Growth remained firm at the end of 2014 but falling energy prices will impact growth and the Canadian dollar in the months to come.

GROWTH EXPECTATIONS:

The latest GDP released late December showed 0.3% monthly growth. This comes on the back of 0.4% in November to end the year on a high after a disappointing result in October (-0.1%). GDP is expected to take a hit early on in 2015 as the plunge in oil prices will be felt by the export sector. Bank of Canada (BoC) Governor Stephen Poloz has said the fall in energy prices will cut 0.3% off 2015 growth, even as the currency weakens. That will see 2015 growth at 2.2% vs the expected 2.5%.

Unemployment has continued to trend in the right direction, falling from 7.0% at the beginning of the quarter to the latest reading of 6.6%. Weaker crude prices may see some layoffs in the energy sector but on the whole, the Canadian job market looks robust.

The Ivey PMI, which surveys businesses to reflect the economy as a whole, has been a mixed bag as usual. During the quarter, it pushed up to 58.6 and quickly fell back to 51.2 only to end at 56.9. The bottom line here is that it remains above 50, which will please Mr Poloz and the BoC.

MONETARY POLICY:

Interest rates were once again held steady at 1.00%, now the 35th time in a row the BoC has kept rates there (at the time of writing). Governor Poloz is happy to remain neutral on interest rates for now as inflation falls along with oil prices. Many Canadians are picking 2015 as the time to raise interest rates and the BoC may follow the lead of the US Federal Reserve if they begin to raise rates.

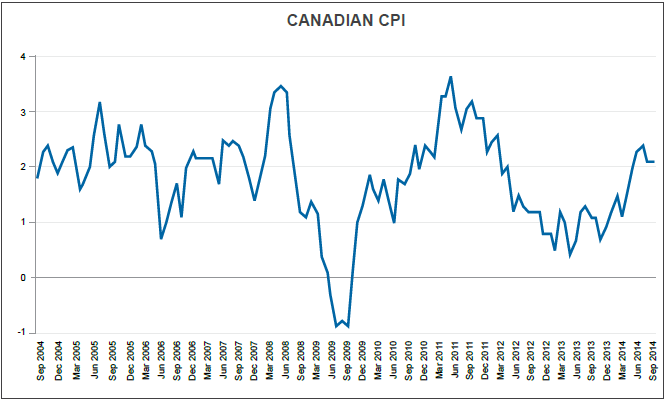

Inflation has returned to the BoC’s 2.0% target in December after a spike to 2.4% in November. The outlook for inflation is certainly on the downside with lower oil prices. The Bank of Canada will be watching this closely along with the robust housing market, which is adding fuel to inflation.

FISCAL POLICY:

The Canadian government is set to balance the books in 2015 despite the recent fall in crude prices. Prime Minister Stephen Harper said, “You should be under no doubt that the government will balance its budget next year (2015). We are well within that range. Even with dramatically lower oil prices, we will balance the budget.” This will be a good result for Canada and will no doubt add strength to the currency.

FX OUTLOOK:

The calls for intervention in the currency markets has quietened down for now as the falling crude prices has done the job and weakened the Loonie. $1.10 now looks a distant memory as the drastic drop in oil prices sends the Canadian towards the $1.20 level against the US dollar. The longer energy prices stay depressed, the weaker the Canadian dollar will become.

The US Federal Reserve has made no secret about its intentions of raising interest rates in 2015. This will certainly strengthen the USD further against the CAD, however, it may be short lived if the Bank of Canada follows suit. The USD/CAD pair will certainly be one to watch in 2015 from a fundamental perspective.