It’s Friday in the Wall Street Daily nation. That means it’s time to embrace the adage that a picture is worth a thousand words.

For the newbies in the group, each week I select a graphic or two to convey an important economic or investment insight.

This week, I’m debunking a stubborn myth about stock markets that’s making the rounds.

Then it’s onto a dire warning we hope you heeded.

Last, but not least, I’m highlighting the hottest growth sector in the market — and the best way to profit from it.

So let’s get to it…

Stocks Destined to Tread Water?

If we’re supposed to believe Wall Street strategists, we should pack up for the year and quit investing.

Why? Because they’re saying that stock prices have peaked. Not kidding.

After an impressive 8.1% rally for the S&P 500 index in the first half of the year, a recent Bloomberg survey of 20 strategists suggests that it’s all over.

They’re convinced that stocks will trade sideways through year-end.

The only problem? Stock market history suggests strongly otherwise.

Take a look:

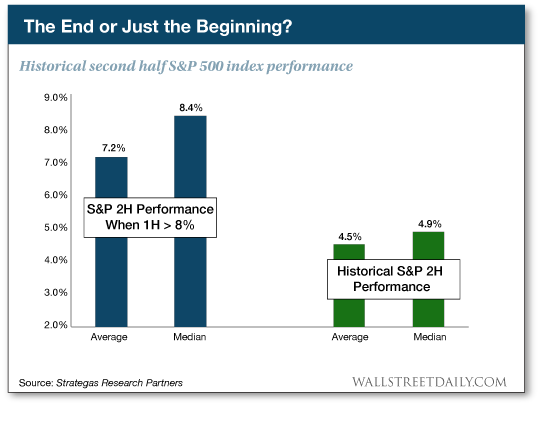

Since 1950, whenever the S&P 500 has risen by more than 8% in the first half of the year, the gains keep coming.

On average, stocks rally another impressive 7.2%.

Talk about sending mixed signals. My recommendation? Listen to analysts and ignore stock market history at your own peril!

Speaking of warnings…

I Hate to Say… We Told You So

But we told you so!

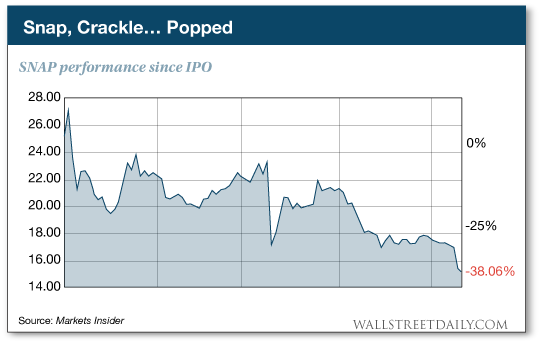

Earlier this week, shares of Wall Street’s latest social media darling, Snap Inc (NYSE:SNAP), officially turned into Wall Street’s latest IPO bust.

Shares crashed below the IPO price of $17 to hit a new all-time low:

What caused the latest breakdown in prices? Turns out that another one of the underwriters that was so eager to earn an investment banking fee on the IPO changed their mind about the company’s prospects.

On Tuesday, Morgan Stanley slashed its price target by 43% — from $28 to $16. This comes on the heels of another one of Snap’s underwriters, JPMorgan, souring on the stock shortly after the IPO.

If you’re nursing losses, it’s not our fault!

We warned against investing in Snap before the company even filed its official IPO documents.

If you somehow missed those early warnings, I repeated them after the IPO — on national television, no less (see here).

If you’re still holding on to shares, get out while you still can.

Chips Away

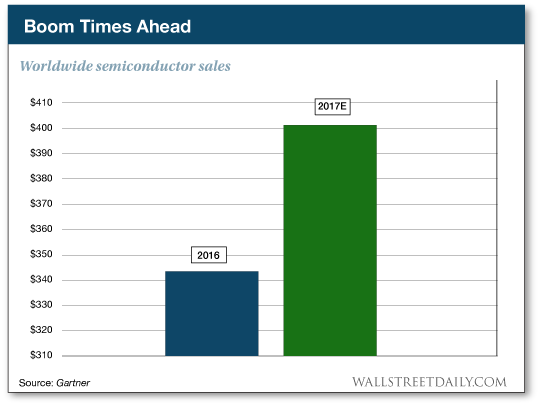

Tech research firm Gartner is out with their latest forecast for semiconductor sales in 2017.

In short, get ready for blastoff:

Worldwide chip revenue is expected to climb nearly 17%, to reach $401.4 billion.

This is the first time we’ve eclipsed the $400 billion mark. The $300 billion mark was hit seven years ago. And the $200 billion mark was hit 17 years ago. So clearly, growth is alive and well — and accelerating.

“A shortage of memory is creating a boom in the overall semiconductor market,” said Andrew Norwood, research vice president at Gartner.

So what’s the best way to invest in this booming market? By scooping up shares of the next chip company that gets bought out at a ridiculously high valuation.