Celanese Corporation (NYSE:CE) will hike the prices for engineered materials products. The rise will be effective Apr 1, 2018 or as contracts permit.

Per the company, prices will increase for Hostaform and Celcon Polyacetal (POM) grades, PBT (such as Impet PET, Celanex PBT and Vandar PBT Alloys), Laprene (TPE-S), Forprene (TPV) and Forflex (TPO) grades, LCP (Thermx, Vectra, Zenite) grades and GUR ultra-high molecular weight polyethylene grades. Moreover, the prices of these products will increase in the Americas, Europe and Asia.

Notably, Celanese is the world’s leading supplier of GUR and polyacetal products. It is also the only supplier with global production facilities that provides local supply to all regions of the world.

Celanese is taking appropriate pricing actions amid a volatile raw material pricing environment. The company’s strategic measures, including operational cost savings through productivity actions and pricing initiatives, are likely to boost its earnings in 2018.

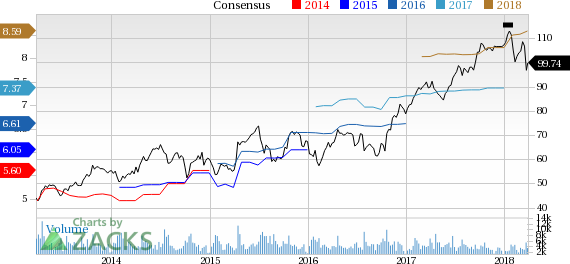

The stock has lost 6.9% over the last three months, outperforming the industry’s 8.3% decline.

Celanese recently raised its earnings guidance for 2018, citing a stronger start to the year across its Acetyl Chain and Advanced Engineered Materials businesses. The company now envisions adjusted earnings per share growth in the 12-16% range from the prior-year quarter, up from its earlier view of 10-14% growth.

Celanese is witnessing better-than-expected performance in all of its businesses. The company’s Acetyl Chain unit continues to gain momentum globally while improved pricing and strong demand trends in its Advanced Engineered Materials business are contributing to its earnings. Celanese plans to provide more details on the same during first-quarter 2018 earnings call.

Zacks Rank & Stocks to Consider

Celanese currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks worth considering in the basic materials space are LyondellBasell Industries N.V. (NYSE:LYB) , CF Industries Holdings, Inc. (NYSE:CF) and Daqo New Energy Corp. (NYSE:DQ) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

LyondellBasell has an expected long-term earnings growth rate of 9%. Its shares have moved up 13.1% over a year.

CF Industries has an expected long-term earnings growth rate of 6%. Its shares have gained 23% over a year.

Daqo New Energy has an expected long-term earnings growth rate of 7%. Its shares have rallied 146.9% over a year.

Investor Alert: Breakthroughs Pending

A medical advance is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating substantial revenue, and even more wondrous products are in the pipeline.

Cures for a variety of deadly diseases are in sight, and so are big potential profits for early investors. Zacks names 5 stocks to buy now.

Click here to see them >>

Celanese Corporation (CE): Free Stock Analysis Report

LyondellBasell Industries N.V. (LYB): Free Stock Analysis Report

DAQO New Energy Corp. (DQ): Free Stock Analysis Report

CF Industries Holdings, Inc. (CF): Free Stock Analysis Report

Original post

Zacks Investment Research