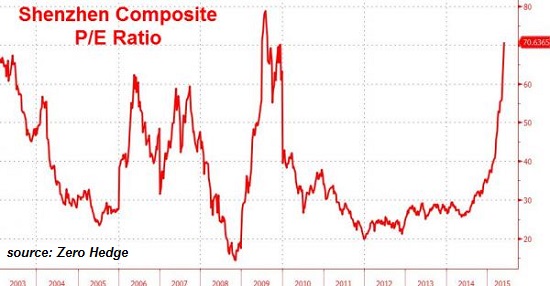

In the event you haven't heard about the stock bubble currently inflating in China, please take a quick look at these two charts of the Shenzhen Composite:

This second chart displays the Shenzhen's price-earnings ratio (P/E), a widely used measure of fundamental valuation. If a company's stock is worth $100 per share, and its net earnings are $10, it has a P/E of 10. If a company's stock is worth $100 per share, and its net earnings are $1, it has a P/E of 100.

As Alan Greenspan noted in his mea culpa for missing the bubble in 2008, you have to keep dancing while the bubblicious music is playing. From Why I Didn't See the Crisis Coming:

Almost all market participants were aware of the growing risks, but they also knew that a bubble could keep expanding for years. Financial firms thus feared that should they retrench too soon, they would almost surely lose market share, perhaps irretrievably. In July 2007, the chair and CEO of Citigroup, Charles Prince, expressed that fear in a now-famous remark: “When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you’ve got to get up and dance. We’re still dancing.”

Financial firms accepted the risk that they would be unable to anticipate the onset of a crisis in time to retrench. However, they thought the risk was limited, believing that even if a crisis developed, the seemingly insatiable demand for exotic financial products would dissipate only slowly, allowing them to sell almost all their portfolios without loss.

The take-away from this is to join the party and offload marginal enterprises at sky-high valuations to greater fools--which is why I plan on listing my 'Of Two Minds' blog as an IPO on the Shenzhen Exchange.

Based on the insane P/E ratio of Shenzhen listed companies, Of Two Minds is worth at least $5 million. But there are various premiums that have to be included in this base valuation.

1. Of Two Minds is highly flexible. It might IPO as Of Two Minds Mobile Apps, unless mobile apps are no longer fashionable, in which case we'll change the name to Of Two Minds P-to-P (peer-to-peer). This adds at least $1 million to the base valuation.

2. Of Two Minds is based in the San Francisco Bay Area (with an active branch in Hawaii). Just being in the white-hot tech frenzy of the Bay Area adds at least $1 million to the base valuation.

3. The growth possibilities are staggering. The Internet is global, and the global population who reads English or has access to online translation is equally vast. This adds at least $1 million to the base valuation.

4. Of Two Minds is in the hot alternative-media space, which includes mobile apps, peer-to-peer marketing, social media--basically every hot technology relates back to alternative media. This adds at least $1 million to the base valuation.

5. Of Two Minds has a long history in China, due to our early ties with the Kroika Cookie and Biscuit Company. This adds at least $1 million to the base valuation. The Kroika Story: This Blog Sells Out (December 21, 2005), and Welcome to the Kroika Cookie and Biscuit Company (Xiangxi)

So here's the deal: an enterprising entrepreneur, hedge fund or private equity fund can snap up Of Two Minds for a pre-IPO price of only $10 million. Who knows how high the Shenzhen Composite can go? 1,000? 3,000? Heck, why not 5,000?

Of Two Minds could easily be worth $50 million in a matter of months. $10 million is insanely cheap for a company that's about to IPO on the Shenzhen. The sky's the limit, Baby!