Action into yesterday had looked to offer bears the advantage, but it was a morning gap higher from buyers which gave bulls the initiative. Beyond the opening gap yesterday there wasn't too much more buyers were able to achieve, with the exception of the Russell 2000, but yesterday's gains would be enough to put bears/shorts on the defensive. The lack of upside follow-through may offer more aggressive shorts an opportunity.

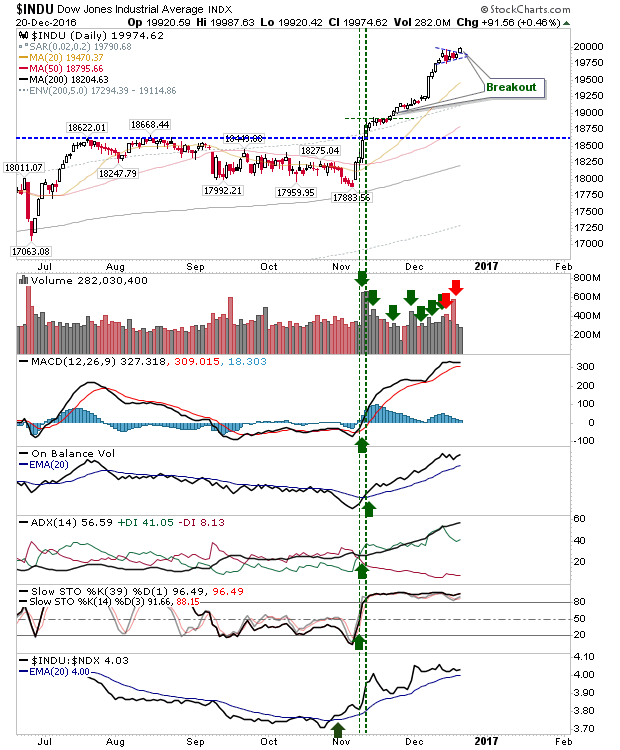

The Dow made a clean upside break of the consolidation.

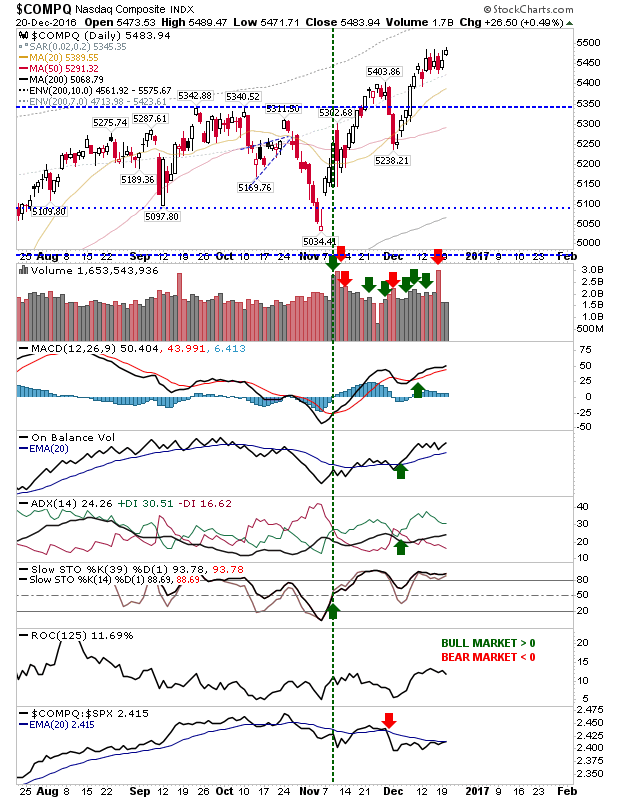

The NASDAQ wasn't able to get above the consolidation. However, it did manage to close near the week's high. Technicals are net bullish with the relative performance between the NASDAQ and S&P about to turn positive too.

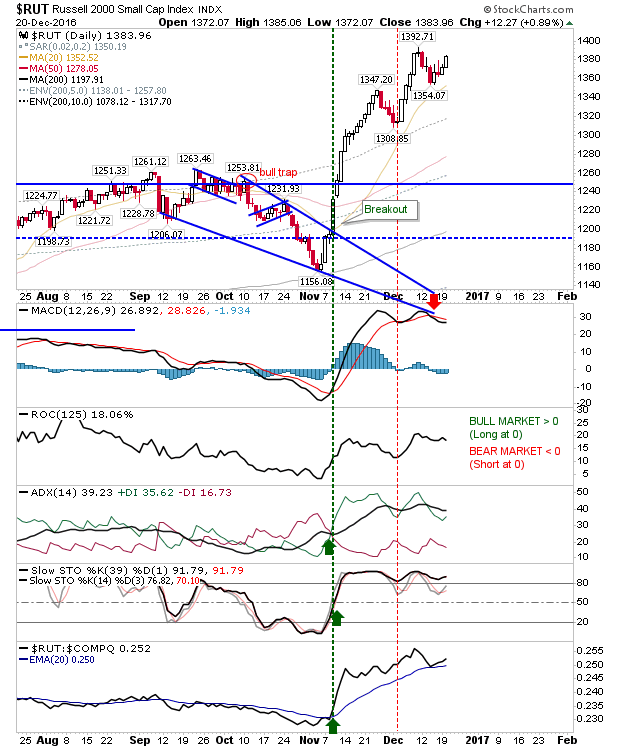

The Russell 2000 is repeating the action of late November, although the MACD hasn't reversed its earlier 'sell' trigger. It remains the index likely to benefit bulls the most.

With the upside coil breakout, bulls have the edge for the rest of the week. If buyers are unable to press their advantage beyond the first half-hour trading then it may instead turn to shorts to have a crack at reversing the breakouts (creating 'bull traps' in the process).