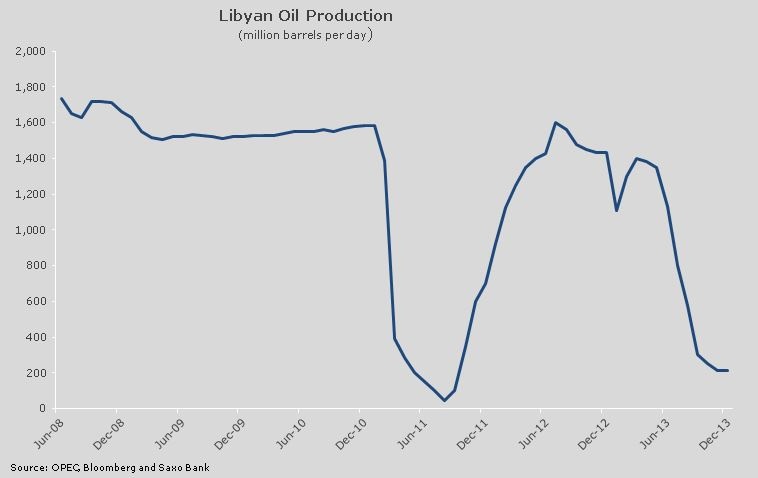

Brent Crude is once again trading lower on the prospect of the return of oil from Libya. Protesters at the 300,000 barrels per day Al Sharara site in Libya have agreed to resume work after a three-month halt. We have seen several disappointments with regard to resumption of oil production in Libya but this news seems to be the most promising so far.

Libyan oil production has been running at a fraction of its capability since last summer after protests at production sites and key ports broke out. From a post-revolution peak at 1.6 million barrels per day in July 2012, production began to slow and during the past couple of months it has hovered around just 200,000 barrels per day and this has been one of the key reasons behind the price support for Brent Crude in recent months.

During December, Brent Crude has twice tried and failed to gain a foothold above USD 112/barrel and with this latest development resistance at that level has increased further. January as mentioned earlier has proven very profitable for investors in Brent Crude over the past three years, during which time it has been averaging a return of 4.6 percent. The combination of raised growth expectations and not least elevated geopolitical concerns help drive prices higher during this time.

As we begin 2014 the outlook for oil supply and demand looks very well balanced and supply growth may actually exceed demand growth for the first time in a number of years, not least due to the continued increase in non-OPEC supply especially from non-conventional production techniques in North America. Against this outlook the upside potential for crude oil seems limited but stubborn supply disruptions have so far kept the market supported. If the latest news from Libya results in a normalisation of supplies from the country holding Africa's largest reserves this should eventually help the price of Brent Crude to settled into a lower range than what has been seen in the previous couple of years.

Current support on the first month continuation can be found at the 200-day moving average at USD 107.50/barrel ahead of the November low at USD 103/barrel.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Brent Crude Weaker As Libya Might Finally Begin To Pump Again

Published 01/03/2014, 02:02 AM

Updated 03/19/2019, 04:00 AM

Brent Crude Weaker As Libya Might Finally Begin To Pump Again

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.