Brighthouse Financial Inc.'s (NASDAQ:BHF) third-quarter 2019 adjusted net income of $2.33 per share surpassed the Zacks Consensus Estimate by 5%. Moreover, the bottom line increased 4.5% year over year.

The quarter witnessed strong annuity sales and increase in net investment income, partially offset by escalating expenses.

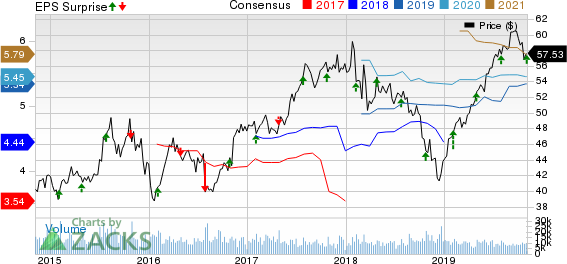

Brighthouse Financial, Inc. Price, Consensus and EPS Surprise

Behind the Headlines

Operating revenues decreased 2.4% year over year to $2.1 billion. However, total revenues of $3.2 billion were up 124% year over year. The top line also beat the Zacks Consensus Estimate by 56.2%.

Premiums of $214 million decreased 4.9% year over year.

Adjusted net investment income was $928 million in the quarter under review, up 8.9% year over year. This upside was driven by asset growth and repositioning of the investment portfolio as well as lower investment expenses. Investment income yield was 4.52%.

Corporate expenses of $248 million pretax increased 2.5% sequentially.

Total expenses increased 33.1% year over year to $2.4 billion on higher policyholder benefits and claims, amortization of DAC and VOBA, and interest expense on debt.

Quarterly Segment Update

Annuities reported adjusted operating income of $203 million, down 49.4% year over year reflecting lower fees, higher deferred acquisition costs amortization, higher expenses and higher taxes, partially offset by higher net investment income. Annuity sales increased 17.3% to $1.8 billion.

Life generated adjusted operating income of $73 million, up 19.7% year over year on lower expenses, partially offset by higher claims. Life insurance sales were $2 million, flat year over year.

Adjusted operating loss of Run-off was $426 million, wider than loss of $105 million in the year-ago quarter. The wider loss indicates higher claims, partially offset by lower taxes.

Adjusted operating loss at Corporate & Other was $19 million, narrower than loss of $87 million incurred in the year-ago quarter. The lower loss reflects higher interest on debt and higher expenses.

Financial Update

As of Sep 30, 2019, cash and cash equivalents were nearly $4.3 billion, up 100% year over year.

Shareholders’ equity of about $17.7 billion at quarter-end increased 37.2% year over year.

Book value per share, excluding preferred stock and accumulated other comprehensive income, was $125.53 as of Sep 30, 2019, up 20.9% year over year.

Share Buyback Program

Brighthouse Financial bought back shares worth $126 million in the third quarter. In October, the company repurchased shares worth $49 million.

Zacks Rank

Brighthouse Financial currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Insurance Releases

Of the insurance industry players that have reported third-quarter results so far, Reinsurance Group of America (NYSE:RGA) , Arthur J. Gallagher (NYSE:AJG) and CNA Financial Corporation (NYSE:CNA) beat the respective Zacks Consensus Estimate for earnings.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Arthur J. Gallagher & Co. (AJG): Free Stock Analysis Report

Reinsurance Group of America, Incorporated (RGA): Free Stock Analysis Report

CNA Financial Corporation (CNA): Free Stock Analysis Report

Brighthouse Financial, Inc. (BHF): Free Stock Analysis Report

Original post