It has been about a month since the last earnings report for Bruker Corporation (NASDAQ:BRKR) . Shares have added about 2.3% in that time frame.

Will the recent positive trend continue leading up to its next earnings release, or is BRKR due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

Recent Earnings

Bruker reported adjusted earnings per share (EPS) of 24 cents in the first quarter of 2018, up 26.3% from the year-ago figure. Also, adjusted EPS beat the Zacks Consensus Estimate by a couple of cents.

On a reported basis, earnings came in at 17 cents a share, a 30.8% increase on a year-over-year basis.

Revenues in Detail

Bruker logged revenues of $431.7 million in the first quarter, up 12.2% year over year. Moreover, the top line surpassed the Zacks Consensus Estimate of $416 million.

Excluding a 7.7% positive effect from acquisitions and a 0.5% favorable impact from changes in foreign currency rates, Bruker reported year-over-year organic revenue growth of 4%.

Geographically, European revenues improved in high-single digits year over year in the reported quarter. North America revenues grew in mid-single digits. In Asia Pacific (APAC), the metric was down in low-single digits due to some shipment and acceptance delays related to BioSpin APAC customers.

Per management, the company registered organic revenue growth, driven by strength in NANO and BEST.

Bruker’s BioSpin Group revenues declined modestly below the first-quarter levels, excluding the impact of currency translation. Within BioSpin, NMR had a slow start to the year with some delayed system shipments and acceptances.

Revenues in the NANO group increased mid-single-digits at constant exchange rate, fueled by a strong uptick in industrial research markets.

CALID revenues were up high-single digits on an organic basis with a strong performance in the Daltonics mass-spec business.

Margin Trend

As a percentage of revenues, gross margin in the quarter under review expanded 36 basis points (bps) to 46.2%. Selling, general & administrative expenses increased 12.4% to $110.3 million. Research and development expenses rose 14.9% year over year to $43.2 million. Overall, adjusted operating margin improved 6 bps to 10.6%.

Financial Position

Bruker exited first-quarter 2018 with cash and cash equivalents plus short-term investments of $283.9 million, down from $439.2 million at the end of 2017. As of Mar 31, 2018, net cash used in operating activities was $43.8 million compared with $32.6 million in the year-ago period.

2018 Guidance

Bruker reiterated its guidance for 2018. For the full year, the company still expects revenue growth of approximately 7% including nearly 3% of organic revenue growth. The company projects a year-over-year expansion of 50-80 bps in adjusted operating margin.

For 2018, Bruker still anticipates adjusted EPS in the range of $1.34-$1.38, up 11-14% from the previous band. The Zacks Consensus Estimate of $1.39 remains ahead of the company’s guidance.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed a downward trend in fresh estimates. There has been one revision higher for the current quarter compared to two lower.

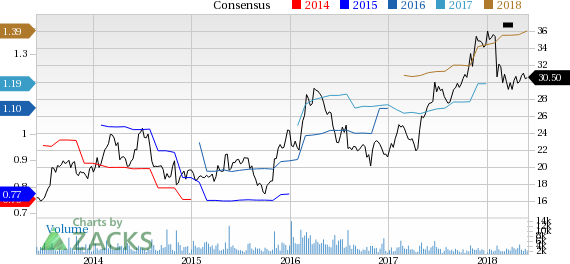

Bruker Corporation Price and Consensus

VGM Scores

At this time, BRKR has a strong Growth Score of A, though it is lagging a bit on the momentum front with a B. However, the stock was allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of B. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for growth investors than momentum investors.

Outlook

Estimates have been broadly trending downward for the stock and the magnitude of these revisions looks promising. Notably, BRKR has a Zacks Rank #2 (Buy). We expect an above average return from the stock in the next few months.

Bruker Corporation (BRKR): Free Stock Analysis Report

Original post

Zacks Investment Research