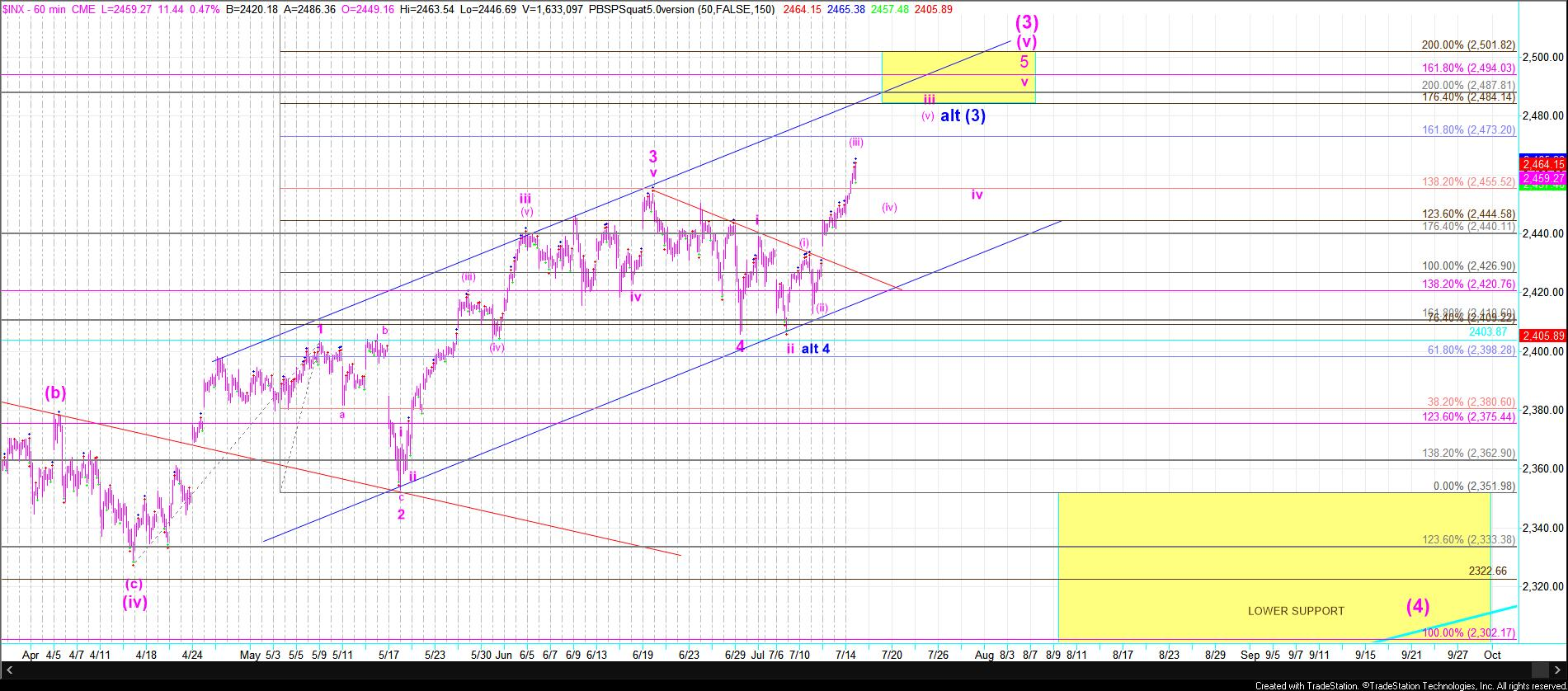

Last week, I noted to members: “As long as last week’s low is not broken, the market still has a setup in place to rally up towards the 2500 SPX region.”

And, as we saw, the market has rallied up towards our long-term target region. The high we struck on Friday is now only 24 points from the bottom of our long-term target box, which we set several years ago.

Since bottoming back in February of 2016, the S&P 500 has rallied 38%. That is one of the best runs in the market’s history. But, were you prepared for it?

The truth is that most in the market were quite bearish back in February of 2016. As I have noted before, back on February 10, 2016, bearish sentiment, according to the AAII Investor Sentiment Survey, was at one of its highest readings, hitting 48.7% (with only 24% responding as bullish), whereas it has a historical average of 30.5% bears and over 40% bulls. The February 10th measurements are considered to be relatively extreme bearish numbers.

