As Caledonia Mining (NYSE:CMCL) (CMCL) continues to implement its investment plan (IP), logistical issues governing ore handling volumes and access to higher-grade ore bodies have affected gold production during Q2 and H117.

Underground works to ameliorate material handling bottlenecks have taken place with successful completion, inter alia an underground tramming loop. However, grades are lower due to restricted access to the higher-grade Eroica and Lima ore bodies situated on the other side of the Central Shaft development area to the main surface haulage route, the No. 4 haulage shaft. We have adjusted our valuation to reflect this and the H117 financial results, leading to a valuation of 933p for successful implementation and operation of the Blanket IP.

FY17 cost and production guidance intact

We have revised our quarterly gold production forecasts to 14,174oz produced in each of Q317 and Q417, requiring 140kt of ore processed each quarter (Q217 saw 136kt processed) at a grade of 3.35g/t (the average of the company’s quarterly head grades since Q114).

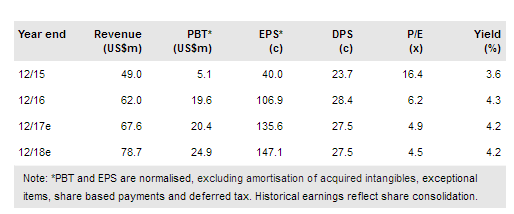

Based on previous cost guidance, we estimate that the company will finish 2017 with net cash of US$10.5m, a y-o-y decrease of 27%, before the effects of the company’s completed Central Shaft development drive cash generation higher in 2018. We estimate end-2018 net cash to nearly double to US$19.6m (from c 64koz Au produced and sold at a US$1,220/oz Au price and incurring cash costs of US$588/oz). 2017 gold production guidance is 52-57koz.

To read the entire report please click on the pdf file below: