The US dollar is lower against majors pairs after the news that President Donald Trump shared sensitive information with Russia. The oil price surge has appreciated the Canadian dollar as both political risk and commodity factors are favouring the loonie, as the currency is known.

The joint announcement on Monday by Russia and Saudi Arabia about a nine month extension to the OPEC production cut has crude prices and the CAD higher ahead of the US weekly inventories. The Canadian dollar had been one of the worst performers of 2017 after the Trump administration had changed the tone on trade with Canada and US shale drillers increasing production.

The US Energy Information Administration (EIA) will release the weekly crude oil inventories on Wednesday, May 17 at 10:30 am EDT. Analysts are forecasting a drawdown of 2.5 million barrels, the sixth decline in a row.

The previous week the market was caught off guard with a higher than expected fall of 5.2 million barrels drove prices higher. The oil production cut extension announcements by Saudi Arabia and Russia were backed up today by supporting comments from Iraq, Iran and Kuwait. The Organization of the Petroleum Exporting Countries (OPEC) agreed with other major producers to cut output starting in January.

The price of West Texas has rebounded after touching five months lows early in the month. The biggest obstacle to the OPEC cuts has been the ramp up in non-OPEC production. The US has increased its output by about 10 percent since 2016. Demand has remained stagnant with some promising news out of China but not enough to offset the current glut.

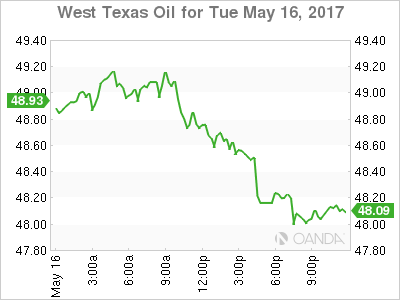

The price of oil fell 0.66 percent on Tuesday. The West Texas Intermediate is trading at $48.61 after the International Energy Agency (IEA) printed a report forecasting that even with an extension to the OPEC production cut agreement the crude market would not be near a five year average. Optimism around the cut by the Saudi Arabia led group has waxed and waned as more members have come out in favour of extending the deal, but at the same time producers who did not sign the agreement have ramped up production limiting the overall effect on prices.

The market is expecting the organization to formalize the extension on its meeting on May 25. The price of oil fell in early may as Russia did not quickly pledge support for the extension due to having to meet with all its national producers. Now with Russia fully onboard and other members voicing their support it is just a matter of supply and demand ahead of the US driving season.

The USD/CAD lost 0.463 percent in the last 24 hours. The currency pair is trading at 1.3576 after the rebound in oil prices boosted the CAD against the USD. US political uncertainty also made it possible for the loonie to reach a monthly high against the greenback.

The news that US President Donald Trump may have leaked classified information to Russia has raised question marks about business as usual in Washington and could create another distraction to the much-awaited pro-growth policies. Tax reform and infrastructure spending fuelled the US rally right after Trump was elected, but as there have been few signs of those plans put into action the USD has retreated.

The CAD is highly correlated with the price of oil. Canadian commodity exports account for a sizeable percentage of the country’s GDP. The drop in oil prices in the last two years has hit the economy and as a result the currency has depreciated. The OPEC and other producers reduction of crude supplies has stabilized the price of crude, but the United States and Canada have ramped up production to take advantage of higher prices. Lack of global demand has also put downward pressure on energy prices forcing the OPEC to extend the original six month deal well into 2018 if they want prices to rebound.

Market events to watch this week:

Wednesday, May 17

4:30 am GBP Average Earnings Index 3m/y

8:30 am CAD Manufacturing Sales m/m

10:30 am USD Crude Oil Inventories

9:30 pm AUD Employment Change

9:30 pm AUD Unemployment Rate

Thursday, May 18

4:30 am GBP Retail Sales m/m

8:30 am USD Unemployment Claims

Friday, May 19

8:30 am CAD CPI m/m

8:30 am CAD Core Retail Sales m/m