A very quiet week all in all last week, with many traders taking off mid-week for an extra long, long weekend. We will see many participants return to work next week and volume should once again begin to pickup.

The markets tried to rally but failed which is never a good sign.

It’s still a tossup whether we see an attack on Syria and that has markets and metals on the fence here. I will say though, if an attack comes over this long weekend there is no telling where metals, markets and stocks open up on Tuesday. It could be wild.

We had some long positions in gold and silver for a trade this week and we did well, but Tuesday saw miners show some extraordinary weakness which cause me to take profits on half my metals trade.

I warned that miners often lead, especially on the downside, so I had stops in place and they were triggered, locking in gains.

It was an easy trade, but there are some who just wouldn’t listen and saw their profits slip slide away.

It’s so important to be able to be objective and able to change your mind in this business. You can always buy a position back but you can never get those lost profits back.

Gold and silver ran into the resistance I’ve talked about here the past couple weeks and while I did think they may continue higher right through resistance, the miners fading while metals were at resistance had to raise some flags.

Let’s dive right into the charts this weekend and see where to look for support in this correction that hopefully won’t be too deep but with a potential strike coming I have no idea which way they will go, but they can move very quickly and overnight so be cautious. Once a trend star.

we can jump on but guess whether that be up or down is not my style.

Gold ended the week basically flat, down only 0.01% after seeing much stronger resistance at $1,425 than I’d thought we’d see.

I saw the miners show weakness as gold was at resistance and took that as a warning signal. I try my best to give you a roadmap here in my weekend letter but things can happen quickly and the roadmap can change in a day, as it did this past week.

If we break this channel here we are going back to $1,350 unless of course a strike against Syria moves gold higher. I wish I knew what was coming and how the markets and metals would react to it but I don’t.

I just react and watch for signs of what is to come and act accordingly giving my members my cheat notes every evening.

Unless we get news that rockets gold higher, I’m looking for a correction here now.

Silver is leading gold lower here and closed the week down 2.21%

It’s broken it’s uptrend channel now and will soon see a $23 print. If that level holds then we see what develops, but if not, the next support level is $22.

I really thought we were going higher here but that’s what I get for thinking!

At least I was able to recognize the weakness in the miners and lock in gains immediately and put stops in for the rest of the position.

Platinum fell 0.88% after breaking out of it’s bull flag and above the important 200 day moving average last week. It failed the breakout by moving back below the 200 day moving average and now we look set for a deeper correction.

If the 21 day moving average near $1,500 does not hold up then we are going all the way back to the $1,450 area most likely.

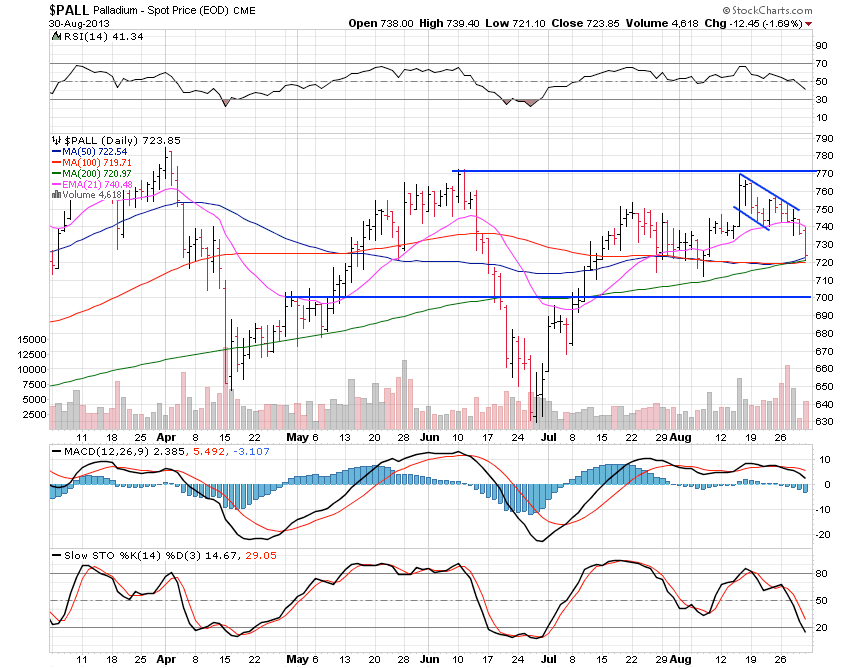

Palladium was hit hardest and fell 3.63% on the week. Last week I talked about it’s bull flag and it looked like higher prices were coming soon. It never broke-out and rolled over.

Palladium is so far finding support at the 21, 50 and 200 day moving averages at $720.

If this level can’t hold then $700 will be the next support level tested.

All in all the metals are needing more time before they can move higher and really, they are doing what they do best, which is bring as many people into the trade before reversing.

They are notorious for that and can really hurt peoples accounts since so many investors in the sector believe in a fundamental story and simply won’t acknowledge or recognize a shift.

It’s a sad fact and one that hurt people over and over again.

I had friends call me mid-week asking about buying gold with the Syrian situation. That made the top call even more likely and luckily they didn’t buy any on my advice.

Thank you very much for reading and please enjoy your long weekend before we really get into some good moves in the fall.

If you’d like much more of my thoughts daily on markets and specific stocks a well as gold and silver then do consider becoming a member. I keep you out of trouble before it comes and get you into the best movers before or as they are moving. What else do you need?

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Precious Metals Outlook: Can’t Fight The Resistance

Published 09/01/2013, 05:04 AM

Updated 07/09/2023, 06:31 AM

Precious Metals Outlook: Can’t Fight The Resistance

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.