben Broadbent. Focus will probably be on the latter, since we still don’t know his positions about a possible rate hike in the near future.

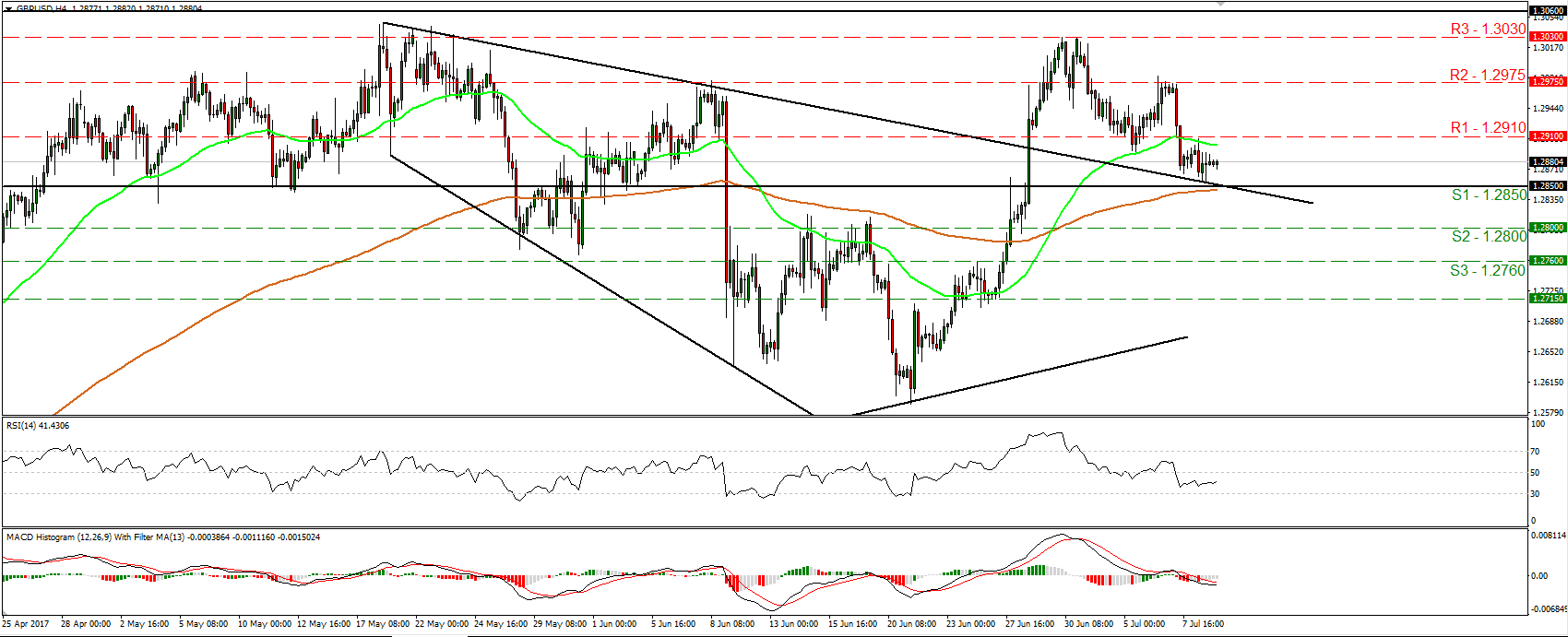

- GBP/USD traded sideways on Monday, between the 1.2850 (S1) and 1.2910 (R1) levels. A clear break above R1 could open the way for a test near 1.2975 (R2), and Broadbent’s comments could be the decisive catalyst for such a move.

- Aside from the UK, we have ECB Executive Board member Benoit Coeure, who will deliver a speech at the FX contact group meeting, and Fed Board Governor Lael Brainard, who will talk about ‘Normalising Central Banks’ Balance Sheets’. Brainard is usually one of the more cautious members of the FOMC and, since US core CPI declined lately, we expect her to maintain her stance today.

