Bristol-Myers Squibb Company (NYSE:BMY) announced that the FDA put a partial clinical hold on three clinical trials- CA209602 (CheckMate-602), CA209039 (CheckMate-039) and CA204142.

The trials are investigating Opdivo-based combinations in patients with relapsed or refractory multiple myeloma.

The FDA put these studies on hold due to risks identified in Merck & Co.’s (NYSE:MRK) Keytruda, another anti–PD-1 agent, in patients with multiple myeloma.

The FDA maintained that data obtained from non-Opdivo studies indicate that the risks of PD-1/PD-L1 treatment plus Pomalyst or Revlimid and possibly PD-1/PD-L1 treatments alone or with other combinations outweighs the potential benefits for patients with multiple myeloma.

Consequently, no new patients will be enroled in the studies but patients who are currently enroled in CheckMate-602, CheckMate-039 and CA204142 and experiencing clinical benefit can continue with the treatment.

The company is working in tandem with the FDA to address these issues.

We note that in July 2017, the FDA placed a clinical hold on KEYNOTE-183, KEYNOTE-185 and KEYNOTE-023, three combination studies of Keytruda in multiple myeloma. The decision was taken following a review of data by the Data Monitoring Committee in which higher deaths were reported in the Keytruda arms of KEYNOTE-183 and KEYNOTE-185 leading to a halt in enrolment.

Our Take

The news comes as a disappointment for investors. Earlier in 2017, the company suffered a setback in January 2017 when it decided not to pursue the accelerated regulatory pathway for the regimen of Opdivo plus Yervoy in first-line lung cancer in the United States based on a review of available data.

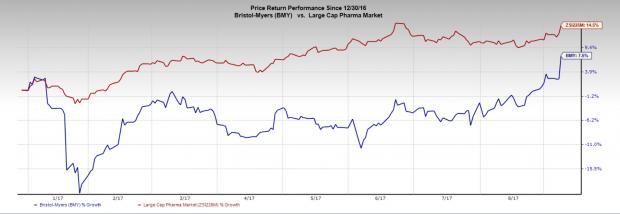

Bristol-Myers’ stock has gained 7.5% in the year to date against the industry’s 14.5% gain.

We note that Opdivo became the first PD-1 inhibitor to be approved for a hematological malignancy — classic Hodgkin lymphoma in both the United States (May 2016) and the EU (November 2016). In November 2016, Opdivo gained the FDA approval for the treatment of patients with recurrent or metastatic squamous cell carcinoma of the head and neck with disease progression on or after platinum-based therapy.

Label expansion into additional indications might give the product access to a higher patient population and increase the commercial potential of the drug. Moreover, Opdivo is facing competitive challenges in the United States. In addition, concerns from AstraZeneca’s (NYSE:AZN) failed study on lung cancer drug Imfinzi loom large on the company’s CheckMate 227 study on Opdivo.

Zacks Rank& Key Pick

Bristol-Myers currently carries a Zacks Rank #3 (Hold).

A better-ranked stock in the healthcare sector is Aduro Biotech, Inc. (NASDAQ:ADRO) which carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Aduro Biotech’s loss per share estimates narrowed from $1.44 to $1.32 for 2017 and from $1.33 to $1.24 for 2018 over the last 30 days. The company has topped estimates in two of the trailing four quarters with an average of 2.53%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Astrazeneca PLC (LON:AZN): Free Stock Analysis Report

Bristol-Myers Squibb Company (BMY): Free Stock Analysis Report

Merck & Company, Inc. (MRK): Free Stock Analysis Report

Aduro Biotech, Inc. (ADRO): Free Stock Analysis Report

Original post