The British pound has posted sharp gains on Wednesday. In the North American session, GBP/USD is trading at 1.2063, up 1.51%. The pound hasn’t been at these levels since mid-August.

UK PMIs Continue to Decline

The UK economy is likely in a recession, and today’s soft PMI data will only raise concerns about the economic outlook. October’s PMIs remained in contraction territory, with the Services PMI coming in at 48.2 and the Manufacturing PMI at 46.2, both unchanged from September.

The UK labor market has been a bright spot in the gloomy economic picture, but tight conditions have pushed wages higher, which is making it more difficult for the Bank of England in its fierce battle with inflation. The BoE is projecting that unemployment will rise to 6.5% and the country will experience negative growth in the second half of this year, throughout 2023 and into the first half of 2024. GDP declined by 0.2% in the third quarter, and the headwinds look formidable for the UK economy and the British pound.

The Fed minutes, which will be published later today, may not contain any nuggets for the markets. The Fed has embarked on a coordinated campaign to convince the markets that it has no plans to pivot on policy and that rates will keep heading higher longer than anticipated. The soft US inflation report triggered exuberance in the markets, with a belief that the Fed would become more dovish. However, as Fed members have been stating for the past couple of weeks, inflation remains unacceptably higher and the fight to curb inflation is far far from over. FOMC policy-makers are united in the need to continue raising rates, and the minutes should shed light on whether they are also in agreement on the end-point for the current rate-hike cycle.

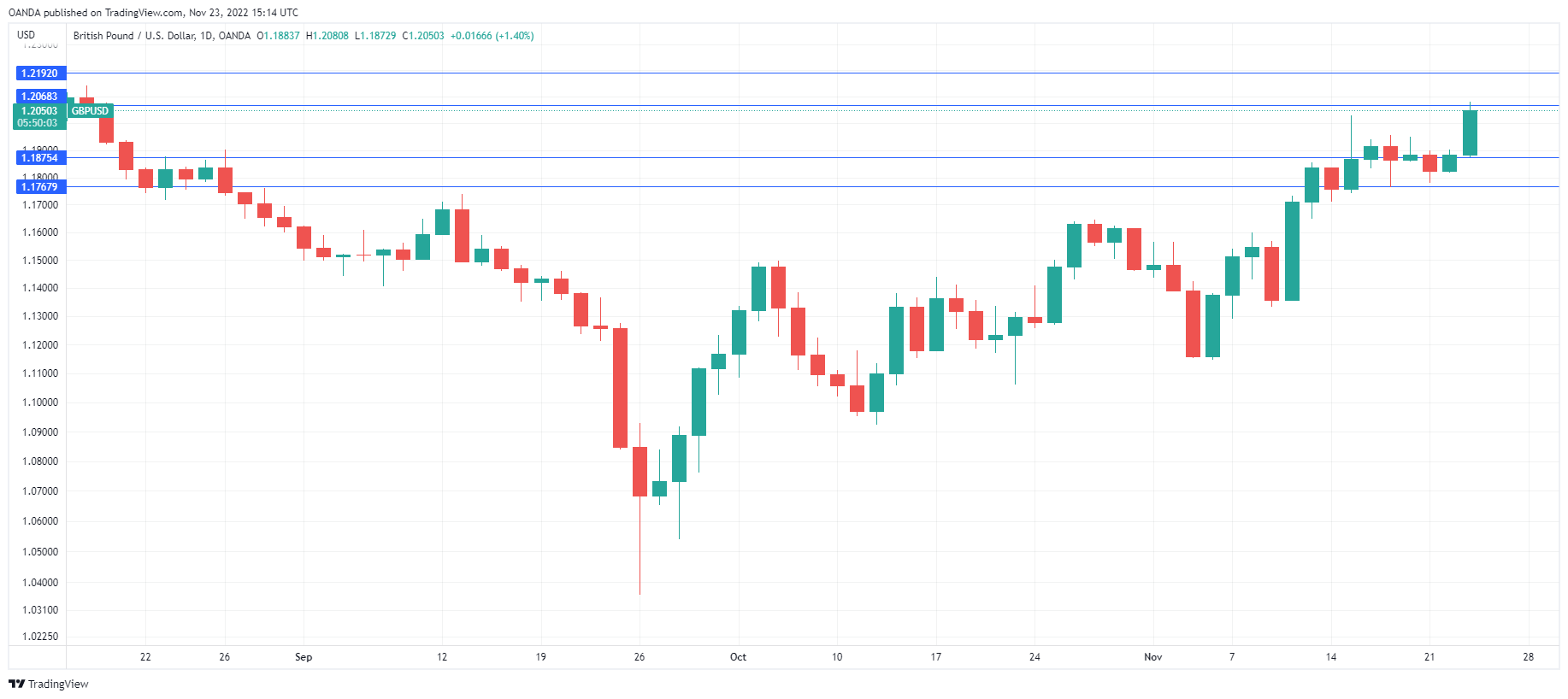

GBP/USD Technical

- GBP/USD is testing resistance at 1.2068. The next resistance line is at 1.2192

- There is support at 1.1875 and 1.1767