Australian wages may show some growth in Q2

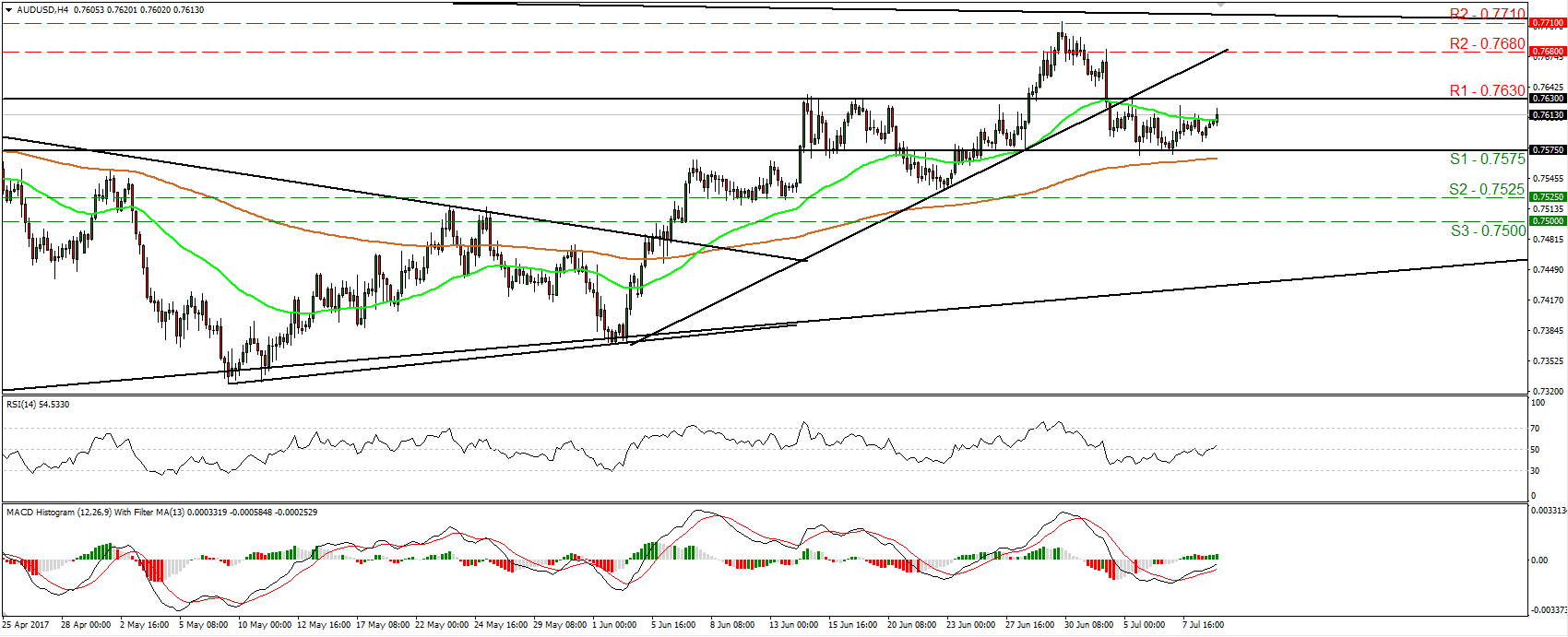

- The NAB business survey for June showed that Australian wages accelerated during Q2. Since slow growth in wages was one of the main reasons that kept the RBA from shifting to a more optimistic bias, more signals towards this direction could fuel speculation in regards to a possible change of tone in the Bank’s next meetings. Until that however, we expect the AUD to underperform against its major counterparts, especially EUR, GBP and CAD.

- AUD/USD has been trading sideways since the 4th of July, between 0.7575 (S1) and 0.7630 (R1). We remain neutral for the time being, but we see the possibility for a downside exit, rather than an upside.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Today’s highlights:

- US: NFIB small business optimism index for June (10:00 GMT); JOLTS job openings for May (14:00 GMT)

GBP/USD

- Support: 1.2850 (S1), 1.2800 (S2), 1.2760 (S3)

- Resistance: 1.2910 (R1), 1.2975 (R2), 1.3030 (R3)

AUD/USD

- Support: 0.7575 (S1), 0.7525 (S2), 0.7500 (S3)

- Resistance: 0.7630 (R1), 0.7680 (R2), 0.7710 (R3)

Risk Statement: Trading Foreign Exchange on margin carries a high level of risk and may not be suitable for all investors. The possibility exists that you could lose more than your initial deposit. The high degree of leverage can work against you as well as for you.