Exposure to Senegal exploration, at lower risk

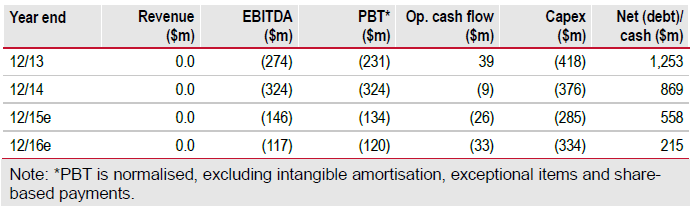

Cairn's (LONDON:CNE) transformation over the last five years has given birth to a new full-cycle E&P company, with two projects under construction in the UK and a large exploration portfolio in the Atlantic Margin. The jewel in Cairn’s portfolio is Senegal, where it made one of the world’s largest offshore oil discoveries in 2014 (SNE). While the market will be closely watching Cairn’s Senegal drilling campaign starting in Q415, an even more material valuation lever for the stock is the outcome of the $1.6bn Indian tax dispute. In an environment where many independents are struggling to secure funding, Cairn is in the comfortable position of being fully funded until first oil from Catcher and Kraken in mid-2017. Cairn’s conservative strategy may reflect its mixed track record on past frontier exploration (outside Senegal) and M&A. Despite this, our RENAV of 216p/share offers reasonable upside at a much lower risk profile than many E&Ps.

Senegal appraisal story in the spotlight

Cairn is two years away from first oil at Catcher and Kraken (30% of our RENAV). The start-ups will turn the company into a self-funding E&P with the ability to reinvest cash flows into exploration and development. Meanwhile, investors should focus on the upcoming Senegal exploration campaign. Two appraisal wells on SNE and one exploration well (likely on the shelf edge) could raise confidence in the commerciality of the 330mmbbls SNE discovery. Senegal is key as it is Cairn’s main operated asset and only real exploration success over the last five years.

Indian tax dispute already priced in

The $1.6bn Indian tax dispute has been a thorn in Cairn’s side but has not affected its investment plans or strategy. Assuming the liability is not likely to be enforceable outside India, the maximum downside would be a write-off of the entire $530m (59p/share) Cairn India stake, which we think is already priced in by the market.

To Read the Entire Report Please Click on the pdf File Below