How many of you even reasonably considered that the market could attain 2500+ in the S&P 500 back in February of 2016, even after I continued to strongly suggest that potential? If you are honest with yourself, the answer is likely going to be an extremely small percentage. But, the potential was clearly on the chart for all those who knew where to look.

You see, the market does offer clues as to where and how it can move. In fact, back on the last days of 2015, I warned that the SPX could drop down to the 1800 region before it began its rally to 2500. And, as we know, the drop we saw into February of 2016 just below the 1800SPX level provided us with sufficient bearishness to catapult us up towards our long-term rally targets which were viewed in disbelief by most.

And, this happens over and over in all different markets. Yet, because investors are looking for the next 2008-type of crash to happen at any time, they fail to understand that many of these fear-intensive drops are what sets the market up to rally just as strongly. Even this weekend, I have seen at least 3 other articles calling for the market to crash.

Another example of how markets fool most participants was seen around the time of the Presidential election. You see, as the market was dropping into our pullback target days before the election in early November, on November 5th, I wrote:

“once the market moves strongly through the 2098SPX level and is able to continue through 2125SPX, that is our initial indication that we could have a long-term low in place, and finally begin our run to 2350SPX next.”

Now, consider the general market expectation at the time. We were within days of the election, and the common expectation was that if Trump was going to win the election, the market was certainly going to crash. However, it did not matter who won the election in our analysis, as the market was set up to rally to 2300+ no matter who was in the White House. And, despite many scoffing at my perspective at the time, the market has certainly proven me correct, as Mr. Trump is now sitting in the White House, and the market is approaching our longer-term target regions.

This is simply another example of how most of the market is fooled by their expectations surrounding news, whereas it truly is market sentiment which “trumps” all other factors when it comes to the stock market. This was likely one of the most obvious recent examples of this perspective, and those who are willing to recognize it are much more wealthy for their willingness to open their minds.

Moreover, as our government continues to seem in disarray, the market does not seem to care. In fact, our government has been doing nothing other than dithering over this ridiculous Russian issue for months. But, again, none of this matters to the market, and it never will, as the market has simply continued to rally towards our long-term targets. Despite what many believe, it matters not who is in office, nor what they are doing. The market has a mind of its own, and if you have not learned that lesson over the last two years with Brexit, terrorism, Trump, Syria, rising interest rates, etc. being unable to derail this rally, then I am not sure you have been paying attention.

As the DOW and S&P 500 hit new all-time highs this past week, and the NASDAQ has come back almost all the way from the “scary” drop we saw in June, many market participants are starting to believe this market may never come down again. Even though you have analysts coming out week after week calling for a market crash, many of them have been saying this weekly during this last 37% rally in the SPX. Oh, and don’t forget about all those Hindenburg Omens which were supposed to portend a market crash. At this point in time, investors may have begun to view these analysts as the little boy who cried wolf.

But, are we approaching the time of day when those broken clocks will finally be right? I think so.

Last Tuesday evening, July 11, my evening update to my members at Elliottwavetrader.net stated the following:

Market Will Be Tested Tomorrow

With the market pullback today, we have a completed i-ii, 1-2 in the bullish set up for wave 5 of (V) of (3). But, with that set up, it means the market is just about out of room to break out to the upside. In fact, I would need to see a strong confirmation as early as tomorrow, with a potential gap up over the downtrend line on the 60 minute chart.

The next day, we gapped up over the downtrend line, as the market tacked on a 20-point rally on Wednesday. It followed up with a further 20 points the next two days, and struck a new all-time high.

As you can see from the charts linked below, the market is now approaching our long-term target we set several years ago. In fact, we are now within the final “squiggles” of this segment of the rally. And, I think we can strike a top to the market within the next 3 weeks. In fact, Luke Miller, who runs one of our proprietary timing models at Elliottwavetrader.net, notes that there is a potential timing target around August 9th which can mark a larger degree top in the market. (Just so you know, Luke’s timing model called for this current rally in the SPX over a week ago).

While many will now turn bullish in disbelief of the action in the equity markets, I am now finally turning somewhat cautious, and will likely remain so until the fall. My expectation is for last week’s ascent to slow down in the SPX over the coming weeks, which will likely result in a multi-month top being struck, sending us back down to the 2300 region in the SPX in the coming months. (Click for larger image)