I am keeping a very close eye on the CDCC indicator for macro signs about the economy right now.

When it comes to performance this year nothing is hotter than Coffee and Cattle, as they are up 83% and 43% respectively as of this morning. The 4-pack below looks at these hot performing assets and two other key assets as well.

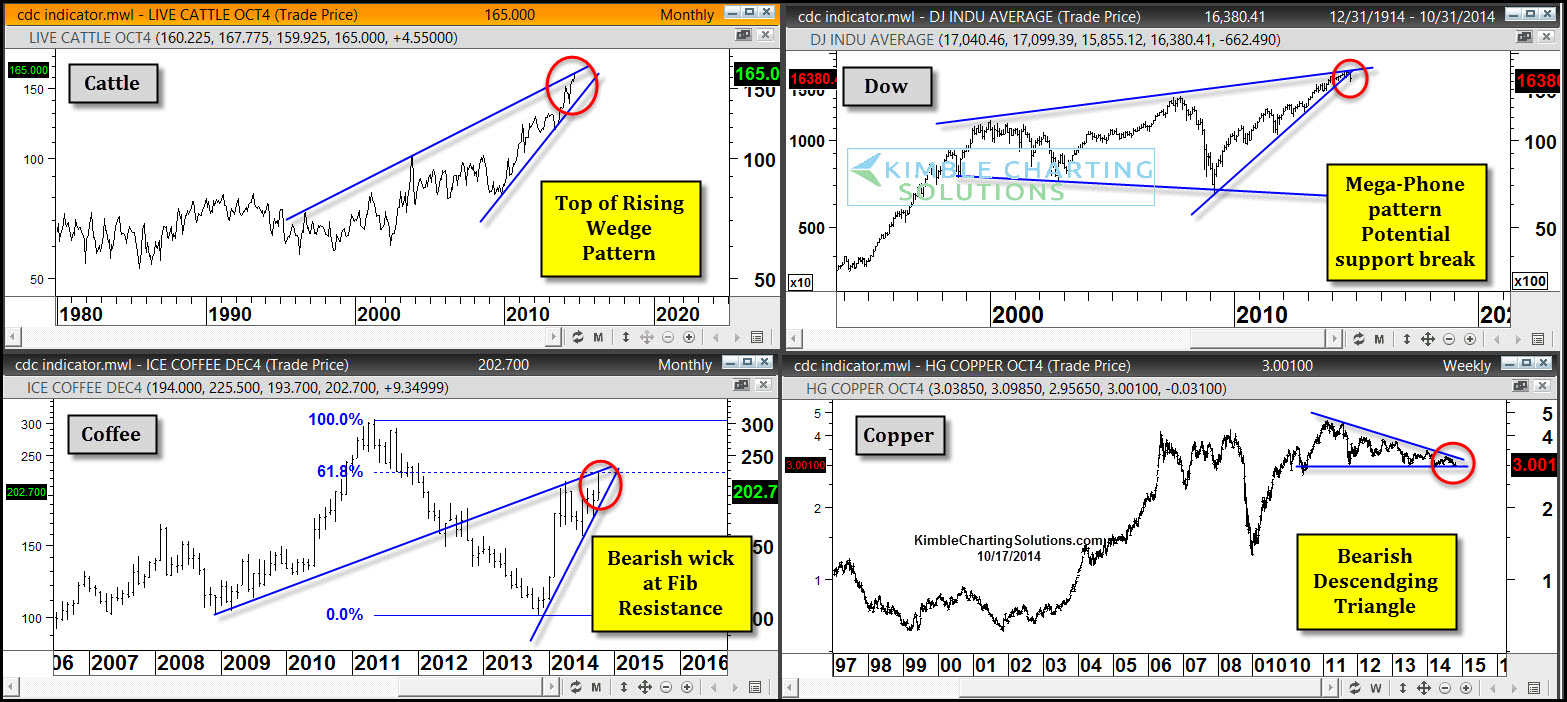

When it comes to investing, global confidence or lack of is very important. This 4-pack above looks at Cattle, Dow, Coffee and Copper.

Cattle is facing resistance at the top of rising wedge pattern, the Dow is at the top of a Mega-Phone pattern and could be breaking support, Coffee might be forming a monthly bearish wick at its 61% Fib retracement level and Dr. Copper looks to be forming a bearish descending triangle that two-thirds of this time results in lower prices.

With technology being what it is, none of us are lacking for information, if anything it is easy to be overwhelmed by it. This 4-pack simply looks at pattern messages from some key assets of our lives, that say a ton about confidence or lack of.

In my humble opinion, what the CDCC indicator does in the weeks ahead is very important for the macro picture!